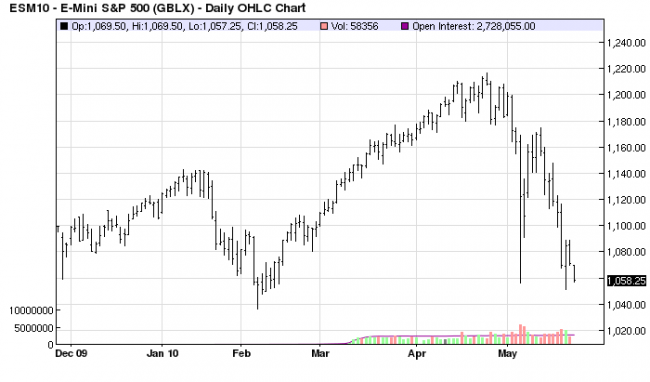

Monday Evening 24 May 2010

Yesterday, mention was made that the market will show its hand. Today it

certainly did that, for clearly the sellers are in total control. We said if there

are any surprises, they tend to happen in the direction of the trend,

[see S & P – Keep A Perspective, 8th paragraph]. The surprise came by the

end of the day: no follow-through rally, and ease of movement down.

What many expected today was the beginning of a recovery rally after Friday’s

strong turnaround close off the low. Initially, price did rally. We even engaged

in a day trade from the long side, [the intra day trend began turning up, so we

knew the time frame for what was solely a day trade, and made money]. The

market made known its intent in the last two hours of the trading session, and

it revealed important information about what to expect.

The first expectation, a continuation rally, was dashed when price could not

get above the lower end of developing resistance ranges starting at 1089, up

though the 1123 area. The high was 1088.75. What confirmed that the rally

was likely to fail, in addition to it being weak, was the lack of volume. In order

to break through a resistance area, there has to be volume, proof that buyers

are present and behind any rally. The opportunity to capitalize on a move up

presented itself, however, buyers were totally AWOL.

For a while, that was also true of sellers. Light volume said neither side was

pressing the market, although the down trend gives the sellers a decided edge.

What spelled Trouble for the bulls, and that is spelled with a capital “T,” was

the ease of movement down going into the close. It was deja vu all over again!

By the end of the day, the market made it crystal clear, price is headed south,

almost with impunity.

There is no need to draw any trend lines or look at artificial indicators, like

moving averages, over bought, over sold, etc. The small range, the lack of

volume, and the close on the low says it all. [Second to last bar. The last bar

is the evening session, as we write]. It tells us how weak the market really is.

The close told us to expect lower prices Tuesday.

The message of the market is very clear. The demonstrated weakness and

inability of buyers to take a stand tells us the February lows, 1035.25, are a

retest, likely at a minimum. The downside momentum tells us that another

wash out of longs could be in the cards, and it could get ugly for them.

Never, ever underestimate the power of a trend, and never get in its way.

You are seeing firsthand why. There is little need to fine tune this decline, for

it will go where it has to go until most all of the hold-out buyers throw in the

towel. We have our rules of engagement, and there will be opportunity to

benefit. We are on the sidelines, waiting for one.