EUR/USD

There was still interest in Euro selling on rallies and the currency retreated to below 1.23 in early Europe on Wednesday as buying support faded. Underlying confidence was also undermined by a relatively weak German bond auction result.

There were renewed fears surrounding the banking sector during the day which undermined the Euro. In particular, there were fears over the Spanish banking sector with some speculation that a major institution would have difficulties in rolling-over its forthcoming debt maturities. There were also wider fears that the financial sector would be undermined by weak growth and rising bad-debts.

The US economic data was mixed, but did have a firm bias which helped underpin confidence in the US outlook. Durable goods orders rose 2.9% for April following a revised figure of no change for March. Although the data was distorted by a surge in aircraft orders, there was still a solid underlying increase over the two-month period. New home sales also rose to the highest level since June 2008 which maintained expectations that the US would out-perform the Euro area. Thursday’s revised first-quarter GDP data is unlikely to have a major impact.

There was some stabilisation in risk appetite during the day, but dollar Libor rates continued to edge higher while Wall Street failed to hold opening gains. In this environment, there was still some element of defensive dollar demand. The Euro was also damaged by speculation that China would reduce its holdings of Euro debt and it retreated to lows below 1.2180 late in the New York session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Asian equity markets attempted to rally on Wednesday, but buying support was still very limited. Continuing unease over tensions between North and South Korea also contributed to the mood of caution, although the yen impact remained mixed. The dollar consolidated just above the 90 area in early Europe as there was still some evidence of defensive yen support.

The US currency gained yield-related support following the US economic data releases, especially with expectations that the Bank of Japan would maintain a highly-expansionary monetary policy.

Risk appetite was never far from the surface and a late reversal on Wall Street pushed the dollar back to just below 90 from a high around 90.65 following the US housing data.

Sterling

Sterling retreated back to just below 1.44 in early Europe on Wednesday as risk appetite remained generally fragile, but the currency did prove to be resilient during the day.

Budget developments remained an important focus and there were expectations that the UK collation government would find it easier than the Euro-zone members to secure political support for the budget tightening while the UK economy also has a more favourable debt profile with less potential near-term funding pressures.

Confidence could still prove to be very fragile given a projected budget deficit above 11% of GDP for 2010, especially if there are renewed stresses within the banking sector. The latest lending data also suggested subdued growth which will curb GDP potential.

Sterling pushed to a 2-week high beyond 0.85 against the Euro while there was selling pressure above 1.4450 against the dollar.

Swiss franc

The dollar found support close to 1.1520 against the franc during Tuesday and pushed to a high around 1.1620 in the New York session. There was some speculation of National Bank intervention during the day, but the Euro remained firmly on the defensive and weakened to lows near 1.4125 against the franc later in the US session.

The Swiss currency continued to gain support from an underlying confidence in the Euro area. The financial sector will be watched closely and the franc may not be immune to difficulties if there is fresh unease over the Swiss financial sector.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

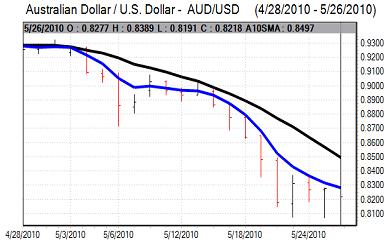

Australian dollar

The Australian dollar found support below the 0.82 level against the US dollar on Tuesday and spiked to a high near 0.8380 following the US data releases. There will still be a high degree of caution over global risk which will offset the potential impact of short covering and bargain hunting.

As equity markets were subjected to renewed selling pressure, there was a decline to lows near 0.8220 against the US currency later in the New York session as risk appetite deteriorated. Volatility is likely to remain a key short-term feature.