US stock futures point to a slightly higher open Monday, just below resistance in the SPDR S&P 500 ETF (SPY) at $134.00. Last week we saw major strength return to the market on account of stellar earnings reports from a series of tech bellwethers. Intel Corporation (INTC), Yahoo! Inc. (YHOO), International Business Machines Corp. (IBM), and most notably Apple Inc. (AAPL) had great quarters, boosting investor confidence. This week earnings season will continue and we will see if corporate profits continue to provide a glimmer of hope for this slow recovery.

Last week we saw Netflix, Inc. (NFLX) break out to new highs once again after mentioning it several times in the Morning Call. Netflix reports after the close today, so most active traders will look to take profits on the trade into earnings. With highly valued stocks like NFLX, even a slight miss can trigger a sharp sell-off.

Watch the T3Live.com Morning Call with Scott Redler and Alix Steel (below).

During earnings season, it is always best to trade stocks that have strong reports (that may sound simple). But even stocks that gap up big following strong reports are usually primed for a second move as long as they hold the initial earnings gap. One such candidate for a follow-through move is VMWare, Inc. (VMW). VMW was one of the strongest stocks in the market for the better part of two years, but in 2011 has been in the dog house a little bit. However, a stellar quarter from the virtualization leader has sent the stock back to all-time highs. Watch VMWare above last Wednesday’s high.

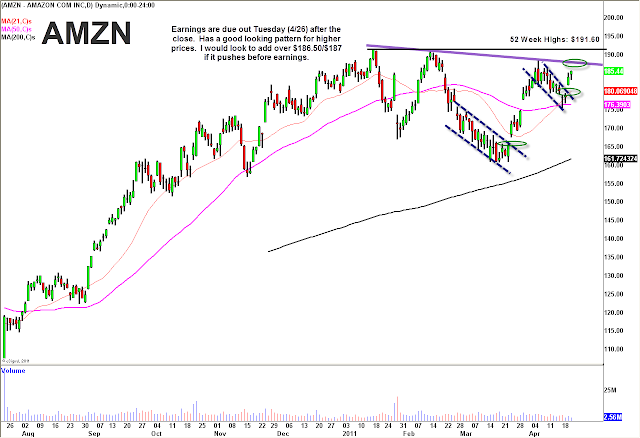

Amazon.com, Inc. (AMZN) is another big cap tech leader that has been able to rebound over the past week. Amazon had performed meekly so far in 2011 before breaking its downtrend last week and bouncing. AMZN earnings are due after the close Tuesday, so active traders that do not like to hold through earnings only have a two-day trade on their hands, but it appears the stock wants to run toward pivot highs into the report.

Although no longer exclusively carrying the iPhone, AT&T Inc. (T) has been strong over the last month. News of a possible takeover of T-Mobile, which would create by far the world’s largest mobile provider, has been the positive catalyst for T, which is now flagging nicely at highs. There are two triggers for the long entry here, $30.75 and $31. Watch out for any news regarding the merger with T-Mobile, as that is driving the price right now.

A group that we cover often here that once again looks bullish is the fertilizer stocks. The group has been prone to sharp drops over the past few months, which is somewhat puzzling given the bullish long-terms story in fertilizers. However, the sector has also been resilient following these pull-ins and usually recovers nicely. Sooner or later, we expect these things to be back at highs. The best performing stock in the group right now is CF Industries Holdings, Inc. (CF), which had an explosive move above its moving averages Thursday. PotashCorp./Saskatchewan (POT) is the industry leader and acting OK here, currently sitting just above its moving averages. Agrium, Inc. (AGU) has a similar set-up as POT, while The Mosaic Company (MOS) has been the weakest with Cargill eager to unload its stake.

Finally, we have to continue to mention silver as it amazes with its parabolic climb. Silver is not an overbought stock, it is a commodity with a complex situation. Reports are rampant that firms with heavy short interest in silver are being squeezed and there are real supply issues with the precious metal, making this trade extremely volatile and unpredictable. At these levels, traders would be best served by staying away from the trade on both sides. At one point this morning the iShares Silver Trust ETF (SLV) was up another 5.5% but has pulled off and is now up about 3.3%.

*DISCLOSURE: Scott Redler is long AAPL, AMZN, CIGX, GLD, CYD, OIH, MGM, BKS, LVS, POT, REDF, CIEN, JDSU. Short SLV, SPY.

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.