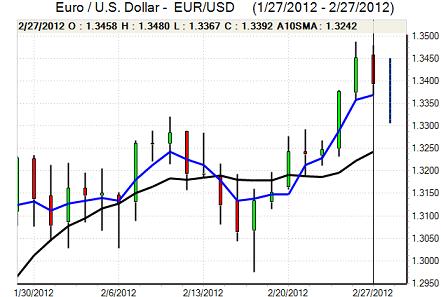

EUR/USD

The Euro hit resistance close to 1.3480 against the dollar in early Europe on Monday and the currency adopted a more defensive tone during the day, although no major support levels were broken.

Risk appetite was weaker during the European session as equity markets retreated and there was unease surrounding G20 reluctance to provide additional backing unless the Euro-zone strengthened defences first. There was also uncertainty surrounding the German parliamentary vote on Greece’s loan deal.

Markets were buffeted by central-bank and semi-institutional buying during the day with Euro support below 1.34. The Euro-zone money supply growth was slightly stronger than expected for January, but loan growth remained very weak and there was a further exodus of funds from Greek banks as the peripheral economies remained under major stress. The ECB bought no peripheral bonds for the second week running.

The German parliament voted comfortably in favour of the Greek loan deal with Merkel’s coalition just securing the necessary votes without the support of the opposition. Merkel, however, also reaffirmed her opposition to increasing the European Stability Fund and insisted that Greece would need to make the necessary policy changes. There was still a mood of unease surrounding the Greek deal with further voices calling for the country to be offered a package to leave the Euro area and rebuild the economy. As expected, Standard & Poor’s cut Greece’s rating to selective default.

The US pending-home sales data was stronger than expected with a 2.0% increase for December which took the annual increase to the highest level since April 2010. The data helped reinforce market confidence in the US housing outlook and also had a positive impact on risk appetite which had a mixed impact on the dollar. The Euro recovered to the 1.3450 area as underlying dollar demand remained weak.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to regain momentum against the yen during Monday with heavy resistance above the 81 level and it was subjected to strong selling pressure during the European session. There were important moves on the crosses as the yen corrected stronger against the Euro following recent sharp losses.

The dollar still gained some support on yield grounds, especially after the pending home sales data, but a significant shift had already been priced in which limited the impact. The Japanese retail sales data was stronger than expected with a 1.9% annual increase.

The yen gained further traction in Asia on Tuesday with exporters selling the US currency ahead of the month end. Expectations of very loose monetary policy supported risk appetite and allowed a dollar recovery back to the 80.50 region.

Sterling

Sterling hit resistance above 1.5870 against the dollar and drifted weaker, although selling pressure was generally continued amid a lack of fresh incentives. The UK currency strengthened against the Euro with a test of resistance below 0.8450.

There was a sense of greater optimism surrounding the UK economy with markets anticipating another relatively firm set of PMI releases for February and this was important in curbing selling pressure on Sterling with the latest manufacturing data due on Thursday. The impact was offset by a stark warning from Chancellor Osborne over the state of underlying government finances.

Defensive situations remained important for the currency and the easing of immediate fear surrounding the Euro-zone outlook curbed defensive Sterling demand, although caution inevitably prevailed.

Swiss franc

The dollar found support close to 0.8950 against the franc on Monday and edged back to just above the 0.90 level, but there was selling pressure above this level. The Euro remain generally subdued and unable to make significant headway despite finding support close to 1.2040.

Markets were inevitably nervous surrounding the prospect of National Bank intervention so close to the 1.20 level with a reluctance to take on the central bank and the Euro secured some recovery in Asia on Tuesday. The UBS consumption index was unchanged at 0.92 for February.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

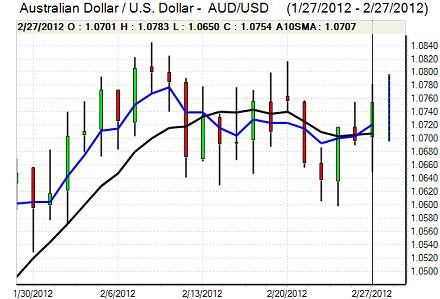

Australian dollar

The Australian dollar dipped to retreat to the 1.0650 area against the US currency during Monday before rebounding strongly in New York. There was a general improvement in risk appetite which helped support the Australian currency and there was still limited demand for the US currency given the very expansionary monetary policies pursued by global central banks.

Choppy trading conditions continued during Tuesday and there was firm demand on dips which helped the currency re-test resistance close to the 1.0780 region. The Chinese PMI data will be watched closely later in the week.