EUR/USD

The Euro was subjected to very heavy selling pressure on Wednesday as the situation in Italy deteriorated rapidly. There was a surge in Italian bond yields during the session as Prime Minister Berlusconi’s resignation promise failed to boost investor confidence and there was a total absence of buying support. Benchmark yields rose through the 7.0% level, a pivotal area which helped trigger rescue packages in Greece, Portugal and Ireland. The very sharp increase in yields inevitably increased fears that Italy would also require multilateral support.

The severe problem for the Euro area is that Italy is the third largest bond market in the world and there would need to be a huge financial commitment to stabilise conditions. The EFSF is very unlikely to have sufficient resources even if it can secure additional leverage which would increase pressure for IMF support. This development will put strong pressure on the ECB to increase its bond purchases through quantitative easing, but the bank will continue to face major resistance to making such a commitment.

Given these pressures, there was also increased speculation that the Euro-zone governments would be forced to consider much more radical solutions. There would either need to be a full-scale commitment to fiscal union or a move to create a narrower Euro-zone. This speculation was fuelled by media reports that Germany and France have been working on a plan for a scaled-down Euro area for months.

There was a serious deterioration in risk appetite on fears that a crisis within the banking sector would undermine the global outlook. Confidence was also undermined by another failure to secure a new Greek Prime Minister even though Papandreou tendered his resignation.

The Euro recorded its biggest one-day decline in 15 months as it fell to a low near 1.3515 against the dollar as the US currency also secured increased defensive support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support in the 77.50 area against the yen on Wednesday and pushed to a high near 77.90. Both currencies gained defensive support from a deterioration in risk appetite with the Japanese currency advancing strongly against the Euro and Australian dollar.

There was a weaker than expected reading for core machinery orders which fell 8.2% for October following a 11.0% increase previously and confidence in the Japanese growth outlook remained weak even though it is a volatile series.

There will be further speculation over Bank of Japan intervention, although the severe stresses within Euro-zone markets will tend to make it more difficult for the central bank to intervene unless it is in the context of wider G7 efforts to stabilise currency markets.

Sterling

Sterling was unable to regain the 1.61 level against the dollar on Wednesday and was then subjected to heavy selling pressure as weaker than expected data was compounded by a strong gains for the US currency. Sterling weakened to lows around 1.59 against the dollar, but the cross-rate influence was illustrated by gains to 8-month highs near 0.85 against the Euro.

The latest trade data was worse than expected with a goods deficit of GBP9.8bn from a revised GBP8.6bn the previous month as exports were subdued and import demand increased. The data will increase fears over a downward revision to the third-quarter GDP data, although the overall impact is likely to be measured at this stage.

Sterling continued to gain defensive support from safe-haven flows from the Euro-zone as confidence continued to deteriorate. There were, however, also fears surrounding the UK economy as there would be a serious impact from a Euro-zone recession. In this context, there was some speculation that the Bank of England could consider additional quantitative easing at Thursday’s monetary policy meeting and volatility is likely to remain at elevated levels.

Swiss franc

Wider Euro losses maintained some downward pressure against the franc on Wednesday, but there was support below the 1.23 level. The dollar found support below the 0.8950 level and pushed to a high above 0.91 during the Asian session on Tuesday.

There was some defensive demand for the franc as Euro-zone fears escalated, but these fears tended to be overshadowed by unease over the potential for an increase in the minimum Euro level. There has been further pressure for additional action by industry groups and the bank is happy to keep an element of uncertainty in the market.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

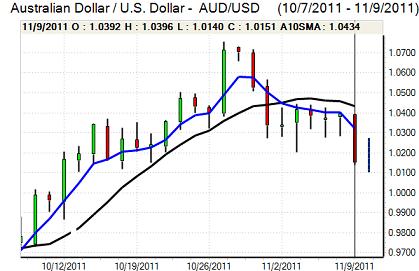

Australian dollar

The Australian dollar was blocked in the 1.0360 area against the US currency on Wednesday and fell sharply as underlying risk appetite deteriorated. As equity markets came under heavy selling pressure, the currency dipped to lows near 1.01. There were additional fears of a global banking crisis which would potentially expose the Australian dollar to heavy selling pressure.

Domestically, the latest labour-market data was broadly in line with expectations as there was a 10,100 increase in employment and a dip in the unemployment rate to 5.2% from 5.3%. The data dampened expectations of further immediate rate cuts, although global risk conditions remained dominant.