Unusual Options Activity

Over 4,000 JBHT Apr $90 calls were purchased for $0.45-$0.65 late in day on April 7th. Call activity was 39 times the average daily volume as implied volatility spiked 8% to 26.88. The one major catalyst that will occur before April options expiration is J.B. Hunt’s first quarter earnings report on April 14th (shares have moved higher on four consecutive reports).

Fundamentals

On March 11th, Credit Suisse raised its price target to $91 from $88 (outperform rating). They cited their meeting with management at J.B. Hunt Transport Services. In their note, they highlighted an optimistic overall tone, rising intermodal rates, and a potential boost in consumer demand from anticipated tax cuts. The $10B transportation and delivery services company trades at a P/E ratio of 23.88x (2015 estimates), price to sales ratio of 1.60x, and a price to book ratio of 8.20x. A multiple near 24x does seem rich until you take into account the 14-16% annual earnings growth and low double digit sales growth expected in the coming years.

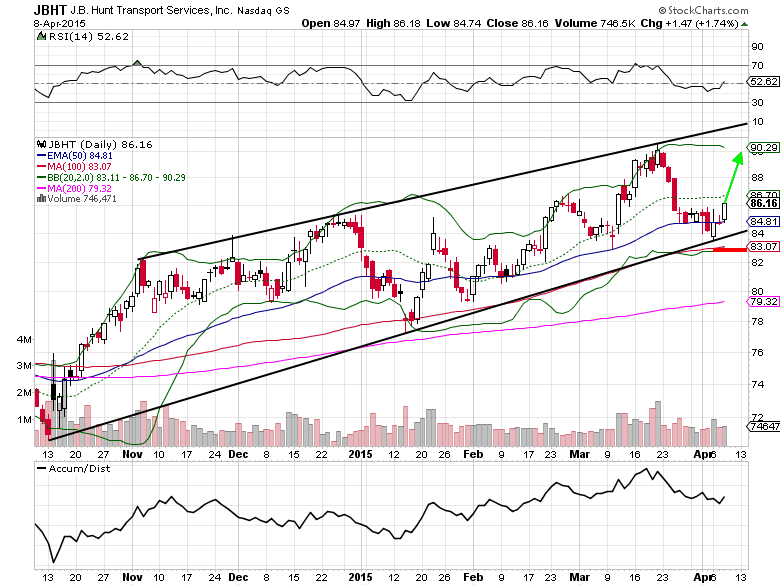

For the previous 6 months, J.B. Hunt has been trading in a well-defined uptrending channel. In recent days the stock tested the bottom of the channel and is now seeing buyers emerge. Consider taking a bullish position now, using an initial stop loss just under the 100-day simple moving average. Look for a move up to the $90-$92 area in the intermediate-term.

J.B. Hunt Transport Services Options Trade Idea

- Buy the Apr $85/$90 bull call spread for a $1.90 debit or better

- (Buy the Apr $85 call and sell the Apr $90 call, all in one trade)

- Stop loss- None

- 1st upside target- $3.80

- 2nd upside target- $4.90

Notes: Selling the Apr $90 calls against the Apr $85 calls does limit your upside, but it does take advantage of the elevated premiums and gives you a lower breakeven point. Plus the likelihood of a significant move above $90.70 (calls trading at $0.65/$0.70) is unlikely by the end of next week.

#####

To read Mitchell’s “Unusual Options Activity Report Featuring Call Buying in Yahoo!” at OptionsRiskManagement.com, please click here.