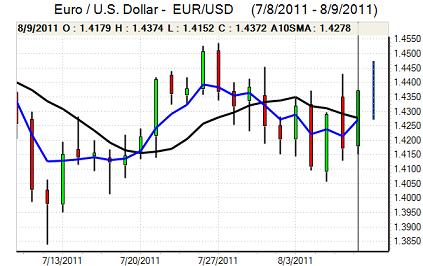

EUR/USD

The Euro was unable to push above 1.44 against the dollar on Wednesday and was subjected to heavy selling pressure during the New York session.

There were fresh concerns surrounding the Euro-zone financial sector which exerted strong downward pressure on the currency. There were very sharp declines in French banking stocks on rumours that a major bank was in difficulties. These rumours have been in the market for weeks, but the sharp decline in European markets has increased fears over vulnerability to bad debts, especially with reduced access to wholesale funds.

There were also further rumours that France would lose its AAA credit rating and French credit default swaps rose again during the day. The three main credit rating agencies stated that the rating was secure with a stable outlook.

There were further strains in the money markets as dollar Libor rates increased to 4-month highs around 0.28%. There were increased concerns that US money-market funds would pull out of the European financial sector which would aggravate any liquidity shortages.

There was a wider deterioration in risk appetite as global equity markets stumbled again which maintained some defensive demand for US Treasuries and the dollar. There was still a lack of confidence in the US fundamentals, especially with further speculation that the Federal Reserve would move to sanction additional quantitative easing within the next few months. There was no significant US economic data releases with the trade and retail sales reports will be watched closely on Thursday and Friday.

The Euro retreated sharply to lows near 1.4120 before rallying back to above 1.42 as risk conditions attempted to stabilise in Asia on Thursday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The yen gained renewed defensive support during Wednesday as risk appetite deteriorated again with stock markets coming under fresh selling pressure. The US currency was unable to regain the 77 level against the Japanese currency and dipped to lows below 76.50 as Wall Street fell sharply while the Euro declined to five-month lows.

The dollar regained some ground during the Asian session as Asian markets looked to stabilise. Japanese finance officials continued to warn over the impact of yen strength with Japanese Finance Minister Noda stating that markets were being watched very closely and that market moves were one-sided.

The Japanese machinery orders data was stronger than expected with a 7.7% increase for June after a 3.0% gain the previous month. The dollar managed to regain the 77 level briefly before a fresh retreat with the yen gaining some support from rumours that the Chinese central bank would widen the yuan trading band.

Sterling

Sterling hit resistance near 1.63 against the dollar during Wednesday and there was a generally weaker tone during the day.

In the latest inflation report, the Bank of England continued to downgrade its growth forecasts with the sixth downgrade for 2011 while the 2012 growth forecast was cut to around 2.0% from 2.5% previously. There were further warnings that inflation could move to above 5.0%.

As far as interest rates were concerned, Bank Governor King was very reluctant to make specific commitments, but he made strong references to market rates which suggested that rates would likely to be on hold until 2013.

As far as quantitative easing was concerned, he indicated that the Bank would resist any near-term moves, although all options would be kept open as uncertainty remained extremely high.

Sterling recovered from initial losses after the report, but was subjected to fresh selling pressure as risk appetite deteriorated with lows near 1.6120 against the dollar.

Swiss franc

There were modest Swiss franc losses following the latest National Bank attempts to weaken the franc, but the currency quickly regained support as wider risk appetite remained extremely fragile. The Euro was unable to regain the 1.05 level and weakened back to lows near 1.0250 while the dollar tested support below 0.7250.

Fresh turbulence within the European financial sector triggered further defensive support for the Swiss currency as fear dominated during the New York session. There will be pressure on the National Bank for even more aggressive policy measures to weaken the Swiss currency and the franc edged weaker again on Thursday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

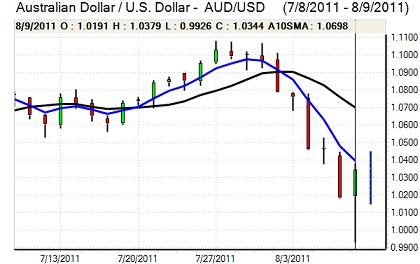

Australian dollar

Australian dollar volatility remained extremely high during the past 24 hours with the currency blocked close to the 1.04 area. As risk appetite deteriorated, there was a sharp decline in the Australian currency to lows below 1.0150 as Wall Street declined sharply.

The labour-market report was weaker than expected with an employment decline of 100 for July following an increase of 18,200 the previous month while there was a sharp decline in full-time jobs. There was also a decline in the latest inflation-expectations survey which will fuel expectations that the Reserve Bank could shift to an easing bias.

From lows near 1.01, there was a recovery back to above 1.02 with reports of Asian central bank buying.