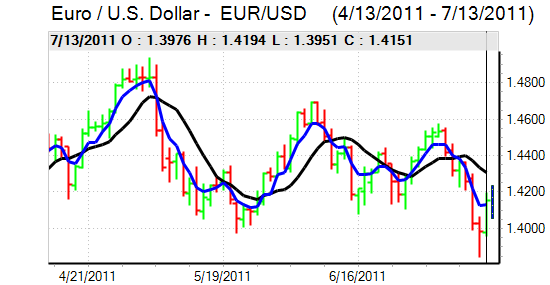

EUR/USD

The Euro hit resistance above 1.4250 against the dollar during Thursday and had a generally weaker tone, due in part to a correction from the sharp gains seen over the previous 24 hours.

As far as the Euro-zone is concerned, there was relief that Italy managed a relatively successful bond auction, but yields still rose substantially from the previous auction, illustrating how much sentiment has shifted and there were still very important fears surrounding the Italian contagion risk with persistent concerns over Spain as well. Austerity measures were approved in the Senate and will now face a Lower-House vote on Friday.

The bank stresses-test results will also be announced on Friday with markets uneasy over the outcome and the methodology used. There was further uncertainty surrounding an emergency EU Summit with Germany still resisting plans and the underlying mood of uncertainty remained an important negative Euro influence.

The headline US retail sales data was close to expectations with a 0.1% monthly increase while underlying sales were unchanged. Jobless claims fell to 405,000 in the latest week from 427,000 previously while headline producer prices fell 0.4%.

In the second part of congressional testimony, Fed Chairman Bernanke stated that inflation was higher than in 2010 and that the Fed was not prepared for further action at this time. These remarks lessened immediate speculation over any additional quantitative easing and the dollar recovered to near 1.4110 against the Euro.

The gains were partially reversed in Asia on Friday as Standard & Poor’s also put the US credit rating on negative watch. There was a reported agreement between the Administration and Congress over US$1.5trn in budget cuts, but there was no overall deal which would allow the debt ceiling to be raised with markets increasingly anxious over the default risk.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

After spiking higher late in the Asian session on Thursday, the dollar was unable to sustain the gains and retreated back to test support below 79 against the yen. There were reports of importer buying which helped underpin the US currency. There was also some relief over the latest US economic data which curbed dollar selling, although yield support remained weak.

The yen continued to gain protection from a crucial lack of confidence in the dollar and Euro, especially with fears over a lack of political leadership.

Markets remained on high alert over possible intervention to weaken the yen as verbal intervention continued by Japanese Finance Ministry officials. There was still scepticism that there would be any concerted G7 action to weaken the Japanese currency.

Sterling

Sterling remained generally out of the headlines during Thursday and there was support close to 1.61 against the dollar as ranges narrowed. The Euro also hit resistance above 0.88 against the UK currency.

With attention focussed on the Euro-zone and US vulnerabilities, there was some defensive support for the UK currency. There was still an underlying lack of confidence in the economic outlook and there were also strong expectations that interest rates would remain at extremely low levels over the next few months.

There was also persistent speculation that the Bank of England could expand quantitative easing over the next few months which curbed underlying capital inflows.

The latest government-bond auction met with firm demand, but markets will continue to watch UK yields closely for any evidence of a deterioration in underlying confidence which would undermine Sterling sharply.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

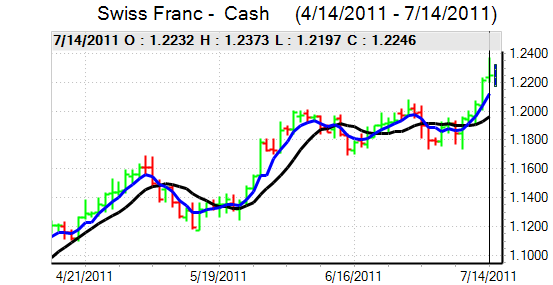

Swiss franc

The Euro was again on the defensive against the franc on Thursday and after an initial move to the 1.1650 area, there was a renewed slide to below 1.1550. The dollar was also unable to regain the 0.82 level against the Swiss currency and consolidated near 0.8150.

There was no significant improvement in confidence surrounding the US and Euro-zone economies during the day and this continued to trigger defensive demand for the franc with fears over capital flight from the Euro area. Markets remained on high alert over comments from National Bank officials given heightened expectations that the central bank would be forced to act.

Australian dollar

The Australian dollar pushed to a high near 1.0785 against the US currency during Thursday, but there was resistance at higher levels and it drifted back to test support near 1.07 as the Euro also failed to hold its best levels.

There was a slightly steadier tone to risk appetite, but sentiment still remained very cautious, especially with increased doubts surrounding the Asian growth outlook with a particular focus on China. Any sharp slowdown in the Chinese economy would undermine the Australian dollar, especially as industrial commodity prices would be subjected to heavy selling pressure as well.