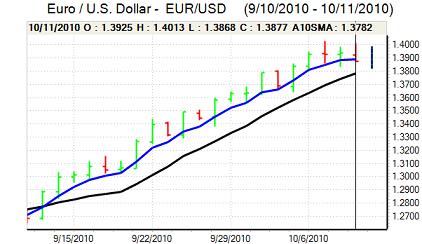

EUR/USD

The dollar nudged lower in Asia on Monday after there were no major international comments in support of the currency at weekend IMF meetings in Washington. The lack of cohesive rhetoric also maintained expectations of capital flows into emerging markets which tended to sap dollar support.

There were reservations over aggressive dollar selling given that speculative short positions were at the highest level since November 2007 with further Euro resistance just above 1.40.

There were no significant economic releases during the day from either the US or Euro-zone with the US officially on holiday even though Wall Street was open. There are important data releases later in the week with the latest retail sales and consumer inflation releases due for release on Friday which will be important for market expectations.

Federal Reserve policy will inevitably remain an important focus in the near term with markets looking for any further comments from Federal Reserve officials. In this context, the latest FOMC minutes will also be watched closely on Tuesday. Any signs of stronger opposition to further easing could support the dollar.

The Euro was subjected to some selling pressure during the day with frustration at the inability to break resistance levels and it retreated to lows below 1.3880 later in the US session as risk appetite was also slightly weaker and markets tested support levels.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar came under renewed pressure in Asia on Monday with lows below 81.50 before a tentative recovery. There was no major criticism of Japan’s currency-market intervention during weekend IMF discussions and this increased speculation that Japan would decide on further intervention.

With Japanese markets also closed for a holiday on Monday, there was notable caution in selling the US currency and it stabilised close to the 82 level with increased speculation over intervention.

There was some deterioration in risk appetite following the Chinese decision to tighten reserve requirements for six commercial Chinese banks. In this environment, the dollar was unable to make any progress significantly above the 82 level with the Bank of Japan also not taking advantage of low liquidity to intervene in the market.

Sterling

Sterling challenged resistance levels above 1.5950 against the US dollar on Monday, but was unable to make an attack on important technical resistance in the 1.60 level.

There was further speculation that the Bank of England could move to sanction additional quantitative easing at forthcoming MPC meetings. There were comments from the Finance Minister and Prime Minister that they would support additional quantitative easing if the central bank judged that further action was required. There is little doubt that the government will push for an easy monetary policy to offset the impact of fiscal tightening.

The latest inflation data will be watched closely on Tuesday and a weaker than expected reading would reinforce expectations that the bank could decide on a policy relaxation.

Sterling drifted weaker against the dollar during the day and dipped to test support below 1.59 while there was consolidation near 0.8735 against the Euro.

Swiss franc

The dollar found support below 0.86 against the franc on Monday, but failed to make strong progress as underlying sentiment remained weak. The Euro also tended to drift weaker against the franc during the day. European officials attempted to reassure markets over the Irish debt situation, but markets remained unconvinced over the longer-term outlook.

There will be further expectations of further quantitative easing by the G7 central banks and this will tend to limit any short-term selling pressure on the Swiss currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

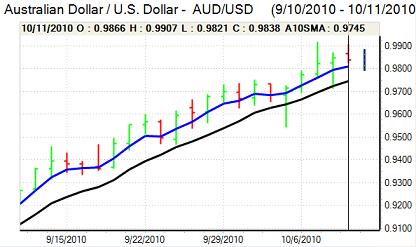

Australian dollar

There was an Australian dollar peak just above 0.99 in early Asia on Monday as the US currency remained weak and risk appetite was firm. The domestic data offered some support with rising home loans. There are, however, likely to be growing doubts over the domestic economy which will represent an important threat to the currency outlook.

There will also be pressure for the Reserve Bank to curb Australian dollar gains. There are also still important risks surrounding the global economy and tighter Chinese reserve requirements helped push the currency back towards 0.9820 against the US currency