TUESDAY – 8/25/09

6 am

ROEMER—

With China being such a large buyer of many commodities, of course, and most recently increasing their purchases of U.S. soybeans, helping to offset the ideal and mostly bearish U.S. weather, we wanted to look more closely at the corn and soybean situation there. Also, we look more closely at the crop index for India. Below we also discuss, in more detail, the current situation in India, which is very important to the world oilseed market, as well as sugar, and a bit, cotton.

KEY POINTS/SUMMARY BELOW–

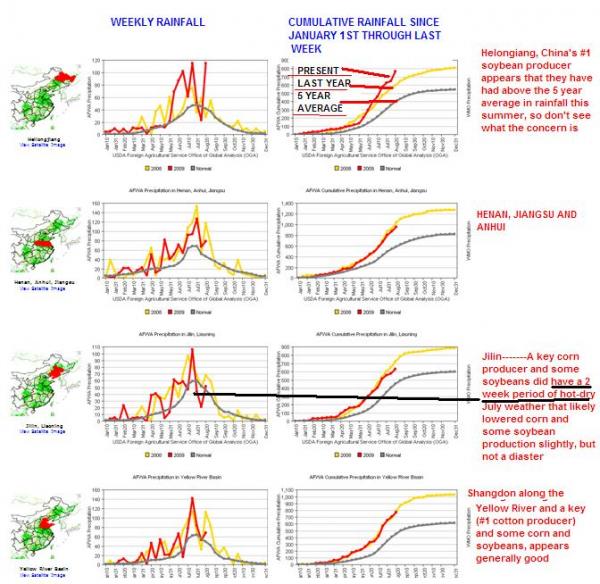

*China corn and soybean production has probably been lowered over some 20-30% of the region, from dryness the last few weeks. Not a disaster, but no better than trend line yields are expected right now and possibly 2-5% below trend line. The weather forecast is for generous rains over 60-70% of the region the next week to ten days. So, kind of mixed signals from the weather.

* In China–The # 1 soybean regions in Heilongjiang- generous rains and generally good early season moisture should result in pretty good crops, otherwise we would have a major panic on our hands out of China! Nevertheless, further south in a few areas around Jilin and the Shandong, some crop reductions are likely. This is in contrast (see maps below from WMO), showing tables that indicate everything is great.

*India’s oilseed regions, especially over Andra Pradesh and the NW have suffered some irreversible damage, as well as some sugar in central regions. Generous rains are coming to 70% of India’s key central sugarcane and soybean regions, while oilseeds in the NW still have slightly below normal rainfall and some problems. The rains will probably prevent further damage, for now, to sugarcane, otherwise a crop below 17.5-18.0 MMT would have been possible. So the question for sugar prices are, how much has the market already rallied on this drought talk, versus their import needs and rains in the forecast?

CHINA RAINFALL IN JULY AND LAST WEEK

The map on the left below shows total rainfall for July, and on the right, rainfall last week. According to NOAA, some key corn and soybean regions were below normal in July rainfall, maybe over 30-35% of the region.

This lowered soil moisture content. The map on the right shows how Jilin, especially missed most of the rains last week, which accounted for a good part of China’s corn production, and about 10% or so of soybeans. Most other areas, such as Heilongjiang to the north (#1 soybean region), received between 25-50 mm of rain (1-2″). This eased dryness somewhat and prevented sharp losses in soybean production.

WORLD METEOROLOGICAL ORGANIZATION WEEKLY AND CUMULATIVE RAINFALL TABLES–according to them…few problems to China corn and soybean regions.

According to the WMO, most crop growing areas in northern China (key cotton, soybeans and corn areas), appeared to have about normal, or even above normal rainfall versus last year and the 5 year average. However, sometimes the WMO has been known to give the most accurate weather info out of China, so further scrutiny was necessary.

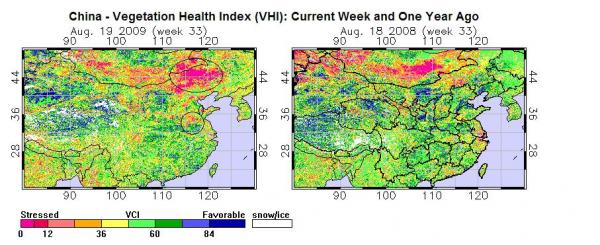

While not a disaster, the map on the left ( below), shows some crop stress around and even south of the Yellow River, as well as Northeastern China. The darkest red is just to the west of the primary corn and soybean regions, otherwise, major crop losses would have been likely. Nevertheless, last year, as you recall, we had above normal yields in corn and soybeans. The map on the right shows generally favorable conditions a year ago, but you can see how conditions this year are not as good. The bottom line——-look for no better than trend line yields for corn and soybeans, and possibly even a few % below trend line, especially in areas around Jilin (#1 corn producer).

