S&P 500 WEEKLY RE-CAP 10-15-2011

The rally that started October 4th, off the 1068 low, continued this week with the S&P auctioning above the 1200 price level. The S&P Cash Index ended the week at 1224, at/or near the August 31st high at 1230.00

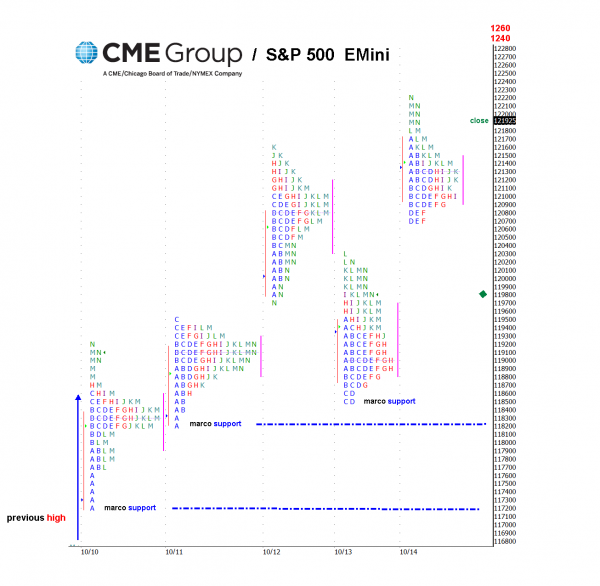

This week, the S&P pulled-back to 1187, October 10th low and confirmed support at 1190 on October 13th. The S&P is currently up 8.25%, the third best two-week start to October in the index’s history. In two weeks the S&P has traded one standard deviation above its 50 day price average.

Intraday trading ranges continue to show “gap’s’ above previous day’s closes and later in the day rallies.

Economic indicators: Of the eight economic releases this week, seven were better than expected. The data is clearly evident, the U.S. economy is stabilizing. Retail sales are improving.

Earnings: A Q3 earnings season is off to a strong start. This first week of earnings season, 7 of 9 S&P 500 components beat earnings estimates. Earnings season will noticeably increase this week.

At Friday’s close, the market was poised to break-out above the 1225 and continue higher. Break-out attempts fail more often than they succeed. The week’s minor pull-back to 1187, 1190 was the only long opportunity, this week. Buyers were rewarded with a higher high at Friday’s close.