One of the most important indicators when looking at global economy and forecasting upcoming trends is the Baltic Dry Index (BDI). This index measures the demand for shipping capacity versus the supply of dry bulk carriers. The demand for shipping varies with the amount of cargo that is being traded in different markets,

LEADING INDICATOR

One of the reasons that the BDI is watched so closely is that it is “objective.” This means that the prices it tracks are not subject to speculative behavior by investors.

The other reason why it’s so important to follow the BDI is because it’s highly effective. The index had marked a sharp drop in economic activity before the explosion of the most recent crisis starting in 2008.

TRADE THE SECTOR

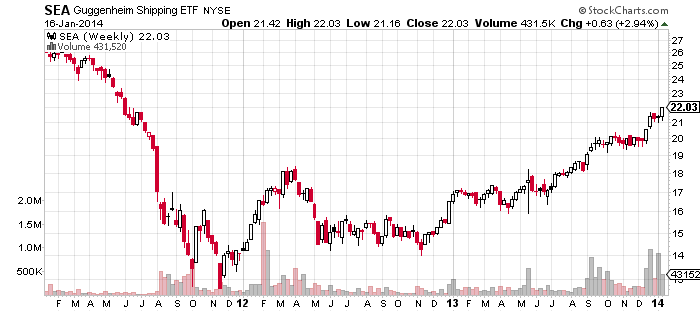

This Baltic Dry Index is frequently associated with the Guggenheim Shipping ETF (SEA) as many consider SEA to be the direct way of trading the BDI. This is wrong.

Although on the surface the relationship appears to make sense, the reality is that SEA tracks the Dow Jones Global Shipping Index, which is a collection of dividend-paying global shipping firms.

The ETF went up almost 30% in 2013 and is currently trading at its highest level in more than two and half years. The strong volume and the recent breakout above resistance levels gives us to understand that SEA will continue in an upswing during the first half of 2014.

BOTTOM LINE

As the global economic engine picks up steam, shippers will help provide countries with the necessary raw materials to fuel their growth, inevitably taking the price of SEA ETF to higher levels.