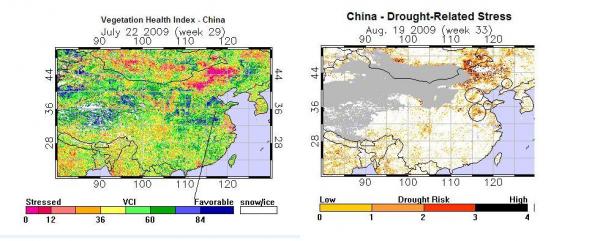

The charts below show the vegetable health index (left), as of a month ago. Notice the blue regions and more favorable conditions. Since then, conditions have deteriorated some for corn and soybeans. Heilongjiang, again, in NE China has been ok.

The map to the right shows areas of drought stress probably affecting some 30% of corn production and 20% of soybean production. I am not sure if the impact on cotton is really a problem, but it’s something to look into. Again, some irrigation does occur in the region of course, but some stress has occurred with last week’s rains at least temporarily halting further problems.

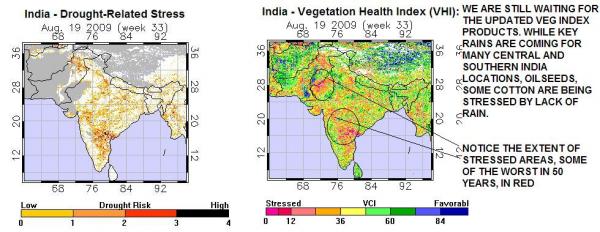

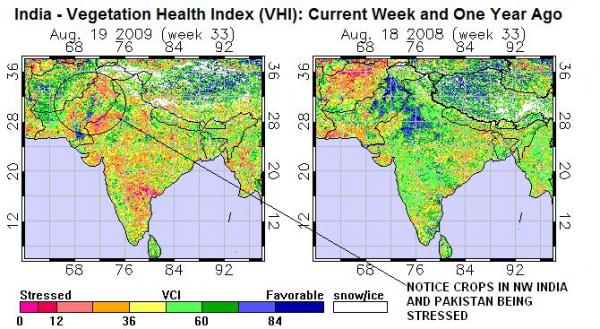

A LOOK AT INDIA’S VEGETATIVE HEALTH AND DROUGHT STRESS REGIONS

Even though the monsoon began a bit earlier than normal, last May in southern India, if you recall, based on increased Eurasian Snow Cover, warming in the equatorial Pacific and a few other factors, I said that

“The monsoon would likely be erratic” with several crops seeing at least slightly below normal yields. This has certainly been the case, even though Sea Surface Temps around India would have suggested a much more favorable solution.

So, what do we know about India right now? First of all, we are aware that India sugarcane production may not surpass 18.0 MMT, which means they have to sharply increase imports this year and has been a main drive in the sugar market lately, along with wet weather in Sao Paulo. However, rains last week in NE India and in central areas this week will at least halt, for now, further deterioration. Whether that is a negative market factor, I don’t know, as some other weather developments are bullish, but we have rallied a long ways.

Also, dry weather, especially in the NW, has reduced seedings of some oilseeds, such as peanuts. I believe that India is the world’s largest buyer of palm oil. China I believe is #1. In India, 35-40% of their oilseed regions have

suffered drought. This would include peanuts, groundnuts and sunflowers. While key soybean regions in central India and Andhra Pradesh are slated to get good rains this week, rainfall has still been below normal in soybean and peanut regions by as much as 55%. This is very significant and has been a background factor offsetting the bearish U.S. weather situation, in my opinion. This is really nothing new.

The forecast for the next week or so is for at least normal to above normal rainfall over probably 70% of this region affected by drought. Some irreversible losses are already likely to sugar and peanuts, but soybeans

can recover somewhat. The NW oilseed regions will see some rainfall, but probably not enough to bring a major improvement. So, all in all, we have some problems, obviously, but generous rains are coming to probably

70% of the region over the next 10 days, with a possible early withdraw in the monsoon, later, sometime in September. We will see.