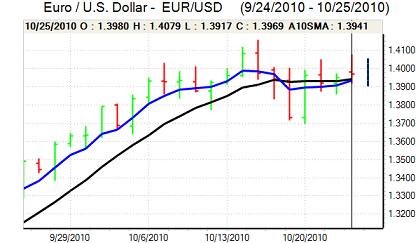

EUR/USD

The Euro was unable to make a challenge on resistance levels near 1.41 against the dollar on Monday and weakened back to the 1.40 area early in the New York session.

There were comments from an IMF official that the Euro was approaching being over-valued, but the main trigger for a weaker trend was a reluctance to hold positions, especially given the recent choppy nature of markets.

US existing home sales rose to an annual rate of 4.53mn from a revised 4.12mn the previous month which provided some degree of relief over potential housing-market trends, although the impact was measured given the recent distortions caused by tax changes and proposals to curb foreclosures.

The potential for further Federal Reserve quantitative easing remained an important market focus. Although markets expect a further round of measures by the Fed, there is still uncertainty over the outcome. There has also been a further debate as to whether there will be a gradualist approach or a more aggressive ‘shock’ programme by the central bank.

Given the expectations already priced in, there has been some reluctance to sell the dollar further. Underlying sentiment still remains negative on fears that a medium-term consequence of the Fed’s determination to reflate the domestic economy will be a weaker dollar. The Euro continued to retreated in New York with lows near 1.39 against the dollar before correcting back to the 1.3950 area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar tested fresh 15-year lows below 80.50 against the yen on Monday before finding some degree of support and edging back to 80.80. Underlying dollar sentiment remained negative with markets also inevitably drawn to the possibility of fresh record dollar lows given the proximity of the current all-time figure just below 80.

Finance official Igarashi stated that yen intervention would be most effective when it came as a surprise while Finance Minister Noda stated that the Monday FX moves appeared one-sided. There will be strong pressure on the Bank of Japan to sanction further intervention within the next few days which will deter aggressive yen buying.

There will also tend to be some caution over additional dollar selling ahead of the Bank of Japan monetary policy meeting on Thursday, but the dollar remained trapped below 81 on Tuesday.

Sterling

Sterling remained under pressure against the Euro during European trade on Monday and weakened to fresh 8-month lows around 0.8940 before correcting back to 0.8870. The UK currency continued to find buying support just above the 1.5650 area against the US currency and attempted to hold above the 1.57 level in early Asia on Tuesday.

The latest mortgage lending data has remained weak, reinforcing fears over a sustained slowdown in the economy as fiscal tightening takes effect.

The latest GDP data will be watched very closely on Tuesday and could have an important impact on sentiment. A stronger than expected figure would ease immediate pessimism, at least temporarily while a weaker than expected figure would reinforce pessimism and would be likely to spark fears that the economy could contract during the fourth quarter.

To revive sentiment, Sterling is likely to need a clear signal from the Bank of England that further quantitative easing is unlikely.

Swiss franc

The franc weakened to lows beyond 1.3650 against the Euro on Monday, but then found fresh support and rallied to near 1.3550. The US currency found support on dips to just below 0.97 even though gains was limited.

The franc has been vulnerable to a correction and there have been suspicions that the National Bank is looking to weaken the franc. Given the current debate over additional quantitative easing by the Federal Reserve and structural vulnerability in the Euro-zone, the franc should still be well placed to avoid heavy selling pressure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

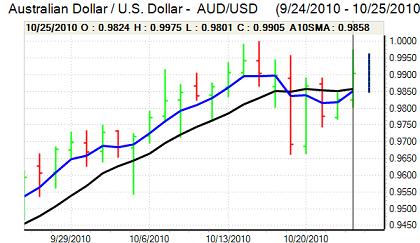

Australian dollar

The Australian dollar peaked just above 0.9970 against the US currency on Monday and, following the inability to make a serious challenge on parity was vulnerable to a corrective retreat. The currency dipped to test support below 0.99 before recovering slightly.

Domestically, there was an improvement in business confidence which will maintain expectations over a potential interest rate increase at the November Reserve Bank meeting. The Australian currency will also draw support from expectations of further global monetary support measures, although the key feature is liable to be high volatility.