Key News

•Germany’s economy will shrink by 6.2 percent this year and stagnate in 2010, the country’s central bank said Friday. (AP)

•The Bank of Japan will consider upgrading its view on the economy this month as improvements in exports and output fuel hopes that the worst of the recession is over. (Reuters)

•The pound fell, heading for its biggest weekly decline since April against the dollar, and gilt yields rose, as Prime Minister Gordon Brown rearranged his cabinet amid calls for his resignation. (Bloomberg)

•Latvia’s central bank on Thursday rejected calls for the country’s currency to be devalued and pledged to defend the lat’s peg to the euro despite fears in financial markets that the crisis-hit country might soon be forced to abandon the fixed exchange rate. (FT)

Key Reports Due (WSJ):

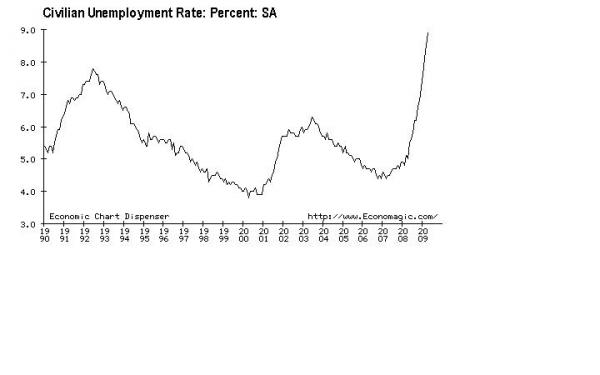

8:30 a.m. May Non-Farm Payrolls: Expected: -525K. Previous: -539K.

8:30 a.m. May Unemployment Rate: Expected: 9.2%. Previous: 8.9%.

3:00 p.m. Apr Consumer Credit: Expected: -$7.3B. Previous: -$11.1B.

Quotable

“An additional lesson learnt from the party’s near-death experience in Tiananmen was that it must co-opt social elites to expand its base. The pro-democracy movement was led and organised by China’s intelligentsia and college students. The most effective strategy for preventing another Tiananmen, the party apparently reasoned, was to win over elite elements from Chinese society, thus depriving potential opposition of leadership and organisational capacity.

So in the post-Tiananmen era, the party courted the intelligentsia, professionals and entrepreneurs, showering them with perks and political status. The strategy has been so successful that today’s party consists mostly of well-educated bureaucrats, professionals and intellectuals.

“…With any self-respecting multinational rushing into the Middle Kingdom, those who refused to recognise the new reality risked being outcompeted. In China, they also found undreamt-of freedom in doing business: no demanding labour unions or strict environmental standards. Wittingly or otherwise, western business has become the most powerful advocate for engagement with China. Its endorsement, along with the pragmatic policy pursued by western governments, has lent a legitimising gloss to the party’s rule.

“Ironically, this political strategy has worked so well that the party is now paying a price for its success. With the technocratic/conservative alliance at the top and the coalition of bureaucrats, professionals, intelligentsia and private businessmen in the middle, the party has evolved into a self-serving elite. Conspicuously, it has no base among the masses.”

How Beijing kept its grip on power, By Minxin Pei

FX Trading – Sentiment extreme?

Ladies and gentlemen step right up and place your bets.

It seems a lot is riding on this opportunity for more “green shoots” this morning. Most expect the dollar to tank on better than expected jobs news; but few seem to be thinking the dollar will rally on worse than expected news; that’s because it’s a foregone conclusion the dollar will continue to weaken no matter what. Thus, it seems a sentiment extreme may be in the air.

We see the usual suspects once again calling for the dollar to be trashed and we just can’t seem to find anyone who likes the dollar. Fact is they may be right. But nonetheless it has the feel of a crystallizing sentiment extreme. And often that’s the best time from a risk-reward perspective to start looking in the other direction for a trade setup.

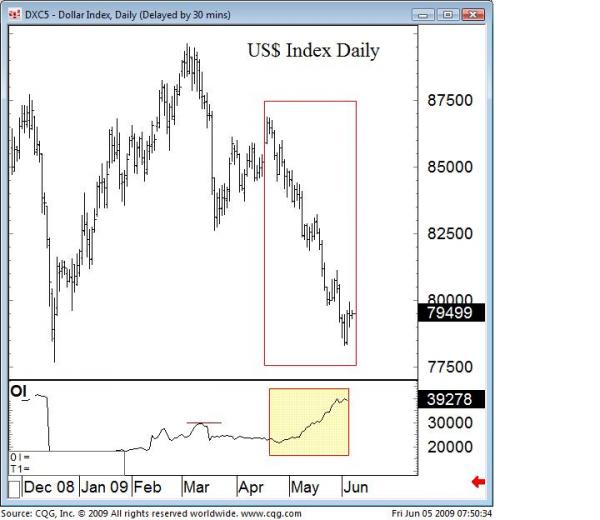

A simple look at the dollar index in the chart below shows the latest leg down in the buck has been vicious and powerful (red box on the price data). This is a healthy trend supported by an increase in open interest (red box with yellow background at the bottom of the chart). This open interest increase shows there have been a lot of players jumping on this trade and riding this move; a bit of a one-way bet in play. Granted, we have seen much heavier positioning against the dollar in the past. But relative to recent positioning, it is high.

Price action perpetuate into self-reinforcing trends as the players in the currency market add to positions when price goes their way; and that process alone hardens their belief that their rationale for the move is correct, which emboldens them to add to the trend, which leads to even more confidence…and so on…and so on…and is why currencies overshoot (why all markets overshoot in fact).

Nothing new here, it is the way markets are and have to be. It’s just that because currency analysis has more potential for getting it wrong, in that the potential drivers are so vast, we tend to see overshoot to a much greater degree in the currency arena.

It is the stuff at the end—the crystallized extremes based on confidence by the players often based on flimsy or outright silly underlying rationales—that gets people into trouble. Of course we only know that with hindsight. But we have seen a common thread over the last couple of years when the dollar has been pasted, it’s the idea the dollar will be losing its world reserve currency status. That seems to be a simple rationale that all dollar haters seem to have in common just before the beginning of a big dollar move the other way. Just a thought…stay tuned.

Have a great weekend.

Jack Crooks

Black Swan Capital LLC

www.blackswantrading.com