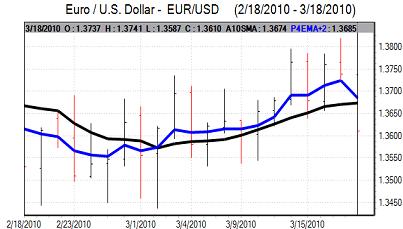

EUR/USD

There were renewed fears over the Greek government debt situation on Thursday with reports that the government would look for IMF support while there was further evidence of German opposition to financial support. The Euro initially dropped to around 1.3670 against the dollar as the currency was unable to escape from debt fears surrounding the Euro-zone, especially with continuing political tensions complicating the economic discussions.

The US economic data failed to have a decisive impact during the day. Jobless claims edged lower to 457,000 in the latest week from 462,000 the previous week while the Philadelphia Fed survey rose to 18.9 for March from 17.6 the previous month which will maintain some degree of optimism over the economy.

Consumer prices were unchanged for February compared with expectations of a small increase for the month to give a 2.1% annual increase while there was a 0.1% increase in core prices which was in line with expectations.

The data overall is unlikely to have a significant impact on interest rate expectations. During the US session, there was speculation over a further near-term increase in the Fed’s discount rate which triggered a sharp Euro dip to below 1.36.

There were no announcements from the Fed, but the Euro struggled to regain much ground as sentiment remained generally weaker while the dollar continued to derive support from favourable yield spreads on longer-term bonds.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Caution generally prevailed in Asian trading on Thursday as risk appetite was weaker and regional stock markets came under pressure. Friction over the Chinese yuan and reports of further restrictions on bank lending by Chinese officials also helped underpin the yen and the dollar was capped below 90.50 against the Japanese currency.

Dollar rallies were also hampered by the prospect of exporter selling on any move towards the 91 level. The US currency pushed to a higher following the US data as risk appetite remained generally solid, but the yen was again able to resist losses and the dollar weakened back to test support below 90 before consolidating above this level.

Sterling

Sterling edged slightly weaker in early Europe on Thursday ahead of the UK economic data. The latest government borrowing data was better than expected with a figure of GBP12.4bn compared with expectations of around GBP14.5bn which will provide some Sterling relief. There will be expectations that the full-year deficit will undershoot the target which could provide some degree of relief for the currency ahead of next week’s budget.

The other data was less encouraging for the data as there was a sharp decline in lending to the corporate sector while mortgage approvals also remained weak for February. Any further evidence of deteriorating credit conditions would be a major negative factor for the currency. The latest CBI industrial survey was also weaker than expected although the organisation was more optimistic over the export sector.

Overall sentiment towards the UK economy is still likely to be very fragile. Stresses elsewhere still provided support and Sterling pushed to a three-week high near 89.20 against the Euro while it held above 1.52 against the dollar.

Swiss franc

The dollar found support below the 1.0550 level against the Swiss franc on Thursday and pushed to a high near 1.0645 before dipping sharply again later in the US session.

The dollar retreat was triggered by a further sharp decline in the Euro which weakened to lows below 1.44 as the franc surged. There were comments from National Bank member Danthine that consumer should prepare for higher interest rates as the bank had an exit strategy prepared. He also stated that exchange rates should be set freely by the market even with the qualification that strong appreciation should be resisted.

The remarks inevitably triggered strong expectations that the bank would resist intervention and triggered sharp gains for the Swiss currency. The bank will need to take action very soon if it wants to reverse these expectations and volatility will remain higher.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

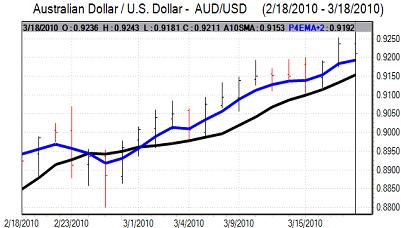

Australian dollar

The Australian dollar hit resistance close to the 0.9250 level against the US dollar on Thursday and edged generally weaker.

Confidence in the economy and currency is likely to remain generally firm in the short term, especially if commodity prices remain high. There will still be some degree of caution given the potential for further Chinese monetary policy tightening.

There was Australian dollar support below the 0.92 level with a cautious advance back towards the 0.9210 level in New York.