By FXEmpire.com

Silver is a new contract for our analysis videos. When trading silver, it is important to know that it is not only a precious metal, but it also has quite a few industrial uses as well. The market for silver can be a bit more volatile than the gold markets, but it does tend to stick to fundamentals as well as any other market out there.

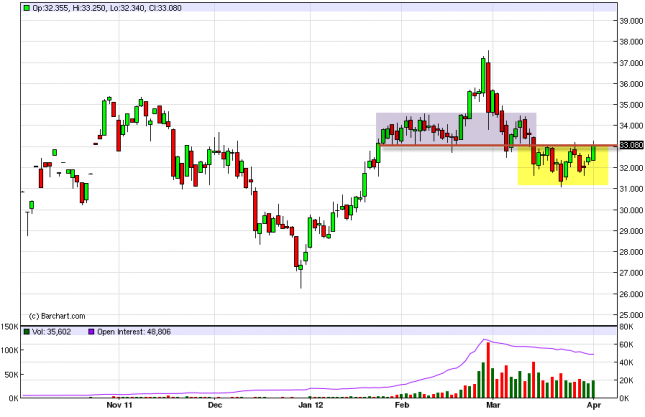

With this in mind, the silver markets have made a potentially significant breakdown below support at the $33 handle recently. Perhaps it is due to perceived economic slowdown, or perhaps it is due to a sympathy move with gold. Either way, the breakdown mattered as it was such obvious support for about 6 weeks.

Since the breakdown, we have seen a drop to the $31 level, and have now pushed back up against the $33 level, and are presently testing it as potential resistance. It is a points like this that we need to pay special attention, as this could end up being a bit of a clue as to how the market is going to move for the next several weeks or even months. This is because we know that what was once support can often become resistance when broken down.

We will have to keep an eye on this level, and where the market closes in relation to the $33 level. The breaking and close above that on a daily timeframe would suggest that we are about to reenter the previous consolidation level. A failure on the daily close, perhaps a nice hammer or something like that, would signal that the market is about to continue the fall.

Needless to say, a move to the upside would have to keep an eye on the $35 level, as it was previous resistance. (Perhaps even just a slight bit lower than that.) If we manage to break down from here, the $31 level should be supportive as well, but the bulls would have to consider that an important area as if it gives way – this should run the market much lower as the $30 level will come into play, but below that looks to be short of support for some time.

Silver Forecast April 3, 2012, Technical Analysis

Originally posted here