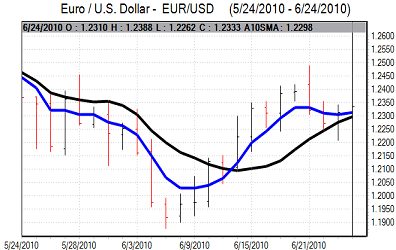

EUR/USD

The dollar lost some further ground against the Euro in Asia on Thursday, but with the Euro still finding it difficult to break above 1.2350 as resistance levels remained intact.

There was a renewed widening in Greek credit default swaps during the European session which unsettled the Euro and it declined to lows near 1.2250. Short-term players were unable to break Euro technical support levels which helped trigger a rebound in the currency.

The US economic data was close to expectations and had a limited market impact. Headline durable goods orders fell 1.1% while there was a 0.9% underlying monthly increase. The jobless claims data recorded a decline to 457,000 from a revised 476,000 previously. There will still be unease over fragility within the labour market while there will also be persistent doubts over the housing sector which will curb dollar support.

Dollar yield support remained weaker following Wednesday’s Federal Reserve statement with 10-year Treasury yields at an 8-month low which will tend to sap dollar support. In this environment, the dollar drifted lower and the Euro pushed higher to a peak near 1.2390 during the US session. The Euro retreated back to the 1.2330 area as Wall Street weakened for the fourth consecutive session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

There was some slowdown in Japanese export growth according to the latest trade data which may trigger some degree of caution over yen appreciation, although the impact will be limited unless fears over the global economy intensify. The dollar was trapped just below 90 during the Asian session on Thursday with the Euro unable to make much headway.

The dollar was again undermined by a decline in yield support following the FOMC meeting. Risk appetite was also generally weaker during the session as Wall Street came under pressure and there was a decline in the dollar to a low near 89.20 before a tentative rally.

Sterling

Sterling retained a firm tone in early Europe on Thursday with further demand following the MPC minutes on Wednesday. The UK currency pushed to a 5-month high on a trade-weighted basis while the currency also pushed to a 19-month high against the Euro given expectations that UK interest rates would be increased earlier than expected.

There was tough resistance close to the 1.50 level and Sterling was subjected to profit taking during the US session. There were also still doubts over the UK economy which curbed further buying support. Policy uncertainty will remain a key focus given doubts over Bank of England policy given conflicting pressures within the economy.

Trends in risk appetite will remain important in the short term with Sterling much more vulnerable to further selling pressure if there is a sustained deterioration in risk conditions. The currency dipped to daily lows near 1.4920 during the New York session as equity markets weakened.

Swiss franc

The dollar was unable to make a fresh move above 1.11 against the Swiss currency during Thursday and there was a test of support below 1.10 before a limited recovery. The Euro found support below 1.3580 against the franc, but was unable to make much headway as underlying sentiment remained weak.

Underlying risk appetite was weaker during the day which maintained some underlying demand for the Swiss currency on defensive grounds. There were also persistent doubts over the Euro-zone which maintained fears over capital flight from the Euro and triggered defensive demand for the Swiss currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

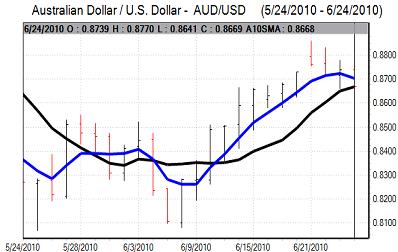

Australian dollar

The Australian dollar was unable to sustain a move above the 0.8750 level against the US currency on Thursday and was subjected to renewed selling pressure during the day. Although immediate political tensions have eased, underlying confidence in the economy remains weaker which curbed Australian currency buying support.

Risk appetite remained weaker during the day as commodity prices also came under further pressure and this also curbed support as equity markets also weakened. The Australian dollar dipped to lows near 0.8670 against the US currency.