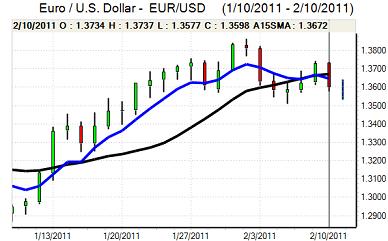

EUR/USD

The Euro was unable to make a fresh challenge on resistance levels above 1.37 against the dollar during Thursday and retreated to test technical support near 1.3580 during the US session.

There were renewed tensions within the Euro-zone peripheral bond markets which unsettled the Euro as Portuguese bond yields rose sharply above 7.5% to the highest level since the Euro’s introduction. There will, therefore, be renewed fears that Portugal will effectively be shut out of international capital markets which would also force it to accept multilateral support and undermine Euro confidence.

Manoeuvrings surrounding Trichet’s replacement as ECB President also remained an important market focus. Bundesbank head Weber declined the opportunity to make a formal statement on his future, but the evidence suggests strongly that he will not be a candidate for the ECB post. The appointment of a German anti-inflation hawk would have been an extremely useful tool for Chancellor Merkel in defusing internal opposition to increased EU bailout funds. If Weber is not a candidate then Merkel’s position will also be weaker and this will increase net risks to the Euro. There were also reports that The ECB was back in the market buying peripheral bonds for the first time since late January.

As far as the US economic data is concerned, there was a decline in jobless claims to 383,000 in the latest week from a revised 419,000 previously which provided a boost to US yields and dollar sentiment. The US currency also gained some defensive support as there were renewed uncertainties surrounding Egypt as the government’s latest concessions were rejected by the opposition and the Euro remained on the defensive.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support above 82.50 against the yen during Thursday and strengthened steadily during the day with a further push to above the 83 level following the stronger than expected US economic data releases. Yield support will remain intact in the near term which will continue to provide important support for the US currency.

There was still evidence of capital repatriation which provided some yen support and the currency will also gain some defensive support if there is a sustained deterioration in global risk appetite. Exporter dollar selling will also be an important feature above the 83 level, but the US currency was able to advance to a four-week high near 83.50 in Asia on Friday.

Sterling

There was cautious Sterling trading ahead of the Bank of England interest rate decision on Thursday and there was a generally softer bias as the US currency held firm within Europe.

The Bank of England left interest rates on hold at 0.50% which had been the expected outcome despite speculation that there could be an increase. There was no statement with the decision and the vote breakdown was also not known. Sterling dipped briefly following the announcement, but recovered ground quickly on the assumption that the bank would increase rates within the next three months. The quarterly inflation report will be watched very closely next week for further evidence on the growth and inflation expectations.

Given the deteriorating inflation outlook, there will be market fears that the Bank of England is expecting the economy to weaken further in the near term and this is likely to cap any Sterling gains. There was also a weak NIESR monthly GDP estimate which will have some negative impact on sentiment. Sterling was, however, able to hold above 1.60 against the dollar and advanced against the Euro.

Swiss franc

The Euro was unable to break above 1.32 against the franc on Thursday, but it did have a generally resilient tone despite renewed stresses surrounding Euro-zone peripheral bond markets. The dollar was able to take advantage of the trend and pushed to a four-week high just above 0.97. The franc’s inability to gain much support from Euro tensions suggests that underlying demand for the currency is weaker.

The latest Swiss consumer inflation data was weaker than expected with a 0.4% monthly decline in prices which will tend to increase fears over deflation pressures from a strong currency and will also tend to increase pressure on the National Bank to resist renewed franc appreciation.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

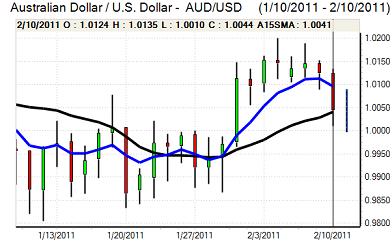

Australian dollar

The Australian dollar has continued to drift weaker over the past 24 hours and tested support below parity against the US currency for the first time since early February.

Reserve Bank Governor Stevens stated that he was comfortable with monetary policy and indicated that an increase in interest rates was not likely over the next few months which dampened Australian dollar support.

There was also a generally cautious attitude towards risk appetite which had a negative influence on the local currency.