By FXEmpire.com

Silver Fundamental Analysis April 18, 2012, Forecast

Analysis and Recommendations:

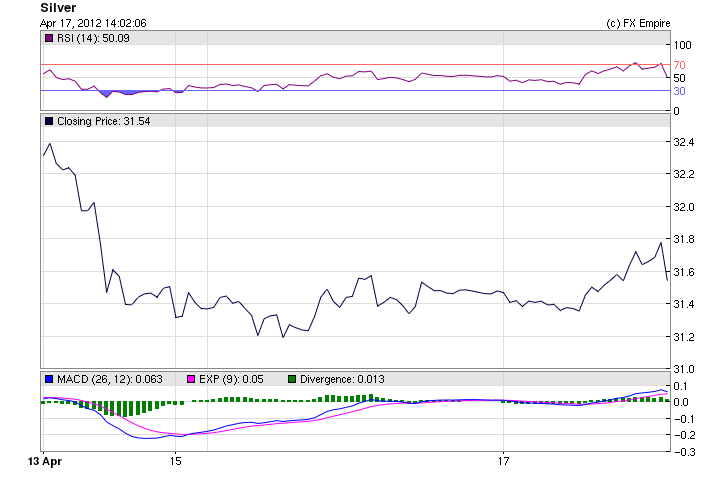

The Silver is trading at 31.778

European markets traded higher on the back of increased demand at the Spanish debt sale coupled with positive economic data from the Euro Zone front. German investor confidence index rose unexpectedly to a two-year high to 23.4-mark in April from the previous level of 22.3 in March. ZEW Economic Sentiment in the Euro Zone also rose unexpectedly to 13.1 in April as compared to 11-mark in the prior month.

Additionally, Spain sold 3.18 billion Euros of bills today as compared to a maximum target of 3 billion Euros that the Treasury set for the sale. Spain sold 12-month and 18-month bills at 2.623 percent and 3.11 percent respectively. These factors led to rise in risk appetite in the European markets.

Taking cues from rise in gold prices and recovery in the global market, spot silver prices witness gains of around 0.7 percent and hit an intraday high of $ 31.77/oz

Economic Reports April 17, 2012 actual v. forecast

|

Apr. 17 |

AUD |

Monetary Policy Meeting Minutes |

||

|

JPY |

Industrial Production (MoM) |

-1.6% |

-1.2% |

-1.2% |

|

INR |

Indian Interest Rate Decision |

8.00% |

8.30% |

8.50% |

|

GBP |

Core CPI (YoY) |

2.5% |

2.4% |

2.4% |

|

GBP |

CPI (YoY) |

3.5% |

3.5% |

3.4% |

|

GBP |

CPI (MoM) |

0.3% |

0.3% |

0.6% |

|

EUR |

CPI (YoY) |

2.7% |

2.6% |

2.6% |

|

EUR |

German ZEW Economic Sentiment |

23.4 |

20.0 |

22.3 |

|

EUR |

ZEW Economic Sentiment |

13.1 |

10.7 |

11.0 |

|

EUR |

Core CPI (YoY) |

1.6% |

1.5% |

|

|

USD |

Building Permits |

0.747M |

0.710M |

0.715M |

|

USD |

Housing Starts |

0.654M |

0.705M |

0.694M |

|

Manufacturing Sales (MoM) |

-0.30% |

-1.00% |

-1.30% |

|

|

EUR |

ECB President Draghi Speaks |

|||

|

CAD |

Interest Rate Decision |

1.00% |

1.00% |

1.00% |

Originally posted here