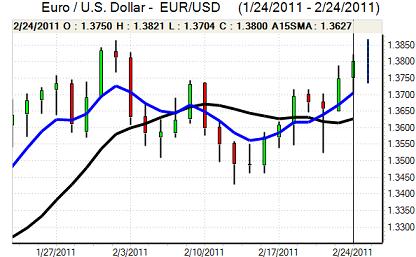

EUR/USD

The Euro dipped to lows just above 1.37 against the dollar in Europe on Thursday, but it rallied strongly back to the 1.38 area with a peak close to 1.3840 during Asian trading on Friday.

Risk appetite remained very fragile with further concerns over the Libyan and Middle East situation. Oil prices remained an important influence as they pushed to a 30-month high above US$100 p/b and the dollar was generally unsettled by high energy costs as it failed to gain safe-haven support.

Within the Euro-zone, there was further tough rhetoric from ECB members with out-going Bundesbank head Weber warning that the only direction for interest rates to go is up. There will be further expectations that the ECB will take a tougher stance on inflation and monetary policy at next week’s council meeting.

The US labour-market economic data offered some encouragement with jobless claims declining to 391,000 in the latest week from 413,000 previously. Headline durable goods orders rose 2.7%, but there was a sharp decline in core orders. In contrast to the ECB, there will be expectations that the Federal Reserve will maintain its dovish policy and keep interest rates low even if there is a further increase in energy costs.

There will still be fears that any increase in borrowing costs would undermine the Euro-zone economy and make it even more difficult for peripheral economies to escape from recession, especially as higher energy costs will also undermine demand. The Irish election result will also be watched closely as any sign of an aggressive stance on debt restructuring by the incoming government would also have a negative Euro impact.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar remained under pressure against the yen during Thursday and weakened to lows near 81.60, the weakest level since early February.

Risk conditions remained extremely important with the Japanese currency gaining further support from a deterioration in confidence and rising energy prices. The yen will continue to derive support when risk appetite weakens and there will also be further expectations of capital repatriation over the next few weeks.

Domestically, there was a recorded 0.2% decline in core consumer prices in the year to January. There will be speculation that higher energy costs will boost headline prices, but underlying deflation is liable to persist. The dollar edged back to the 82 area, but was unable to gain any significant momentum.

Sterling

Sterling again hit resistance above the 1.62 level against the dollar during Thursday and, after initially recovering from a decline to below 1.6150, there was heavy selling pressure during US trading which pushed it to below 1.61. The UK currency also weakened to a three-week low near 0.8575 against the Euro. Sterling will tend to under-perform when international risk appetite deteriorates, but there will also be domestic concerns.

The latest CBI retail sales survey recorded a sharp decline to 6 for February from 37 the previous month while the prices component rose to the highest level for 20 years and consumer confidence remained weak in February. The data will reinforce market unease over the threat of higher inflation at the same time as growth conditions deteriorate. If stagflation fears do increase, there will be pressure on the Bank of England not to raise interest rates aggressively. Even if the bank does tighten, the positive Sterling impact will be limited if the economy is weakening. Sterling edged back from lows in Asian trading on Friday but remained below 1.62.

Swiss franc

The Euro did find some support near 1.27 against the franc on Thursday and rallied slightly, but the US dollar was trapped close to record lows just above 0.9250. The franc continued to attract safe-haven support as risk appetite remained weaker. There is a general lack of confidence in the major G7 currencies and this lack of attractive alternatives is tending to amplify defensive Swiss franc support.

The National Bank will remain an important focus as there will be increased fears over deflation. As the franc gains ground, the bank will also record greater losses on its reserves which will increase domestic friction and criticism of the bank.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

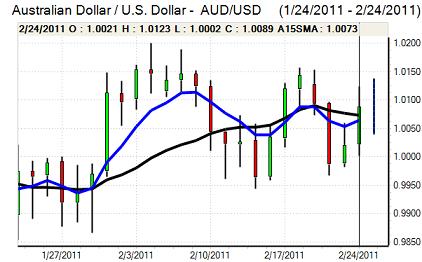

Australian dollar

The Australian dollar found support close to 1.0050 against the US currency during Thursday and rallied strongly to a peak above 1.0130 as the US unit remained under pressure. The currency was able to gain ground even though risk appetite was generally weaker during the day.

There will be expectations of further fund-related demand for commodities which will tend to underpin demand for the Australian dollar and the yield advantage remains intact. Nevertheless, there are still important risks surrounding the global economy and volatility is likely to remain high.