Monday Evening 7 June 2010

Next to reiterating how important the trend is for successful trading,

developing market activity is the best way to read the market for

understanding the probability of what may next happen. Last Thursday’s

small range resulted in the article, [see S & P – Rally In Trouble?, click on

http://bit.ly/aplYRE]. The lack of demand, [buying effort] at resistance,

and the inability of buyers to extend the range higher was the clue to

expect a sell-off. There is no way to know how large or small a correction

that may follow, but at a minimum, the clue said not to be long or at least

move up stops on any long position.

In the last article, the market read suggested there was buying on the

sharp breaks, [see S & P – Hold Or Give Way?, click on http://bit.ly/9rh4bL,

6th paragraph]. These observations were based on an interpretation of how

market activity develops, and it is why this article is prefaced in the title,

“Watch Developing Activity.” The read of a market can change on any given

day, or if a read is wrong, it can be better clarified by developing activity, and

it is so important to be flexible and willing to change as new price information

comes out.

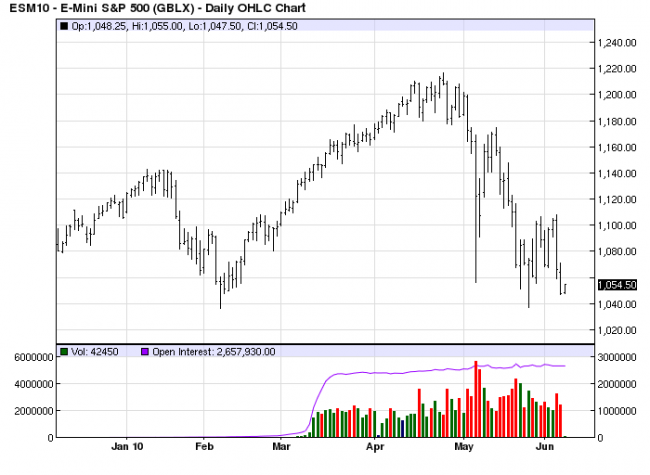

It is apparent from the daily chart that the three lowest lows, prior to last week,

were wide range bars down with closes on the upper end of the range. The only

way a bar can close upper end of a range is if there are buyers to rally price by

the end of the day. Thursday’s small range bar that led to Friday’s sell-off, 4th

bar from the end, failed at resistance from three trading days earlier. Now there

is Monday’s bar, second from the end, [the last bar is the start of the evening

session, leading into Tuesday].

This is the latest in developing market activity, and it is a change in behavior.

The bar did not close on the upper end. There was no demand rally. First, let

us deal with the read, and for that, a look at the intra day activity will provide

important information.

1

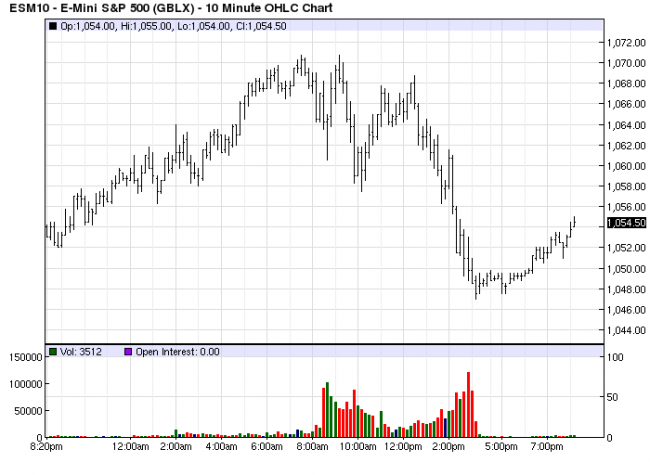

The 10 minute chart, starting with the day session at 8:30 a.m., CST, shows

a small double top around 1071, from the overnight session. Volume was

very light throughout the day. Shortly after 12 p.m., price formed a lower

swing high. Compare the level of volume on that lower swing high to the

level of volume from the first few hours of trade…dramatically lower. This

says there was no demand, no buying interest, a weak rally. Weak rallies

will lead to lower prices.

Just as with not knowing what kind of correction would follow last Thursday,

there was no way of knowing what kind of correction would follow the weak

rally. Turns out, price dropped 14 more points by the end of trade. Previous

sell-off bars showed demand, and prior to the final decline yesterday, the

day’s range was relatively small to the downside, and that suggested little

selling pressure.

The point of all this is that the change of behavior was not known until the

last hour of trade. Up to that time, there was no reason to be long, at all.

With the previous demand lows and developing trading range, there was

not much reason to be short, either, because price was at the low end of the

range.

One would think that all of this information brings clarity, but it does not.

Price still has to exceed and close under 1040 to confirm greater market

weakness and the end of the rally that started in March 2009. We could

see demand enter the market tomorrow and start another rally. There is

no way to know. That leaves us with watching developing market activity,

once again, to see HOW price reaches or exceeds the 1040 support area,

if it gets there, and how price responds, once it does get there.

Monday’s close was right on the low, and that kind of close can sometimes

be exhaustion, a prelude to a, dare we say, rally? The trading range remains

intact, even though Monday was the lowest close since early February. In

addition to the apparent weakness and the possibility of new lows and

continuation lower, we can still see a quick drop to a slightly new low, followed

by a higher range close, for when it comes to the markets, anything can

happen.

We remain sidelined until there is a more definitive place in which to take a

position, long or short. The market will let us know, just as it already has.