The S&P 500 e-mini futures – the vehicle we use to trade the equity market – is going to be pulled and pushed by competing forces this week.

The long-term trend is up. Despite the wreckage of the past three weeks – for the first time in many months the market looked to be cracking – we still believe the long-term top may not have been reached yet.

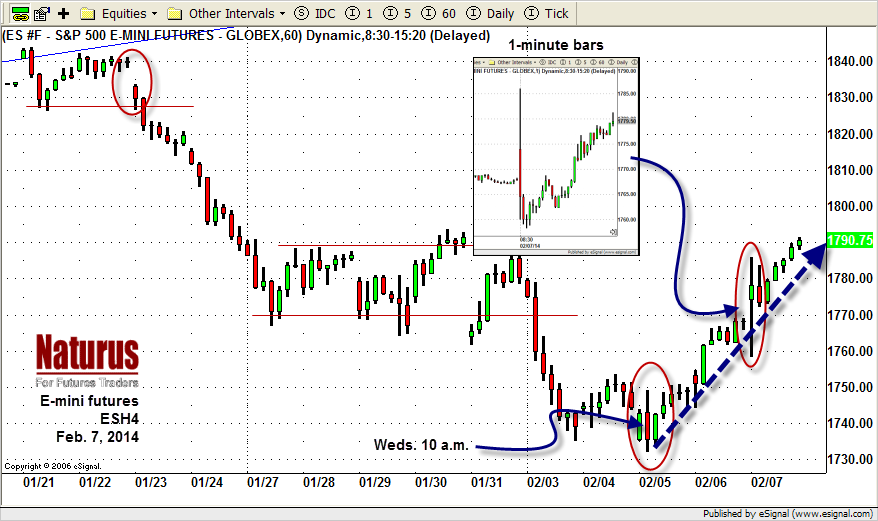

But the short-term trend is down, even though the bulls made a pretty good recovery last week – back within spitting distance of 1800 for the close.

What you need to watch out for

We don’t know how this competition will be resolved, but we do know a couple of events you need to watch this week.

On Tuesday (Feb. 11) and again on Thursday (Feb. 13) the new chair of the Federal Reserve, Janet Yelled, is appearing before Congress to give her perspective on the direction of the economy, and the Fed’s next moves.

Whatever she says, it will make the market skip. We just don’t know in which direction.

The background

The Fed has announced plans to cut its bond-buying program – the fuel that has kept the market moving up for at least the past two years – from $85 billion a month to $75 billion.

$75 billion a month is still $1 trillion a year in excess liquidity sloshing around in the market, which should be enough to make even the greed heads of Wall Street fat and happy.

But the reality of the first actual reduction in Fed spending, coupled with the possibility there might be more cuts coming, pushed the market down 10% in a few days, and penetrated a significant support level, the December low around 1754.

And then it stopped

And then, last Wednesday (Feb. 6) around 10 a.m., it stopped, just as the price was flirting with the November low 1736. And then it started moving back up.

The reason was speculation that the employment numbers were bad, and if they were bad enough, the Fed might be forced to reverse course and “untaper,” if that’s a word.

The climax came of Friday at 8:30 a.m., when the Non-Farm Payroll report was released. The number stank, way below expectations, for the second time in two months. Bad news! Hurray!

You can see the result on the chart. In the space of a little more than three minutes the e-mini futures (ESH4) spiked up, and then down a distance of about 25 points in each direction, a round trip which undoubtedly ran all the stops on both the buy and the sell sides. Ouch.

What happens next

Technically the market is in no-man’s land, trading above long-term support and trying to regain control of the broken short-term support, now become resistance. Intraday ranges are increasing and the price movements are becoming more violent.

The rally is based on speculation about the Fed’s plans, (plus a little pump-and-dump action leading up to Yellen’s remarks) and rallies based on speculation tend to fade away when reality bites.

Still, the market has rallied almost 60 points from Wednesday to Friday. Hard to ignore that.

We’re looking for a continuation up first, and a pullback later. The first resistance is 1802-04; the second is 1812-15. Those are places where the rally could easily stop; assuming Yellen does not say something outlandish.

The support is around 1775, and below that, 1754. Again.

The first hour of trading on Monday is likely to set the tone for the day, and perhaps for the week – at least until the Fed speaks. Then it is time to duck and cover, and come out after the train has passed to scavenge in the wreckage.

Chart: Emini futures (ESH4) Feb. 7, 2014

= = =

Polly Dampier is the brains behind Naturus.com, a subscription service for active traders. For more information about her outlook for equity markets, visit www.members.naturus.com