Sunday 25 July 2010

The most important piece of information one can have is knowledge of the trend.

While that statement can be viewed as Technical Analysis 101, it is equally true for

the most advanced of trading, and that is because the trend is a principle that

applies all the time in all time frames. Forgetting this seemingly simple bit of

information can be costly.

In the last article, mention was made that a trading range is a nemesis for trend

trading. [See S & P – A Trading Range – Nemesis For Trend Trading, click on

http://bit.ly/cbOEXN, and note the second to last paragraph, for the market is still

at this phase…no ending action to the current rally.

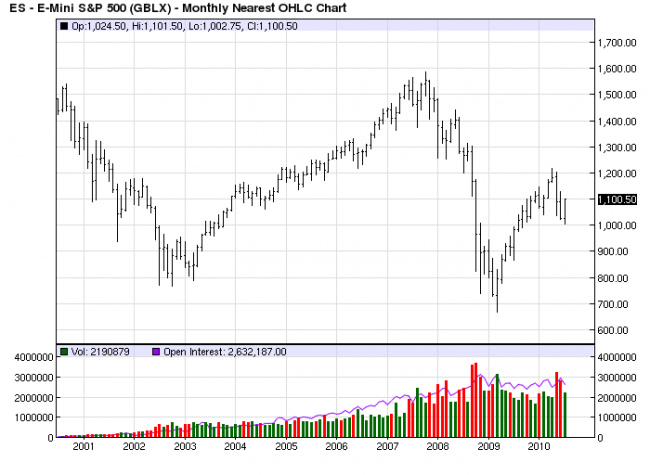

The trend is important in the time frame being traded, so a quick review of the

trend over the various time frames. Monthly: Down. Price failed on a small range

monthly bar, indicative of an inability of buyers to extend the range higher. Price

failed just above the half-way retracement point and at the July 2008 low. Lower

highs and lower lows = down trend.

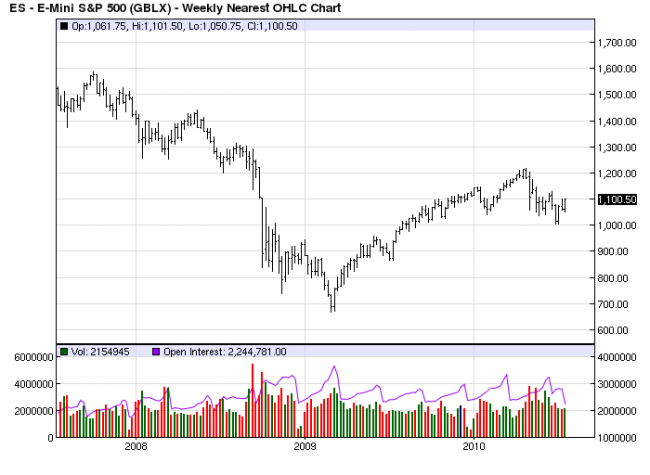

The weekly chart is a more detailed version of the monthly, and it shows how

price has broken a previous low for the first time since the March 2009 rally

began. The biggest clue that the March 2009 rally is one within a down trend is

the length of time it has taken to retrace to the 50% area, and the bar ranges

are so much smaller than the previous down bars, including the recent failure

from April. The bars have gotten decidedly larger on this break. Trend down.

Adding the above two charts was an afterthought to the next two, so the charts are

from a different vendor, which does not really matter, other than as an explanation

for the difference. Here is where the current analysis begins. The trend is clearly

down here, after a series of lower highs and lower lows.

There is a supply trend line connecting the April – June highs that has been

broken. As an aside, these kind of trend lines are not that significant for us,

although many analysts put a lot of emphasis on them, often to their detriment.

There are more important price levels to be gleaned. Even though the trend line

has been broken, there is still some resistance at 1100, and again at 1130, the

mid-June failed rally. Both are more important indicators of resistance than the

identified supply trend line.

The devil must have been a technical analyst, too, for the devil is in the details

of the charts. The details are important, for they tell the market’s “story.” For

now, that story is muddled, and that is a simple fact. Not everything in the market

is as clear as many would like, but exercising patience and waiting for that clarity

will pay off. Eventually, market activity will become clearer.

Price is in a trading range, defined by the April high and July low, and there is

another trading range within, defined by the 1100 high and the last low near

1050. The next chart will show yet another smaller trading range. What can be

said about these trading ranges is to leave well enough alone until they come to

a resolve, and they will. THAT is when an opportunity can present itself with a

higher level of knowledge than is available right now. In a trading range, the

level of knowledge is low.

The half-way points on the monthly and weekly charts, from the April high to July

low is 1109. That is considered resistance. From the daily chart, with the current

rally evolving, there does not appear to be any ending action. Until there is, we

can expect the rally to continue. There are three possibilities to expect from here:

up, down, or more sideways. What else can any market do?

Continuation up is the most likely scenario, but the question is, how much

higher? The market has to deal with the immediate resistance at 1100, and

Friday’s close puts price right there. This daily chart was printed earlier in the

day, so it does not show that price closed at 1100. Next resistance is the 1109

level, just mentioned.

What will be important from Monday is to watch HOW the rally continues, and

HOW it approaches the 1109 half-way mark, IF it does. We do not know that,

yet. If the intra day rallies are wide ranges to the up side with increased volume,

1109 may not hold, and 1130 becomes the next target. Of course, there can be

a brief rally above 1109 that fails and closes lower, and that becomes another

story.

Yet more detail from a 180 minute chart, or three hours. It cuts out a lot of

“noise.” Here you can see the trading range within the other trading ranges,

defined by the 1100 high and the 1080 area. Oops. This chart does not show

the current trading range detail. Let us add one more, the 60 minute. The

current trend on this 180m chart is either a trading range, or down, so make it

questionable.

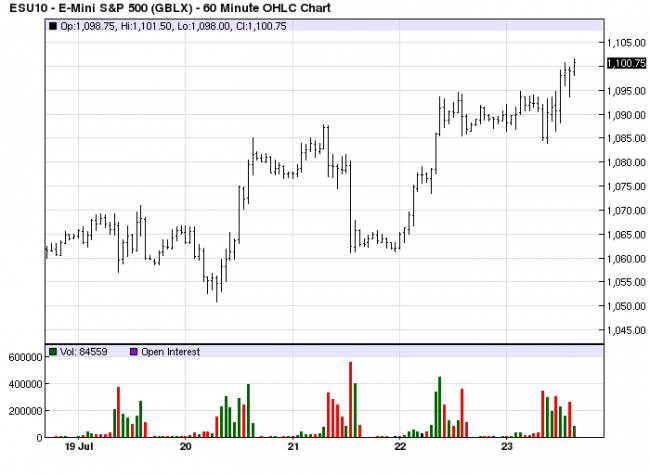

Here you can see the smaller trading range, within all the other trading ranges,

between 1095 and 1085. For now, it has resolved itself by closing higher, but we

are comparing a relatively much smaller time frame when compared to the larger,

more controlling monthly, weekly, and daily time frames. While the 60 minute

time frame trend is up, it has too much opposition to rely on it. Use it more as

a timing tool.

The point to be made is that the charts are not showing clarity, so wait, or the

devil may get you.