Sunday 6 June 2010

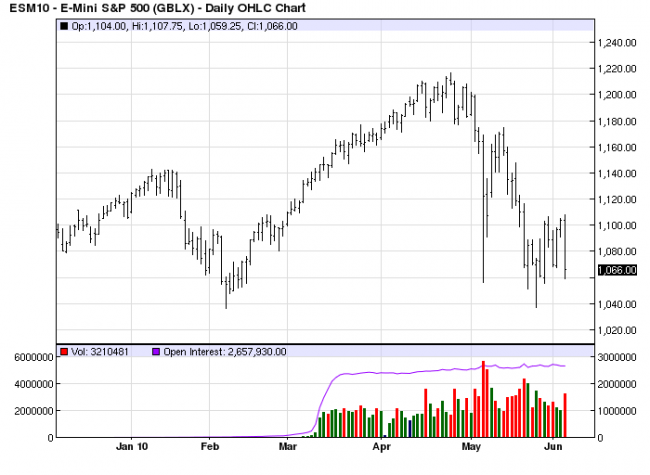

The answer to the question posed, is there trouble with a big “T” or a little “t”

in store for the S&P? Turns out, it was large. That there would be a decline

came as no surprise. What came as a surprise was the rapidity and extent of

it. The small range high was the tip-off. [See S & P – Rally In Trouble?, click

on http://bit.ly/aplYRE, third paragraph]. The Thursday small range bar, a red

flag because it occurred at a known resistance area, raised the possibility of a

retest of the 1060 area if price failed, [see third paragraph after first chart,

same article].

It is not good practice to have a new, or relatively new, position established

going into a report. There must have been some kind of advance leak, for

price sold off several hundred points prior to the release of the employment

report. After the report, the decline afforded little opportunity for a position

without entailing undue risk. In order to know what to do next, we revert back

to the basics: what is the TREND?!

It is clear that sellers resumed total control of the market as it declined with

impunity. We saw that back on 24 May when we mentioned that “surprises”

most always occur in the direction of the trend. [See S & P – The Market Is

Showing Its Hand, click on http://bit.ly/9PpjCm, first, and last paragraph].

Contrast the difference between Thursday’s small range rally bar with that of

Friday’s wide range decline bar, and you see the difference between a lack of

demand on the one, and supply selling on the other. Knowledge of the trend

is crucial, for it makes for reading market activity somewhat easier.

The logical question to pose is, what do we know for certain?

In a market that exhibits such weakness, we know that price will continue to

decline until there is evidence of buyers entering and arresting the selling

activity. Thursday’s small range rally is a perfect example of buyers failing

to take control when they had an opportunity to do so. That left the door

open for sellers, and for Friday, that door was a floodgate.

However, we have seen such declines in the past few weeks, and from our

perspective, they uncovered demand, [buyers] at the lower levels. Right

after a steep decline on the 24th, we determined there was buying at the

lower levels, [ See S & P – A Set-Up In The Making, click on

http://bit.ly/aLZKzQ, fifth paragraph]. It is important to remember that

smart money buying comes from lower levels. It is axiomatic that smart

money is buying when weaker hands are selling.

Will that continue to be the case here?

We do not often reference the Nasdaq chart, but here it is. The Nas,

comprised of mostly technology stocks, has been leading the stock market

rally since November/December 2008. The S&P closed under the week’s low

ranges, above. The Nas held last week’s lows, forming a short-term double

bottom. Didn’t we recently discuss a double bottom? Why, yes. [See S&P –

The Market Message Remains On Point? click on

http://www.insidestocks.com/commentary/story.asp?id=153676, first

paragraph after first chart.] Will this double bottom on a shorter time frame

work? We can never know in advance, nor do we need to, so we always

follow developing market activity to provide the answer.

Note is made that Friday was an Outside Key Reversal, [OKR], for both the

Nas, and the S&P. An OKR can be a very strong message. [OKR = higher

high, lower low than previous day, and in this instance, a lower close, as well.]

While we wait for developing market activity to tell us if the May lows will hold

or not…clues will be the size of the bars and volume…a look at whether

buyers are still showing up at these lower levels is in order. The direction and

momentum of the market is down, as acknowledged, and will continue until

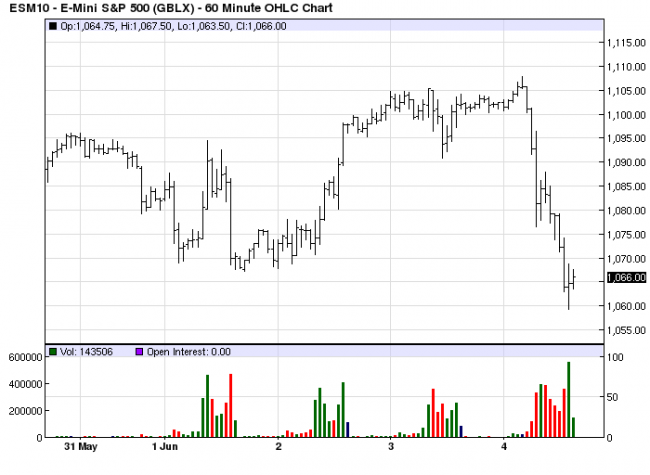

opposing evidence shows up. What can be asked about the hourly chart is,

is there any such opposing evidence?

Look at the highest volume bar from Friday’s intra day activity. It occurred

right at the low. We see that as a transfer of risk, weak longs selling out

under pressure, while strong hands scoop up the offerings. The close of that

low bar was mid-range, and that tells us there was buying at the lows. Who

would be doing that level of volume buying, and at the lows of a somewhat

panic decline? You get the point.

This is the caveat to the sellers being in control, and why we raise the

question…not to recommend any buying at the bottom, but as an alert to a

possible turnaround rally as has occurred throughout the month of May, and

last February.

Why not also look at the stronger Nas 60m chart to see what it shows? There

is the double bottom set-up from an intra day perspective. Just as with the

S&P, the Nas’ highest volume was at the low of the decline, and the close was

positive. There is also a clustering developing there, and that can some-

times be a clue for a turnaround. [Note in both instances, the S&P and Nas,

the high volume at the very low was also the highest hourly volume in several

trading days. That can be added significance,]

Sellers now have every opportunity to press the market to crush buyers and

make new lows. It would seem that most would take that point of view. What

is not expected is a hold in the decline and a reversal, once again, to rally

prices to the 1150, or higher, level. How many expect that when price is so

low?

The odds favor more decline, and we would never stand in the way of market

momentum and the trend. It is just as important to be aware of a few

observed hints, outlined above, in case the unexpected does take place.

What we also know for certain in futures trading is, anything can happen!!

Always, always, let the market be the best guide, and follow its path.

If there is to be more downside, an opportunity to short a weak rally will

present itself. If the recent lows are to hold, in some fashion, an

opportunity to get long will present itself, as well.

Patience is the standing order, at this point.