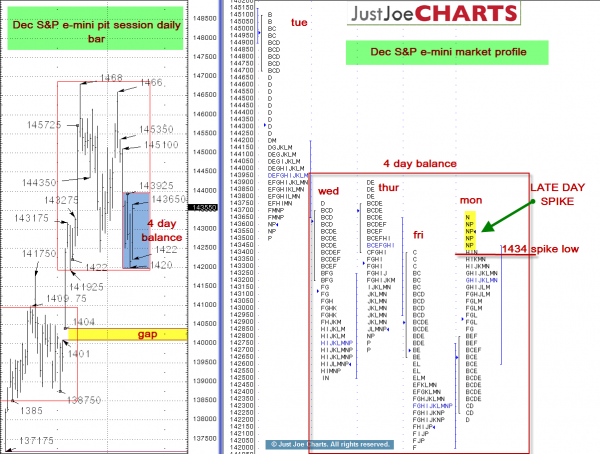

The December S&P e-mini contract has been in a 1422 to 1468 balance bracket over the past several weeks. Additionally, the market has been a relatively tight balance of 1420 to 1439.25 over the last four days.

BE READY FOR A BREAKOUT

When a volatile market such as the S&P is contained within a tight balance for several days, a significant move usually follows the breakout from balance.

LATE DAY SPIKE UP

At the end of the day on Monday, the market made a new daily high and extended the daily range higher and formed a “late day spike up” on the market profile. A “late day spike up” is simple and extension of the daily range that takes place during the last 30 minutes of the pit session. Late day spikes are measuring sticks for the next trading day. If a market opens in or above a late day spike up, or the late day move, it is a bullish signal. If the market rejects a late day spike up and opens below a late day spike up, it is a bearish signal. Monday’s late day spike range is 1434 to 1436.50

KEY LEVELS

If the market gains acceptance above the 1439.25 four day balance high, 1451 and 1453.50 and the upside references to watch.

If the market rejects the late day spike, it may simply continue to rotate within the four day balance range.

If the market gains acceptance below the 1420 four day balance low, it may test the 1402 to 1404 gap below.