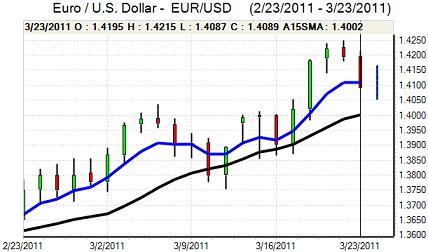

EUR/USD

The Euro was unable to make a fresh attack on resistance in the 1.4250 area on Wednesday and was subjected to significant selling pressure during the European session.

There were renewed fears surrounding Euro-zone sovereign debt which unsettled the currency. The Portuguese parliament rejected the minority government’s austerity plan and this also triggered the resignation of Prime Minister Socrates. The increased political uncertainty also raised market fears that Portugal would rapidly require assistance from the Euro-zone support fund. There were also fears that further recapitalisation of the Irish banking sector would be required and wider unease over the Euro-zone financial sector.

There were comments from Euro-group leader Juncker that agreement on an expanded EFSF facility would not be taken until June and this did have a significant impact as markets had been expecting agreement at the EU summit this week.

As far as the US economic data is concerned, there was a sharp 16.9% decline in US new home sales to a record low annualised rate of 250,000 which reinforced fears over the housing data and also continued to dampen expectations that the Federal Reserve would shift monetary policy. There were further comments from regional Fed President Fisher that the Fed must be vigilant on inflation.

The Euro fell to a low of 1.4075 against the dollar before stabilising around 1.41 and remained on the defensive in Asian trading on Thursday as European difficulties remained in focus.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support close to 80.70 against the yen during Wednesday and rallied to the 81 area during the New York session as there was caution over selling the US dollar aggressively.

US currency support was stifled by the sharp decline in new home sales which curbed support on yield grounds and there was still a lack of buying support for the dollar.

Euro-group leader Juncker stated that the US and G7 were ready to act on the Japanese currency and that the yen was moving slightly in the wrong direction which reinforced expectations that there could be further yen selling. Markets will still want evidence of action before selling the Japanese currency aggressively. Japan’s trade data did not have a major impact given that it related to pre-earthquake shipments.

Sterling

Sterling was unable to make a challenge on the 1.64 area against the dollar during Wednesday and dipped sharply during the European session with reports of aggressive selling by a UK clearing bank.

The Bank of England MPC minutes from March again recorded a 6-3 vote for unchanged interest rates with 3 members voting for an increase while Posen again called for an expansion of quantitative easing. The bank’s commentary stated that inflation was liable to rise further in the short term and remain above 4% this year.

There were also comments that there was merit in waiting, especially given uncertainty over the impact of high oil prices on the economy and there were concerns over the outlook for consumer spending. These uncertainties are liable to have been increased since the Japanese earthquake which will also tend to make the bank hesitate over a near-term rate increase, but the inflation pressures will be difficult to ignore.

The UK budget was broadly in line with expectations with no major policy changes. There was some downgrading of GDP growth forecasts and an increase in borrowing levels which will tend to have some negative impact on sentiment.

Sterling weakened to lows near 1.62 against the dollar and also tested support beyond 0.87 against the Euro before regaining some ground with the MPC minutes and budget not providing any fresh reason to buy the UK currency.

Swiss franc

The dollar found support below 0.90 against the franc during Wednesday and rallied to highs just beyond 0.9085 during the New York session. The franc did initially strengthen to beyond 1.2750 against the Euro but, significantly, it failed to hold the gains and retreated back to the 1.28 area despite rejection of Portugal’s budget. Wider risk appetite held relatively steady which would have curbed underlying franc demand.

The Swiss currency will still tend to gain support if there is a sustained increase in fears surrounding the Euro-zone economy with markets again fretting over the possibility of capital flight into Switzerland.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar found support on dips to the 1.0070 area against the US dollar during Wednesday and generally maintained a firmer tone even though the US currency rallied against European currencies. The Australian currency rallied to a high of 1.0150 before edging lower late in the US session.

There was support from a high level of commodity prices during the session and risk appetite was broadly resilient which provided support. Domestic issues remained of secondary importance with a solid Chinese PMI index also providing some support.