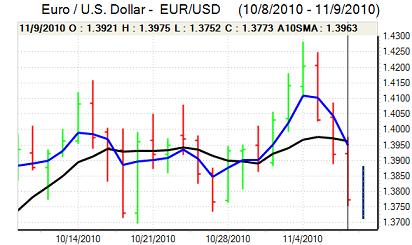

EUR/USD

From lows below 1.3850, the Euro rallied firmly with gains to a peak around 1.3975 during the European session on Tuesday. The Euro was unable to sustain the gains and was subjected to heavy selling pressure later in New York trading.

There were further stresses surrounding the Euro-zone bond markets which unsettled the Euro with continuing fears that peripheral economies will find it very difficult to tap international capital markets. Although the near-term funding position for countries such as Ireland is comfortable, the stresses will also maintain fears over longer-term stability and undermine the Euro.

There were no major US economic releases during the day with a small improvement in consumer confidence. There was, however, a significant rise in US Treasury yields which provided some important dollar support. There was also a sharp dip in commodity prices during US trading with a squeeze on long positions and this also triggered a recovery in the dollar given that positions had tended to be funded through the US currency.

There were reports of heated debate between G20 officials during discussions ahead of meetings later this week and this will be a potentially important market factor. Any further increase in tensions would tend to intensify market volatility and could also trigger a deterioration in risk appetite which would underpin the dollar. The Euro retreated to lows below 1.3750 against the US currency in choppy trading.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support below 80.70 against the yen during Tuesday and then rallied strongly to a high near 82 during the Asian session on Wednesday.

The US currency gained support from a significant rise in US bond yields during the session and there was also significant stop-loss selling as the yen dipped through important support levels.

There were reports of substantial selling of Japanese bonds by China for the second successive month which also had a negative impact on the yen.

Risk appetite tended to deteriorate later in Asian trading on Wednesday and this did discourage yen selling while there was also evidence of increased exporter and fund selling near the 82 level with the dollar consolidating above 81.50.

Sterling

Sterling initially found support below 1.61 against the dollar on Tuesday and rallied to a high near 1.62 as US currency moves dominated.

The UK economic data recorded a small increase in industrial production for September while the trade deficit narrowed to the lowest level since June at GBP8.2bn. The data still suggested that there was little momentum within the industrial sector while exports will find it difficult to make much of a positive contribution to the economy as a whole.

Sterling fell sharply from later in the US session with lows below 1.60. The Wednesday Bank of England inflation report will be important for sentiment and there were some rumours that the report had been leaked which triggered further selling pressure on Sterling. The UK currency will gain relief if there is an upgrading of inflation forecasts within the report as it would make it more difficult to justify any further monetary easing, but the bank is still likely to be cautious over the growth prospects and volatile trading is liable to be a key feature.

Swiss franc

The franc has maintained a strong tone against the Euro over the past 24 hours and advanced for the sixth successive day with a peak close to 1.33. The US currency was put on the defensive by franc strength on the crosses, but did find support below 0.96 and rallied back to the 0.97 area.

There was a significant fourth-quarter decline in consumer confidence which will tend to reinforce unease over a potential slowdown in the Swiss economy.

International considerations will still tend to dominate in the short term and the Swiss currency will continue to gain defensive support from fears over the Euro-zone outlook, especially if there are wider global exchange-rate tensions.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

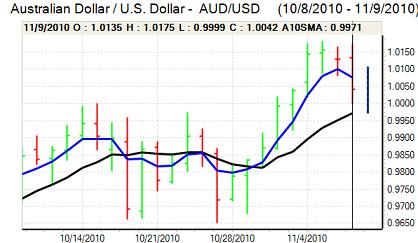

Australian dollar

The Australian dollar moved above 1.0150 against the US dollar on Tuesday, but was unable to sustain the gains and weakened sharply in US trading with further losses in Asia on Wednesday as support levels below parity were briefly tested.

There was a decline in metals prices which undermined the Australian dollar and risk appetite was also more fragile on fears that China would curb capital inflows.

The domestic data offered no support with a decline in consumer confidence and small increase in housing loans. The Australian currency did find support close to parity as corporate interest was still healthy.