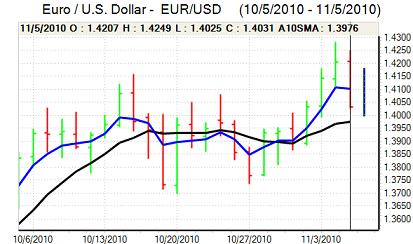

EUR/USD

The Euro was unable to make a fresh challenge on levels above 1.4250 in Europe on Friday and dipped sharply during the session. The currency was vulnerable to profit taking and a correction following the very strong gains seen following the Federal Reserve quantitative easing announcement, but there were also important fundamental factors undermining the currency as well.

As far as the Euro-zone is concerned, there were renewed stresses within regional bond markets as yield spreads continued to widen. There were reports that bond clearers were making it more difficult to trade Irish instruments as budget stresses persisted. There was also evidence that sovereign wealth funds were taking some Euro-zone bonds off their approved lists as Spanish yield spreads over German bunds hit a 3-month high. The economic data was also disappointing with Spanish GDP estimated to have stalled in the third quarter while there was a sharp decline in German factory orders.

The US employment data was stronger than expected with a headline increase of 151,000 for non-farm employment following a revised 41,000 decline previously while there was private-sector job creation of over 190,000. The unemployment rate was steady at 9.6% and there were still important areas of vulnerability, but the data did help stabilise dollar confidence and the Euro weakened to lows below 1.4030.

Treasury Secretary Geithner stated that the US would not use the dollar policy to gain competitive advantage while Fed Chairman Bernanke stated that a strong US economy was in the dollar’s best interests. There will need to be more convincing rhetoric to secure a major change in sentiment, but the Euro dipped to below 1.40 on Monday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips towards the 80.50 level against the yen during Friday and advanced firmly following the US payroll data as US bond yields rose with a gain to above the 81 level.

There were some reports of stop-loss dollar buying, but the US currency’s performance was still unconvincing. The yen gained some support when risk appetite faded, but the Japanese currency lost ground against the Australian and Canadian dollars with a hunt for additional yield.

The dollar maintained a firmer tone in Asia on Monday, holding above 81, while there was tough resistance close to 81.50.

Sterling

Sterling was blocked close to 1.63 against the dollar and dipped sharply to lows below 1.6150 with reported heavy sell orders associated with a rights issue in the banking sector.

The producer prices data was stronger than expected which provided some degree of Sterling support on expectations that inflation rates would be very slow to fall. In this context, the Bank of England inflation report will be watched very closely during the forthcoming week for further evidence on the bank’s forecasts as these will also have an important impact on monetary policy expectations.

Underlying confidence in the UK currency remained firm, primarily due to a lack of confidence in the dollar and Euro with reduced expectations of central bank easing also important. Sterling advanced to near 0.8650 against the Euro and also recovered to near 1.62 against the dollar as the trade-weighted index hit a five-week high. Sterling retreated on Monday, primarily due to a renewed US currency advance.

Swiss franc

The Swiss currency gained sharply against the Euro on Friday as the single currency dipped to lows below 1.35 during the session. Although the dollar gained strongly against the Euro, it found it difficult to make much headway and was blocked comfortably below 0.97 against the franc.

The Swiss currency gained important support from renewed fears surrounding the Euro-zone peripheral economies and increased stresses within the bond markets. The franc will tend to gain further support if sovereign wealth funds withdraw from some of the weaker Euro-zone markets with the Swiss institutions seen as an attractive defensive destination for funds.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

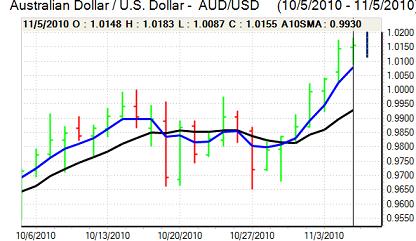

Australian dollar

The Australian dollar dipped sharply against the US dollar during the Europeans session on Friday as risk appetite deteriorated and there was general US currency rebound, especially against the European currencies.

The currency found support comfortably above parity and regained ground following the US employment data. A better than expected figure boosted confidence that global growth would be more robust and there was also further demand for the Australian dollar on yield grounds with the currency still able to hold above 1.01 on Monday despite the firm US currency tone.