EUR/USD

The Euro found support on dips to just below the 1.31 level against the dollar during Friday and pushed higher again during the US session. There were further suggestions that a Greek private-sector debt deal was in prospect, but there were no announcements of an agreement during Friday or over the weekend.

The headline US GDP data was slightly weaker than expected with a fourth-quarter GDP increase of 2.8% compared with expectations of a 3.0% increase. The breakdown of the data also recorded a strong increase in inventories for the quarter which increased concerns that there could be a slowdown in growth over the next few quarters which had some impact in curbing risk appetite.

The Euro dipped briefly during the US session with Fitch finally announcing its downgrades of Euro-zone debt ratings. Spain and Italy’s ratings were both downgraded by two notches with three other countries also having their ratings cut. The news had only a short-term impact after the Standard & Poor’s cuts announced earlier in January. The Euro recovered from a brief slide and again pushed to challenge levels above 1.32. The latest IMM data recorded a fresh record high for Euro speculative shorts and there was further evidence of short covering which pushed the currency higher.

There were underlying concerns surrounding the Euro-zone economy with much weaker than expected money-supply and lending growth. There was a particularly sharp drop in Portuguese lending during the month which increased fears surrounding the peripheral economies as a Portuguese default remained in focus.

The German government suggested that there would need to be stronger oversight of EU budgets and there were leaked reports that Germany would insist on a commissioner to be based in Athens to monitor budget developments which met with a frosty response. The Euro dipped in Asia on Monday, but the dollar was still finding it difficult to gain any underlying traction given the Fed stance.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar attempted to rally in the European session on Friday, but was unable to move much above the 77.10 area before hitting fresh selling pressure and sliding back to the 76.70 area with the Euro testing support below 101.

The US currency gained no support from the US GDP releases which was slightly weaker than expected and a solid reading for the University of Michigan consumer confidence data did not have a major impact.

There have been further negative media reports surrounding the longer-term yen outlook with a focus on the debt burden and structurally weaker trade account. There has still been solid yen buying on dips and there will be further speculation over underlying capital repatriation with the currency holding steady in Asia on Monday.

Sterling

Sterling hit resistance above the 1.57 level against the US currency on Friday and dipped sharply to test support just below 1.5650 before securing fresh buying support with a move to 5-week highs around 1.5730 while the Euro re-tested the 0.84 region.

Bank of England MPC member Miles stated in comments on Friday that it would be presumptuous to assume that there would be additional quantitative easing at the February policy meeting.

The latest UK PMI data will be watched very closely this week with data due on all sectors of the economy. The January data was stronger than expected and another stronger than expected release this month would lessen immediate fears surrounding recession despite the fourth-quarter data releases. Firm PMI releases would also raise fresh doubts over additional quantitative easing.

Swiss franc

The dollar was unable to make any headway above 0.9225 against the franc on Friday and dipped sharply to lows near 0.9120 during the US session as wider US currency support fell again. The Euro was unable to gain any support and retreated back to the 1.2050 area where there are reported National Bank orders to sell the franc.

The central bank policies will inevitably remain an extremely important focus in the short term and there were further comments from the Economic Forum in Davos that the bank was prepared to sell unlimited franc amounts to prevent any renewed franc gains.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

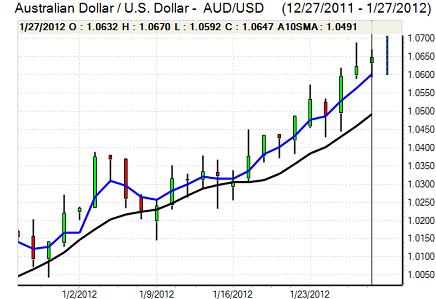

Australian dollar

The Australian dollar held a firm tone on Friday and, after a sharp dip following the US GDP data, it challenged resistance levels above 1.0650 as underlying risk appetite was firm and commodity currencies gained fresh support from expectations of capital inflows given the US Fed’s commitment to ultra-low interest rates.

The Australian currency faded again on Monday as there was a generally cautious tone as Chinese markets re-opened following the new-year holidays with markets also subdued ahead of the EU Summit later in the day.