EUR/USD

The Euro remained under pressure in Europe on Monday, but there was support below the 1.31 level and funds were unable to trigger stop-loss selling which was instrumental in triggering a limited short-covering rally later in the session.

There was little in the way of fresh incentives during the day with a natural tendency for a pause with an interval between key events.

There was a general mood of optimism surrounding the US economy following the employment data on Friday which also helped underpin demand for the dollar. There was caution ahead of the US Federal Reserve meeting on Tuesday. Given improved sentiment towards the US economy, there were reduced expectations that the Fed would look to push for additional quantitative easing in the short term. There was still speculation that the Fed would keep the potential for action later in 2012 if there was evidence of a fresh deterioration in conditions.

The US budget deficit amounted to US$231.6bn for January which was the highest monthly deficit since 2008 and will act as a reminder that there are important structural vulnerabilities within the US economy.

There was relief that the Greek situation had been resolved for now despite an important lack of confidence in the medium-term outlook. There was speculation that an additional support package may be required for Greece and there were fears that Portugal would get dragged towards a default in the medium term.

Narrow ranges again dominated during the New York session with the Euro nudging towards the 1.3150 area as selling pressure eased and there was some evidence of sovereign buying, although support was still limited.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips towards the 82 level in Europe on Monday and was confined to narrow ranges as steady buying support prevented further losses.

Underlying risk appetite was slightly more fragile following weakness in Asian markets and this curbed yen selling pressure to some extent.

The Bank of Japan held policy steady at the latest policy meeting with no further action following the additional easing last month. Inaction provided an initial boost to the Japanese currency, but there was support close to the 82 level with the dollar underpinned by a firmer tone surrounding risk appetite as regional equity markets strengthened.

Sterling

Sterling edged towards the 1.57 level against the dollar in Europe on Monday, but was unable to regain significant support and was subjected to significant selling pressure during the session.

Thin liquidity conditions exaggerated the potential moves and there was significant stop-loss selling ahead of the New York open which pushed the currency to a six-week low near 1.56 against the US currency. The UK currency was generally on the defensive against the Euro and dipped to lows near the 0.8415 area.

There was further uncertainty surrounding the UK economy with no major data releases during the day. The latest RICS house-price survey recorded a figure of -13 from -16 previously, reinforcing stagnation within the sector. There was solid evidence of buying support below the 1.56 level against the US currency.

Swiss franc

The dollar hit resistance just above the 0.92 level against the franc on Monday and edged back towards the 0.9160 area against the currency later in the US session. As has been the case for the past few sessions, the Euro was trapped in the 1.2055 region against the Swiss currency.

From the Euro perspective, there will be further disappointment that the currency has not been able to pull away from the 1.2050 region despite some easing of immediate Euro-zone tensions. There will still be an important mood of caution ahead of Thursday’s National Bank monetary policy meeting.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

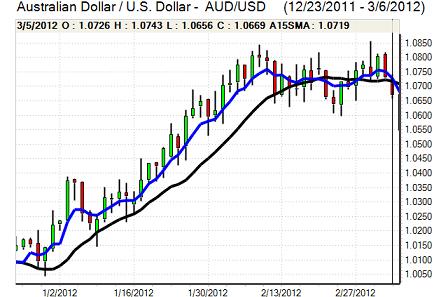

Australian dollar

The Australian dollar initially rallied during the European session, but was unable to make much headway and dipped weaker again during the New York session as markets tested support below the 1.05 level against the US dollar

There was further caution surrounding the Asian growth outlook following China’s trade data and a general sense of unease surrounding the Australian outlook.

There was a weaker than expected reading for home loans with a 1.2% annual decline and a retreat in the latest NAB business confidence survey which had some dampening impact on sentiment, although there was solid support below 1.05 against the US dollar.