EUR/USD

The Euro hit resistance above 1.3020 against the dollar in Europe on Wednesday and there was only a brief advance following the better than expected German IFO survey. The currency then traded with a weaker bias ahead of the US open as Euro-zone structural fears persisted. There were continuing doubts surrounding the Greek situation as the default risk remained high amid there were further concerns surrounding Portugal as yields pushed to a fresh record high.

There were also suggestions that German Chancellor Merkel was losing faith in Greece’s ability to avoid default which undermined confidence and there were generally negative comments surrounding the Euro-zone outlook and the currency dipped to lows around 1.2925 against the dollar.

After a strong focus on the Euro-zone, attention switch strongly back to the US with the latest Federal Reserve policy decision. There were no policy surprises with interest rates left on hold. The statement was, however, significantly more dovish than expected as the majority of participants were expecting Fed Funds to remain at the current extremely low levels until late in 2014 compared with previous expectations of 2013 previously.

In his press conference, Fed Chairman Bernanke was also dovish in his outlook despite being slightly more optimistic surrounding near-term economic prospects. Bernanke stated that further quantitative easing could be considered and, although the Fed adopted an inflation target of 2.0% for the first time, he stated that further easing could be considered even if inflation was above 2.0%.

The dovish statement was important in underpinning risk appetite and was also important in undermining the dollar as it dipped sharply to lows beyond 1.31 against the Euro. There will be the risk of fresh trade tensions and friction with Europe given the perception that the US will resist forcefully any strengthening of the US currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar maintained a strong tone in Europe on Wednesday and pushed to highs around 78.35 against the Japanese currency. The yen was still unsettled by the latest trade data as the first annual trade deficit for 16 years reinforced a lack of medium-term confidence in the economy and increased pressure for a weaker yen.

The dollar failed to sustain the gains and weakened back to the 77.70 area later in the US session. The US currency was undermined by the dovish Federal Reserve tone with reduced yield support.

Underlying risk appetite was firm which helped lessen yen demand on the crosses as the Euro pushed to one-month highs in the 101.90 area.

Sterling

Sterling retreated ahead of the GDP data on Wednesday, retreating to lows below 1.5550 against the dollar while the Euro approached the 0.8380 area.

The headline GDP data was slightly weaker than expected with a contraction of 0.2% for the fourth quarter and there will be concerns over the lack of growth in the private sector given that government spending actually made a significant positive contribution. The data will reinforce near-term fears surrounding the economy and the underlying debt trajectory.

The Bank of England MPC minutes from January’s meeting recorded a 9-0 vote for keeping interest rates and quantitative easing on hold. The minutes did, however, reveal greater divergence in opinion surrounding the outlook for growth and inflation. There was still a lack of confidence in the outlook, but several members were more doubtful whether there would be a sustained decline in inflation. In this environment, it will be more difficult to secure unanimous support for any further boost to quantitative easing at February’s meeting which will tend to increase Sterling volatility.

Dollar weakness was the dominant theme later in the US session and this pushed Sterling to highs around 1.5670 while the Euro was able to recover from losses to the 0.8325 area.

Swiss franc

The dollar was again unable to break above the 0.9320 area against the franc on Wednesday and dipped very sharply to lows around 0.9210 following the Federal Reserve meeting. The Euro was also again unable to hold above the 1.21 level.

There was evidence of speculative Euro buying against the Swiss franc while there was also evidence that funds were selling the Euro. If these reported flows are accurate, then there will be a much higher risk that the Euro minimum level will come under attack in the short term. In this environment, volatility is likely to increase given that the National Bank will aggressively resist any franc strengthening.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

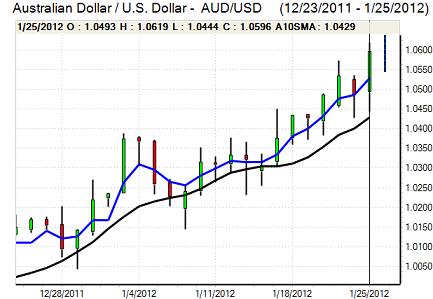

The Australian dollar came under pressure during the European session on Wednesday and retreated to lows around 1.0450 before stabilising. US trends dominated later in the US session and the currency gained very strongly with a peak above 1.0620.

The Australian dollar gained support from an increased yield advantage as the Federal Reserve maintained an ultra-dovish tone and the prospect of extremely low rates also helped underpin risk appetite which supported the Australian dollar.