I told you I have had people calling my office who know absolutely nothing about wheat wanting to own it. If a limo driver in LA thinks its time to own wheat, its got to be a top…On Thursday night, the same day the following CNBC show aired, we opened five cents higher and then moved as much as 50 cents higher. Somewhere during the middle of the night, Russia indicated that they would allow exports in the pipeline to go free… Low and behold we have not only give back the overnight high and high of the move for WZ at 868… We settled at 755 1/4.. Only a 1.12 3/4 cent “correction”.

I read some newsletter sources calling this “profit taking”. I wonder if the people who got long on the CNBC story overnight felt like they were taking profits, as they lost a potential $5,650.00 per futures contract, if they bought the high and held it through the limit down settlement. Unless they did a synthetic short by buying a put and selling a call, they could have an after dinner desert on Sunday night. I like to call it “Up the Creek, Ala Mode”.. Why? Because on Sunday night we will have expanded limits. That means not 60 cents, but 90, so if we open and move lower once again, those lucky longs who did not get out by close of business today, Friday the 6th, will be looking at losing another 90 cents, or $4,500.00. Now I am starting to understand why they call the show “Mad Money”. You might be mad if you took the bait and bought the rumor fueled by speculation and greed. Losing potentially over 10K, per contract, in just two days would be enough to make even the wealthiest speculators ‘mad’…

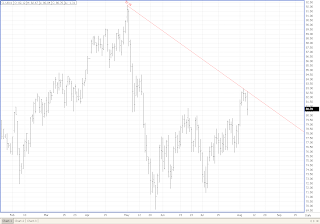

Moving on to Crude oil, please click on the graph (at the top of the page) I have included in this post. It graphically shows the downside risk now in front of Crude Oil prices. A look at my older posts from just a few sessions ago, outlined the ‘head-fake’ for bulls in crude oil. Now we have the door opened for a meaningful downmove. You call it profit taking… I call it weak longs coming to the party late and getting left holding the bag…

Today’s high completes the third touch of a nice long term bearish trend line. Please look at the chart. You can see that Sep crude is vulnerable to another $4.00 move down to the 76 support/congestion area. I would not be surprised to see that. In fact, I think its a good short position to have on the books. Could we pop back up and test the trend line again? I hope so. That will give a good entry point to either initiate or add to the short position.

We’ll see how she breaks in the next week. Based on this chart, though, I want to be short with a target at 76.