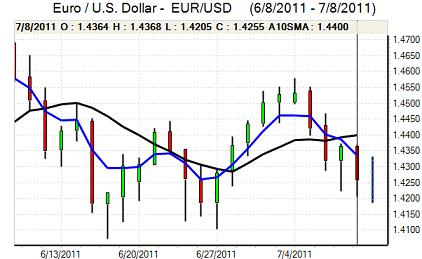

EUR/USD

The Euro was unable to make any impression on resistance levels above 1.4350 against the dollar ahead of the US payroll data on Friday and weakened to lows below 1.4250 as underlying Euro confidence came under fresh attack.

There was a renewed increase in fear surrounding the peripheral economies with a particular focus on Italy. There was an increase in Italian bond yields to above 5.6% with the spread over German bunds widening to the highest level since the Euro’s creation. There were also further important political stresses with continuing rumours surrounding the departure of Finance Minister Tremonti. The Finance Minister is well-respected in international circles which makes markets very sensitive to resignation rumours.

The Euro-zone vulnerabilities were briefly over-shadowed by the US payroll report which was much weaker than expected with an employment increase of only 18,000 for June following a revised 25,000 gain the previous month. Unemployment rose to 9.2% from 9.1% and there was a further decline in participation rates.

The data renewed fears surrounding the US economy and there will be additional speculation that the Federal Reserve will have to embark on further quantitative easing. The weak economic backdrop will make it even more difficult for congressional negotiators to reach a deal on the debt ceiling. The Euro initially rallied back to the 1.4350 area following the data, but was subjected to renewed pressure later in the session with lows below 1.4250 as Euro fears reasserted themselves.

The seriousness of the Euro-zone debt situation was illustrated by the fact that Euro-group officials will hold emergency talks on the Italian situation on Monday, ahead of scheduled Euro-group meetings. Debt fears dominated in Asia on Monday with the Euro testing support below 1.42.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar held a firm tone ahead of the US employment data on Friday and reports of a President Obama press conference triggered gains to near 81.50 against the yen. Given market positioning, the much weaker than expected payroll data had a much bigger impact and the dollar fell very sharply to lows near 80.50 before a limited recovery.

The data will inevitably undermine US economic confidence and US Treasury yields fell sharply which will undermine demand for the dollar.

The latest Chinese trade surplus was stronger than expected, but there was a dip in import growth to the lowest level for 20 month while the latest consumer inflation figure was higher than expected at 6.4% which reinforced fears over a sharp slowdown in economic growth with weaker growth prospects limiting selling pressure on the yen.

Sterling

After testing support below 1.5950 against the dollar, the much weaker than expected US employment data pushed the UK currency sharply higher to a peak near 1.6075 as volatility spiked higher. Sterling was also able to strengthen through 0.89 against the Euro.

Wholesale inflation rose to a 30-month high 5.7% in June even though the pace of input-price inflation eased and this will maintain expectations that the consumer-inflation report will also be higher than expected. There will also be expectations that the Bank of England will continue to resist pressure for higher interest rates and Sterling yield support will remain very weak with the Chambers of Commerce also predicting very subdued second-quarter growth.

Euro-zone considerations will also be extremely important in the short term. Sterling did gain some short-term protection from increased fears surrounding the debt crisis, although this could easily be compromised by fears over the UK banking sector. Sterling drifted back towards 1.60 against the dollar and also weakened slightly in Asia on Monday.

Swiss franc

The Swiss franc found support close to 1.2150 against the Euro during Friday and moved sharply higher following the US employment report as fears over the Euro-zone sovereign-debt situation were intensified by a general and sudden deterioration in risk following the US employment report. The Euro weakened to lows below 1.19 against the franc and, after a spike to above 0.85 ahead of the release, the dollar plunged to lows near 0.8350.

Swiss National Bank Chairman Hildebrand stated over the weekend that Swiss price stability was not threatened at the present time and there was therefore no need to counter the franc’s rise. Such comments will maintain the potential for defensive flows into the Swiss currency if Euro-zone fears intensify further.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

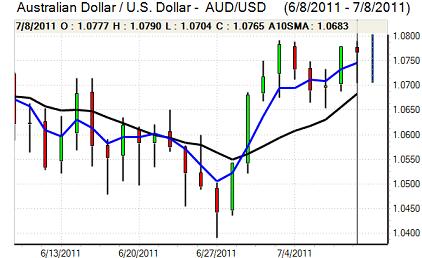

Australian dollar

The Australian dollar hit resistance above 1.0780 against the US dollar during Friday and weakened sharply following the US payroll report as risk appetite deteriorated. There was also further unease surrounding the Chinese economic outlook following the Chinese economic data and this combination pushed the Australian dollar to lows below 1.07 in Asia on Monday, although the currency was still broadly resilient.

Domestically, the housing loans data was slightly weaker than expected, but there was a second successive monthly gain which boosted sentiment to some extent and cushioned the impact of increased fears surrounding the global outlook.