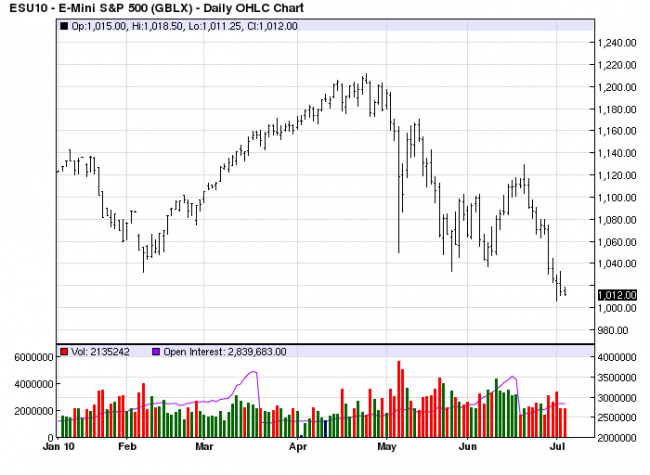

Monday Evening 5 July 2010

In the last article on 1 July, mention was made about a rally potential, but on a

“maybe” basis. None, of any consequence developed, and what was described

as a weak market is living up to that characterization. There is little need to get

too analytical here. The trend has turned down, for some time now on the daily,

and more importantly, also on the weekly. Price remains in an oversold condition,

and the caveat issued last time about oversold conditions is that they can become

MORE oversold. Always wait for a sign from the market before deciding a change

has occurred.

So far, none has.

We still see the low from Thursday, third bar from the end, as important for the

near term. The range was somewhat contained, volume increased, and the

increased effort rallied to close near the upper end of the bar. The only force that

can close a market on the upper end of a bar is stronger buying over selling

efforts. One would not expect to see buying stronger when price is making a new

low, so that raises a red flag of caution for downside continuation. Keep in mind,

price has been down eight days without any kind of relief rally.

A closer look at a 60 minute intra day chart shows that the market has really

been moving in somewhat of a sideways direction since the 29th of June. We

also see the highest intra day volume occurred on last Thursday. There has

been no downside follow-through, and that day could be evidence of stopping

volume, at least temporarily.

“Could be stopping volume” does not mean that it is until the market confirms

it. Remember, the market HAS to confirm every aspect of its activity before it can

be established as true. Given the weak character of price behavior, it looks to us

like last Thursday’s low could be exceeded, and if it is, we would expect it to be

brief, with a counter-trend rally then getting underway.

If that turns out to be what develops, THEN we will be in a better position to gauge

where a counter rally would likely fail, and THAT is where a short position will be

entertained. The obvious first level of resistance is the 1035- 1040 area, where

price clearly broke a support range. Previous support becomes future resistance.

Elementary, as Holmes would say. No place to pull the trigger, yet.