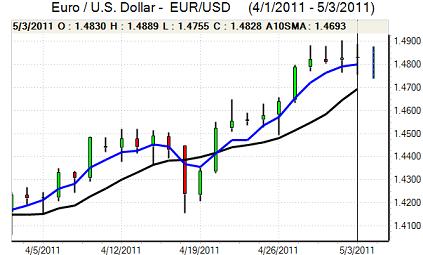

EUR/USD

The Euro again found support above the 1.4760 area against the dollar on Tuesday and rallied strongly during the US session with a peak around 1.4880. The Euro was unable to sustain the advance and retreated to lows around 1.4780 in Asia on Wednesday.

Risk conditions continued to have an important impact and the dollar gained support on renewed downward pressure on Asian equity markets. Global equity-market trends will remain very important, especially given the substantial capital flows into emerging markets. Any reversal in equities would also risk a substantial covering of short dollar positions.

The US employment data will be watched closely on Wednesday with the release of the ADP report, although the impact is liable to be measured unless the figure deviates sharply from expectations. There was a decline in short-term US Treasury yields and the lack of yield support for the US currency will remain an important barrier to more substantial gains.

Portugal announced that it had agreed a EUR76bn bailout package, but attention was focussed more on other countries, especially with some speculation that core Euro-zone economies could be subjected to selling pressure.

There will be further caution ahead of the ECB interest rate decision on Thursday. There will be no change in interest rates this meeting, but the central bank signals on future policy will be extremely important. With speculation that the bank could signal a further increase in rates at the July meeting, there will be reservations over aggressive Euro selling.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to gain any traction against the yen during Tuesday and continued to test support below the 81 level as the Japanese currency also gained some support on the crosses with the Euro moving to below the 120 level.

Risk appetite was more fragile as commodity prices retreated and there was also renewed speculation that the Chinese central bank could raise interest rates again during May which exacerbated the mood of caution and curbed carry trades funding through the Japanese currency.

Tokyo markets remained closed for a holiday on Wednesday as part of the Golden Week holiday which dampened trading activity. There were further expectations of medium-term capital flows out of Japan and fears over the domestic debt situation. Yen buying was also curbed by unease over the threat of G7 intervention.

Sterling

Sterling drifted weaker ahead of the UK economic release on Tuesday and then fell sharply once the data was released.

The PMI index for manufacturing declined to 54.6 for April from a revised 56.7 the previous month and this represented a seven-month low for the series. Manufacturing has been a strong point for the economy over the past few months and the second successive sharp drop in the index undermined confidence. The latest CBI retail sales survey was strong, but the expectations component weakened to a 12-month low.

The data reinforced market expectations that the Bank of England would leave interest rates on hold at 0.50% at the Thursday MPC meeting. In contrast, there was speculation that the ECB would signal a further tightening at central bank meeting on the same day. This speculation pushed Sterling to a 12-month low just beyond 0.90 against the Euro.

The UK currency remained under pressure in Asian trading on Wednesday as it struggled to move far away from the 1.6450 area against the dollar.

Swiss franc

The dollar was again blocked in the 0.8670 area against the franc on Tuesday and retreated to fresh record lows near 0.86 before finding some limited respite. The Swiss currency remained strong on the crosses as it strengthened beyond 1.28 against the Euro and also reached fresh record highs against Sterling.

The franc will tend to gain further support if there is a sustained deterioration in risk appetite, especially as the National Bank, rather surprisingly, has not indicated any major protests over the franc’s level at this stage.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

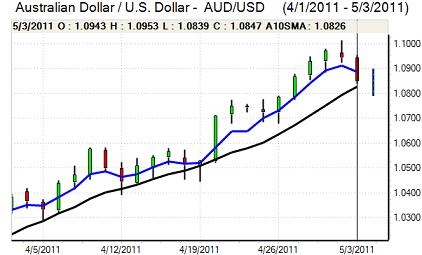

Australian dollar

The Australian dollar retreated to the 1.0850 area against the US dollar on Tuesday and after a rally attempt failed at the 1.0920 area, the currency was subjected to renewed selling pressure with a temporary retreat to lows below 1.08.

There was some disappointment over the relatively dovish tone by the Reserve Bank, but international considerations tended to dominate with the Australian dollar unsettled by a deterioration in risk conditions. There was also speculation over further monetary tightening by the Chinese central bank which increased pressure for profit taking on long positions.