By FXEmpire.com

Silver Fundamental Analysis April 9, 2012, Forecast

Analysis and Recommendations:

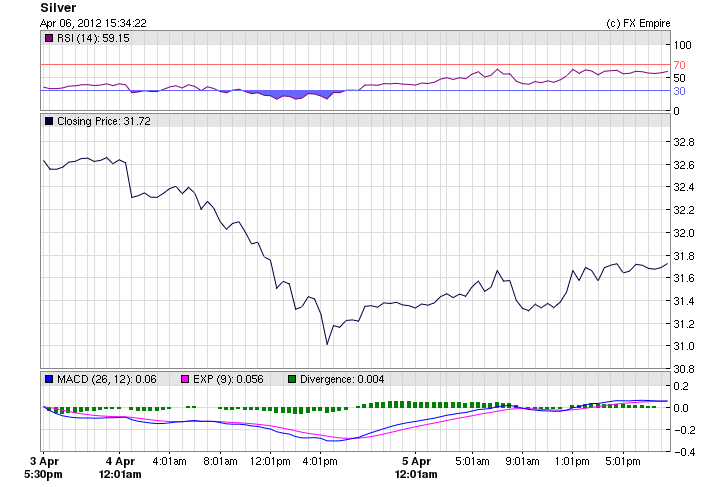

The Silver gained 69 cents, or 2.2%, to $31.73 an ounce. Silver gained as bargain hunters honed in after dashed expectations of further U.S. monetary stimulus prompted a sharp decline for both metals in the previous session.

The gains were not enough to erase weekly losses of 2.3% for silver. Commodity markets were closed Friday in observance of Good Friday.

It is a very quiet day, with global markets closed for the holiday weekend.

The Non Farms Payroll data showed for the first time since November that job growth dropped below the 200,000 level. Economists expected a rise of 210,000. The unemployment rate fell to 8.2% from 8.3%, mostly because more people dropped out of the work force.

In the forex markets, the dollar fell against other major currencies, posting a particularly steep drop against the Japanese yen, which tends to be seen as a safe-haven currency.

Economic Reports for April 6, 2012 actual v. forecast

|

Apr. 06 |

JPY |

Leading Index |

96.6 |

95.6 |

94.5 |

|

EUR |

French Government Budget Balance |

-24.2B |

-12.5B |

||

|

EUR |

French Trade Balance |

-6.4B |

-5.2B |

-5.6B |

|

|

HUF |

Hungarian Industrial Output (YoY) |

1.10% |

-1.00% |

-0.50% |

|

|

USD |

Average Hourly Earnings (MoM) |

0.2% |

0.2% |

0.3% |

|

|

USD |

Nonfarm Payrolls |

120K |

203K |

240K |

|

|

USD |

Unemployment Rate |

8.2% |

8.3% |

8.3% |

|

|

USD |

Average Weekly Hours |

34.5 |

34.5 |

34.6 |

|

|

USD |

Private Nonfarm Payrolls |

121K |

218K |

233K |

|

|

USD |

ECRI Weekly Annualized (WoW) |

1.00% |

-0.40% |

Economic Events scheduled for April 9, 2012

02:30 CNY Chinese CPI (YoY) 3.3% 3.2%

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

02:30 CNY Chinese PPI (YoY) -0.2%

The Producer Price Index (PPI) measures the change in the price of goods sold by manufacturers. It is a leading indicator of consumer price inflation, which accounts for the majority of overall inflation.

10:00 EUR Greek CPI (YoY) 2.10%

Consumer Price index is the most frequently used indicator of inflation and reflect changes in the cost of acquiring a fixed basket of goods and services by the average consumer.

Originally posted here