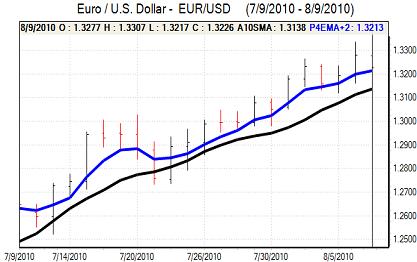

EUR/USD

The Euro continued to probe resistance levels in Asian trading on Monday. The Euro-zone data releases were also generally favourable with a stronger than expected reading for the Sentix business confidence index and German trade surplus. The Euro was unable to make any further headway as resistance levels held and the Euro edged lower with some profit taking following Friday’s sharp gains.

Markets continued to speculate over Tuesday’s Federal Reserve meeting with some further talk that there would be additional quantitative easing in the form of further bond purchases. The market consensus edged slightly towards expecting that the Fed would hold off additional steps at this point, but announce that it will take whatever steps are necessary in the future.

The shift in expectations provided some degree of dollar protection and there was also less potential selling pressure given the big shift in speculative positioning already seen. There were greater doubts over the global economy and this also provided some degree of US currency protection. US market rates edged lower, however, which suggested that dollar liquidity was still improving and this will limit dollar support

The Euro retreated to the 1.3220 area, but the dollar will still find it difficult to secure strong buying given the lack of confidence in the fundamentals.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The intensity of verbal intervention increased on Monday with Japanese Finance Minister Noda stating that he was giving his utmost attention to forex moves. There was also heightened uncertainty with the Bank of Japan policy meeting on Tuesday with further speculation that there would be moves to increase liquidity in an attempt to curb yen strength.

The domestic economic data did not have a major impact with a slightly stronger than expected figure for consumer confidence. The dollar resisted a further test of support close to 85 against the yen and consolidated near 85.50.

The dollar continued to edge higher during the New York session with a peak close to 85.90 as yen buying abated. If the Bank of Japan does not take additional policy action then the dollar will be vulnerable to some initial selling pressure, although support levels will still be tough to break.

Sterling

Sterling continued to hit tough resistance close to the 1.60 level against the dollar in Europe on Monday, but failed to break though this level with evidence of options barriers being defended a significant market factor.

There were no significant economic releases during the day with markets looking ahead to key events later in the week. Wednesday, in particular, will be extremely important for Sterling direction with the latest labour-market data as well as the quarterly Bank of England inflation report.

Expectations of a generally downbeat central bank report were significant in curtailing Sterling support during Monday and it weakened to lows just below 1.59 against the dollar before stabilising. The UK currency will also be much more vulnerable to selling pressure if global risk appetite deteriorates.

Swiss franc

The dollar found support below the 1.04 level against the franc on Monday and strengthened to a high close to 1.05 ain US trading. As well as gaining from a general rebound, the US currency secured backing from a weaker franc tone on the crosses as the Euro strengthened to the 1.3870 area.

There were reports of merger-related selling pressure on the franc during the day which added to the generally negative currency tone.

There will be some speculation of National Bank reserve diversification away from the Euro if there is a further significant advance and this may curb further near-term franc selling pressure which will also hamper dollar rally attempts.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

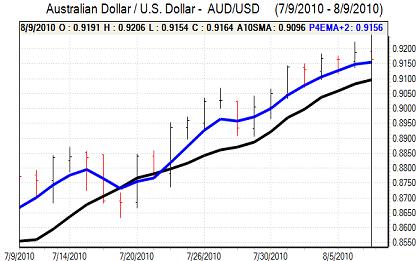

Australian dollar

The Australian dollar was again unable to move above the 0.9220 area against the US dollar during Monday. The domestic data recorded a decline in home loans and there will be further unease over the economy which will tend to be a barrier to Australian dollar gains.

Confidence in the global economy is likely to be fragile with doubts over all the major economies and in this environment risk conditions could suddenly deteriorate. For now, confidence has held relatively firm and the Australian dollar held above 0.9150 during the US session.