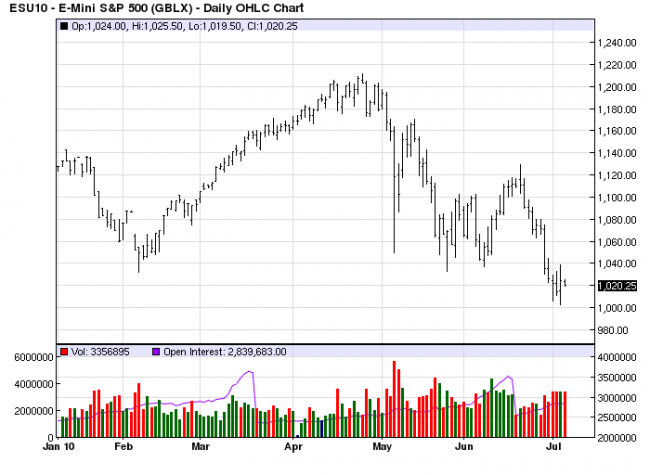

Tuesday Evening 6 July 2010

Let us start with the good news. The new low was the smallest decline from a

previous sell-off, just by about 4 points, if the 1002 low holds. We know from this

that the market pressure is lessening. If it were not, the new low would be greater

than it was. Tuesday is the widest bar to the upside since the mid-June high.

Finally, price closed in the upper half of the bar, and above the two previous lower

closes.

There is a solid basis why we keep saying to wait for confirmation. Over the

past 11 trading days, how many longs are making money? Not many. Always,

always know the most important piece of information before making a trade

decision, and that is: KNOW THE TREND OF THE TIME FRAME BEING TRADED!

This is one rule for which there are no short-cuts. The trend is down.

Today’s sharply higher open and early rally ran right into our projected resistance

area we stated in yesterday’s article, 1035 – 1040, and then, rather than hold the

gains, price steadily deteriorated. The prevailing down trend continues to weigh

on the market, and it takes time to make a turn. The intra day hourly chart

looked like a turn was in progress, but it was not confirmed. We digress a bit.

The other piece of good news is the volume, at least it seems to belong in the

good news column. The level of volume has picked up at the lows, and price is

holding. That can be attributed to only one factor. The buyers are stepping up

and preventing the market from going lower. Today’s low is a line in the sand

that needs to be protected, and a rally away from current lows needs to happen,

and soon.

The bad news is that intra day price came down hard. That is to be expected in

a down market environment. The off-setting counter to this bad news is that the

market was able to rally about 11 points off the lows to save what looked like a

potential larger sell-off.

If, that little qualifier that always looms large, price goes under 1002 with ease,

950 and then eventually 850 are in the cards, and it does not take a fortune teller

to make that determination. Ending not on good news nor bad, we have to wait

for the developing market activity to tell us in which direction the market will

proceed, and then look for a spot to go with it.