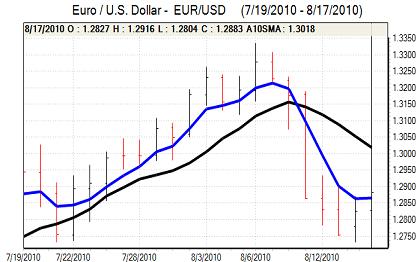

EUR/USD

The Euro maintained a firm tone in early Europe on Tuesday with a move towards 1.29 against the dollar. There were some rumours of a stronger than expected German ZEW business sentiment report, although the underlying evidence suggests that there was solid investor demand for the currency.

In the event, the headline ZEW survey was weaker than expected with a decline to 14.0 for August from 21.2 previously, although there was a robust gain in the current conditions index. The data will maintain doubts whether the German economic rebound is sustainable and will reinforce fears that there will be a wider deterioration in Euro-zone prospects.

The Euro proved resilient following the data with a round of successful bond auctions helping to provide support for the currency while a stabilisation in risk appetite also provided some support.

The US housing data was slightly weaker than expected with starts at an annualised rate of 0.55mn for July from a revised 0.54mn previously while permits declined to the lowest rate for 14 months which maintained underlying fears surrounding the housing sector. The headline industrial production increase was a higher than expected 1.0% for July.

The Euro was unable to hold above the 1.29 level and retreated to just below this level later in US trading.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

During Tuesday, there were further comments from Japanese officials warning over the impact of currency strength and the weaker than expected Japanese GDP data will continue to increase pressure for yen gains to be curbed. Nevertheless, there was no clear strengthening of rhetoric during Tuesday as the yen strengthened.

Although there was some stabilisation in risk appetite, there were further concerns over the risk of a global slowdown and the yen and the dollar continued to test support levels close to 85 against the Japanese currency in European trading.

The dollar found support close to 85 and moved back to the 85.60 area in New York. There was additional speculation of additional measures by the government to support demand while a rally on Wall Street helped curb immediate yen demand.

Sterling

The headline UK consumer inflation rate was in line with market expectations with a decline to 3.1% for July from 3.2% previously while there was a larger than expected decline the core rate to 2.6%. Bank of England governor King warned in his letter to the government that inflation was likely to remain high in the short term and the policy dilemmas will continue.

The Bank of England minutes will be watched closely on Wednesday and Sterling will tend to be subjected to renewed selling pressure if Sentance was the lone supporter of higher interest rates at the August meeting. Underlying confidence is likely to remain fragile, especially with doubts over consumer spending trends.

Sterling was unable to make a serious challenge on resistance levels near 1.57 against the dollar and retreated to lows below 1.56 with reports of US selling undermining the UK currency. Sterling also retreated to near 0.8275 against the Euro.

Swiss franc

The dollar again found support below 1.04 against the US dollar on Tuesday and moved to a high near 1.0450 in US trading. Trends on the crosses remained important with the Euro recovering to near 1.3450 against the Swiss currency.

The successful Euro-zone bond auctions had some impact in dampening franc demand, but underlying defensive support is likely to remain firm given that confidence in the global economy is likely to remain generally weak.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

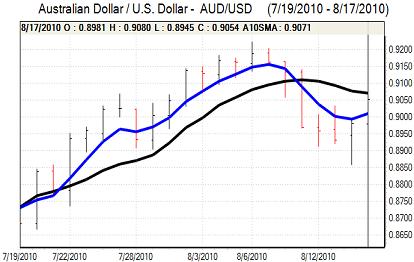

Australian dollar

The Australian dollar pushed to a high just above 0.9020 against the US dollar in early Europe on Tuesday as US dollar momentum faded. Immediate risk appetite has stabilised, but underlying doubts over the global economy are liable to continue and could certainly intensify. Confidence in the domestic economy is also likely to remain generally fragile with concerns liable to increase after weaker than expected data.

The Australian dollar was able to prove resilient in US trading on Tuesday and it strengthened to a high near 0.9080 in US trading before correcting slightly weaker.