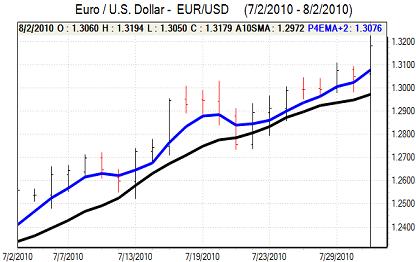

EUR/USD

The dollar remained fragile in early Europe on Monday with the trade-weighted index at a three-month low and the currency was subjected to further selling pressure during the session.

The Euro gained ground on technical grounds with a break above the 1.31 resistance zone triggering fresh demand for the currency. There was also a significant impact from liquidity trends with a decline in US Libor rates lessening demand for the dollar.

Risk conditions remained important and there was reduced defensive support for the US currency as confidence surrounding the global economy improved. Global stock markets remained firm with indices at a 12-week high.

The US ISM index for the manufacturing sector edged lower to 55.5 for July from 56.2 previously which was slightly stronger than expected. In similar vein to last week’s GDP data, the data was strong enough to sustain risk appetite, but not firm enough to boost the dollar.

Fed Chairman Bernanke stated that the US economy was growing, but that it remained far from normal. He also stated that monetary policy must offer support for the economy and these comments reinforced the fact that the dollar would struggle to gain any significant support on yield grounds.

The Euro strengthened to highs near 1.32 against the dollar early in the US session and held the bulk of gains later in the US session. There was still some evidence of structural stresses with risk premiums in the options market suggesting that there was still strong Euro selling interest.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

China’s HSBC PMI index was weaker than expected with a decline to below the pivotal 50 level for the first time in 16 months, but risk appetite was able to hold broadly firm during in Asian trading on Monday and this dampened defensive demand for the Japanese yen.

Finance Minister Noda stated that excessive moves were undesirable and there will be expectations of more aggressive rhetoric against the Japanese currency if the yen advances further, especially given persistent deflation fears. Expectations will tend to focus on the potential for additional liquidity measures, but there will also be speculation of actual intervention if the yen threatens to break the 85 level. The dollar edged higher to the 86.50 area against the yen on Monday.

The yen was unable to break above 86.80 against the yen later in the day and dipped to just below 86.50 as the US currency remained generally on the defensive.

Sterling

Sterling retained a firm tone in early Europe on Monday and maintained a robust tone during the day as it gained support from the improvement in international risk appetite.

There was also support from robust banking-sector earnings with HSBC results much stronger than expected for the latest quarter and confidence in the banking sector helped underpin Sterling.

The CIPS index for the manufacturing sector was slightly stronger than expected with a small decline to 57.3 from 57.6 the previous month which maintained some degree of optimism over the UK economic outlook.

In this environment, Sterling strengthened to a six-month high just above 1.59 against the dollar while it also pushed to a five-week high near 0.8250 against the Euro.

Swiss franc

Franc volatility against the Euro remained high on Monday with the Euro strengthening to a high close to 1.37 and it held the bulk of the gains. The dollar pushed to a high close to 1.0480 against the Swiss currency, but was unable to sustain the advance, primarily due to all-round vulnerability.

The Swiss retail sales data was weaker than expected with an annual increase of 0.9% for June compared with a revised 3.9% previously and this triggered some doubts over the strength of consumer spending.

In contrast, the PMI data was stronger than expected with the index close to record high 66.9 for July which will lessen any immediate fears surrounding the industrial sector and competitiveness.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

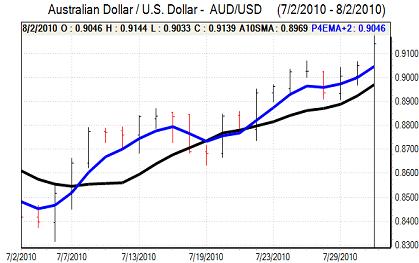

Australian dollar

There was a further Australian dollar advance to 0.9120 on Monday as risk appetite improved and the US currency remained on the defensive. The currency will jump higher if interest rates are increased by the Reserve Bank on Tuesday, but unchanged rates are the more likely outcome.

Risk conditions will inevitably remain very important and the Australian currency will gain further support if confidence remains stronger. There are very important risks surrounding the global economy and complacency looks to be a clear risk, and the Australian stalled near the 0.9140 level against the dollar.