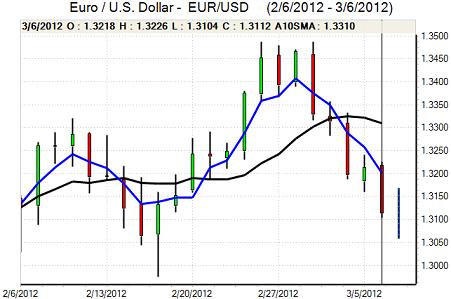

EUR/USD

The Euro hit resistance just above the 1.32 level in Europe on Tuesday and was subjected to fresh selling pressure with a test of support close to the 1.31 level.

Risk appetite remained significantly weaker which had an important negative impact on the Euro as equity markets were subjected to the sharpest decline in 2012. Euro-zone GDP was unrevised at -0.3% for the fourth quarter which maintained fears surrounding the recession risks, although the impact had been priced in to some extent given that the data had already been released.

There were further uncertainties surrounding the Greek private-sector debt restructuring and the net impact was to undermine the Euro. There was an initial warning from the IIF that a disorderly Greek default could cost EUR1trn, although this alarmist talk will have been aimed primarily at encouraging reluctant members to sign up to the deal.

There were still rumours that the PSI deadline would be extended which were denied by the government and there were also uncertainties over the take-up rate. A rate below 75% would effectively trigger a collapse in the loan deal while a rate in the 80% region would be likely to trigger collective action clauses.

There were no significant US economic releases during the day with markets waiting for important labour-market releases over the next three days. Attention was paid to the Republican Super Tuesday primaries, although the market impact was limited given a lack of decisive outcome.

A deterioration in risk appetite helped underpin the dollar and it advanced against commodity currencies as well as the European units. There was a general mood of consolidation in Asia on Wednesday as the Euro moved back to the 1.3150 area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was blocked in the 81.50 region against the yen in Europe on Tuesday and retreated sharply with stop-loss selling of a break below the 81 level. Despite a brief recovery, there was renewed selling during the New York session.

There was significant defensive support on the yen on defensive grounds as risk appetite deteriorated. There were particularly sharp yen gains on the crosses with the Euro and Sterling both retreating sharply.

An increase in Japan’s leading indicator did not have a major impact as markets focussed on global risk trends and there was dollar support in the 80.50 region on expectations that US yield support would be sustained.

Sterling

Sterling hit resistance just above the 1.5850 level against the dollar on Tuesday and retreated sharply during the day with an initial retreat to below 1.58. Sterling was unable to make a significant correction and tested support near 1.57 during New York.

On domestic grounds, there was some negative impact from the economic data as the Halifax house-price index recorded a 0.5% decline for February, reversing gains seen the previous month. The latest BRC shop-price index also recorded a further small decline which will give the Bank of England scope for some room for manoeuvre.

The major impact was from an underlying deterioration in risk appetite which pushed the currency significantly weaker. Sterling will continue to be influenced by trends in risk conditions, especially given the underlying UK banking-sector vulnerability. Sterling was also blocked in the 0.8325 region against the Euro.

Swiss franc

The Euro was unable to make significant headway against the franc on Tuesday and dipped to lows below the 1.2050 level. This hampered the dollar to some extent, but it was still able to advance to test resistance in the 0.92 area against the Swiss currency.

The National Bank is due to hold a press conference on Wednesday on foreign currency transactions. There were rumours that further transactions involving bank members would be revealed, but that they would not be resignation matters. A formal clearing of interim Chairman Jordan would tend to increase confidence that the minimum Euro level will be defended.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

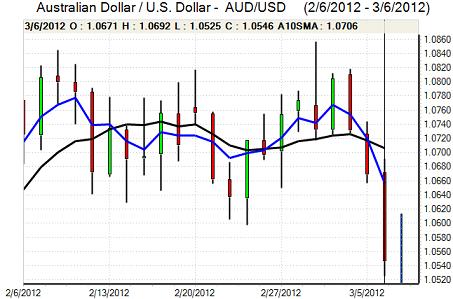

Australian dollar

The Australian dollar was unable to secure any significant recovery during Tuesday and there was further stop-loss selling on a break below 1.0580 with lows around 1.0520. Reserve Bank member Lowe again sated that the bank had scope to lower interest rates if necessary.

The currency was unsettled by a deterioration in risk appetite during the day as equities remained on the defensive amid doubts surrounding the global growth outlook. The currency was subjected to renewed selling pressure in Asia on Wednesday as there was a much weaker than expected GDP increase of 0.4% for the fourth quarter and another decline in the PMI construction index which triggered a test of Australian dollar support close to 1.05.