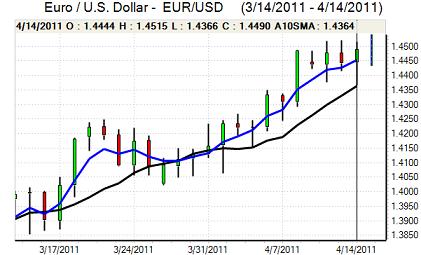

EUR/USD

The Euro hit tough resistance close to 1.45 against the dollar in European trading on Thursday and dipped sharply ahead of the US open as it tested support below 1.4380.

There was a renewed increase in fear surrounding the Euro-zone peripheral economies triggered in part by fresh speculation over a Greek debt rescheduling following comments from the German Finance Ministry. Markets remain very sensitive to the debt issue, especially as any restructuring would increase the bad-debt burden within European banks. There will also be further unease over the risk of a Greek default which would seriously compromise market stability within the Euro area.

The Euro was able to recover ground quickly, helped by expectations that the ECB is still looking to tighten monetary policy aggressively, especially as there are still expectations of Asian central bank diversification away from the US currency.

The US economic data did not provide support for the dollar with jobless claims rising to 412,000 in the latest reporting week from a revised 385,000 previously. The headline increase in producer prices was also lower than expected at 0.3% for March.

Regional Federal Reserve President Plosser stated that the US would need to reverse monetary policy in the not too distant future, but markets are still expecting that core FOMC members will maintain the commitment to very low interest rates. The 2-year yield advantage on German bunds over US Treasuries widened to a 28-month high above 115 basis points which severely limited the scope for a dollar advance. The Euro hit further resistance close to 1.45 in Asia on Friday as buyers remained cautious at these levels.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar retreated steadily in Europe on Thursday and dipped to test support below 83.00 against the yen. The dollar rallied to a high near 83.75 with evidence of institutional dollar buying but was still unable to gain momentum.

The yen gained support from a more cautious attitude towards risk especially when European debt fears increased and there is likely to be greater caution towards carry trades in the near term. The latest Chinese inflation data was marginally above market expectations which will fuel expectations of further monetary tightening which will also provide some yen support.

Finance Minister Noda stated that he had asked G7 members to act in the currency markets when needed. There will be further speculation that global central banks will act to prevent a renewed yen surge and comments from G7 officials will be watched closely over the weekend.

Sterling

Sterling hit resistance above 1.6360 against the dollar during Thursday, but it was able to resist heavy selling pressure and found support on dips to below 1.63 as Euro/Sterling selling provided support as there was a test of Euro support below 0.8850. The UK currency was hampered by a generally cautious attitude towards risk, but sentiment held relatively firm as Sterling was not the main focus with no major economic releases.

The Bank of England minutes will be watched very closely next week to assess how close the MPC was to raising interest rates in April and guidance over future policy will also be extremely important. The retail sales data will also be watched closely given uncertainties over the consumer spending outlook.

Trends in risk appetite will also be watched closely and the UK currency will be more vulnerable to selling pressure when confidence in the global economy deteriorates. Sterling consolidated just below 1.6360 in Asia on Thursday.

Swiss franc

The dollar found support just below 0.89 against the franc during Thursday, but found it difficult to gain any traction wand was blocked below the 0.90 level as the Swiss currency maintained a firm tone on the crosses. Domestically, the latest ZEW business confidence index improved to an 8-month high which improved sentiment towards the economy.

Risk considerations still tended to dominate and there was further support from a generally cautious tone and from renewed fears over Euro-zone structural debt. An underlying lack of confidence in all fiat currencies also maintained global demand for the Swiss currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

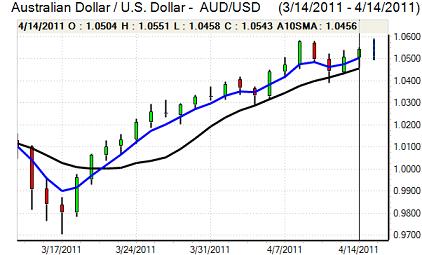

Australian dollar

The Australian dollar dipped to test support below 1.0480 against the US currency during European trading on Thursday as there was a sharp deterioration in risk appetite. There was solid buying support on dips and there was a fresh test of resistance above the 1.0540 area before a consolidation just below this level. There were reservations over risk conditions and some caution over aggressive Australian currency buying at these elevated levels.

The trends in risk appetite will tend to remain dominant in the near term and the domestic influences are likely to be of secondary importance in the near term. There will still be some caution over the economy, especially given reservations over the housing sector.