In October of this year, we suggested writing strangles on the soybean market based on a belief that longer term supply projections would help to cap short term weather concerns.

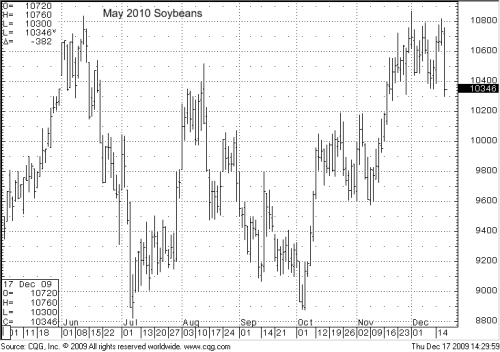

Indeed, the market has gone from about $10.00 per bushel to $10.67 per bushel since that time. This, of course, is of little concern to investors who sold 17.00 calls and 7.40 puts.

The market has done it’s job of pricing in the late season reduction to the US soybean crop and a slightly better demand outlook for 2010. However, now that US production has more or less been pegged, the market will soon begin focusing on the upcoming South American harvest.

This should not be a bullish development for prices.

Brazil and Argentina are expected to harvest 63 million and 53 million tons of soybeans respectively. This would be new records for both countries.

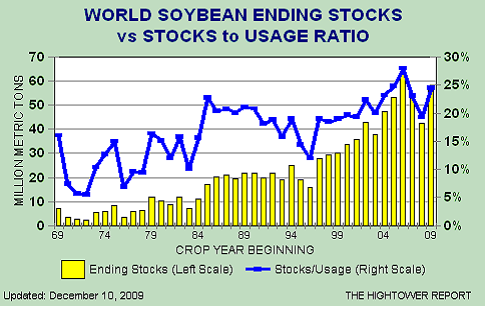

The effect of these harvests, set to begin in March, will be to raise World Soybean Ending stocks for 2009/2010 by 539 million bushels over last year. This means that come the end of the crop year on September 1st, 2010, the world will have 34.6% more soybeans in storage than it did at the same time in 2009.

Ending stocks represent the amount of soybeans on hand at the end of the crop year after all demand has been met. If the projected figure of 57.09 million tones is realized, it would represent the 2nd highest global soybean ending stocks on record.

For those not familiar with supply side price models for agricultural contracts, that is a considerable figure.

And it should be the 600 pound gorilla looming over soybean prices during the next 90 -120 days or at least until US planting gets underway in the Spring.

Obviously, prices can still rally during this time. Demand related strength based on brighter economic outlooks could support prices. A resumption of dollar weakness could prompt rallies. However, it is our opinion that the shift in focus towards Southern Hemisphere crops will make most rallies limited in nature.

Rallies in soybean prices should be viewed as call selling opportunities over the next 30 days. Expect additional pressure to be placed on prices in early 2010 if the US dollar continues to firm.

Look to sell deep out of the money calls on the May or July contracts with a target of buying back near worthless options in February or March. This allows the market plenty of room to rally while you “wait out” the fundamentals.

In this environment, you might not have to wait too long.

To learn more about selling options in the commodities markets, feel free to visit us on the web at www.OptionSellers.com. A complimentary option selling information pack is available for qualified investors.