By FXEmpire.com

Silver Fundamental Analysis April 19, 2012, Forecast

Analysis and Recommendations:

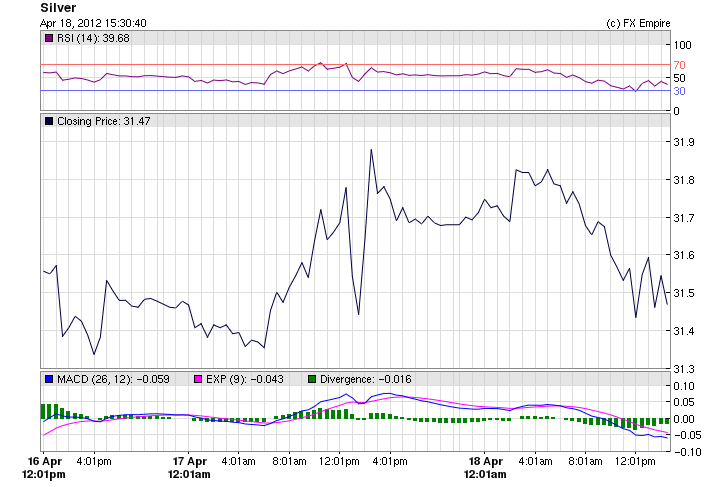

Silver once again followed the gold trail, dropping 0.20 in today’s session. Silver traded higher by 0.7 percent on the international markets on Tuesday, on the back of weakness in the US dollar index coupled with upbeat sentiments in the markets. The white metal touched an intra-day high of $ 31.43/oz and closed at $31.68/oz yesterday.

Economic Reports for April 18, 2012 actual v. forecast

|

AUD |

MI Leading Index (MoM) |

0.2% |

0.6% |

|

|

EUR |

Current Account |

-1.3B |

5.0B |

3.7B |

|

EUR |

Spanish House Price Index (YoY) |

-7.20% |

-5.90% |

-6.80% |

|

GBP |

Average Earnings Index +Bonus |

1.1% |

1.3% |

1.3% |

|

GBP |

Claimant Count Change |

3.6K |

7.0K |

4.5K |

|

GBP |

MPC Meeting Minutes |

|||

|

GBP |

Unemployment Rate |

8.3% |

8.4% |

8.4% |

|

CHF |

ZEW Expectations |

2.1 |

-8.0 |

0.0 |

|

EUR |

German 2-Year Schatz Auction |

0.140% |

0.310% |

|

|

EUR |

Spanish Trade Balance |

-3.75B |

-3.90B |

-3.65B |

|

USD |

MBA Mortgage Applications |

6.9% |

-2.4% |

|

|

USD |

Crude Oil Inventories |

3.856M |

1.363M |

2.791M |

|

BoC Monetary Policy Report |

||||

|

USD |

Gasoline Inventories |

-3.671M |

-0.931M |

-4.277M |

Economic Events scheduled for April 19, 2012 that affect the European and American Markets

14:00:00 EUR Consumer Confidence -19 -20.3

The Consumer Confidence released by the European Commission is a leading index that measures the level of consumer confidence in economic activity. A high level of consumer confidence stimulates economic expansion while a low level drives to economic downturn. A high reading is seen as positive (or bullish) for the EUR, while a low reading is seen as negative (or bearish).

14:00:00 USD Existing Home Sales (MoM) 4.63M 4.59M

The Existing Home Sales, released by the National Association of Realtors provide an estimated value of housing market conditions. As the housing market is considered as a sensitive factor to the US economy, it generates some volatility for the USD. Generally speaking, a high reading is positive for the Dollar, while a low reading is negative.

14:00:00 USD Philadelphia Fed Man 12.2 12.5

The Philadelphia Fed Survey is a spread index of manufacturing conditions (movements of manufacturing) within the Federal Reserve Bank of Philadelphia. This survey, served as an indicator of manufacturing sector trends, is interrelated with the ISM manufacturing Index (Institute for Supply Management) and the index of industrial production. It is also used as a forecast of The ISM Index. Generally, an above-the-expectations reading is seen as positive for the USD.

Originally posted here