By FXEmpire.com

Silver Weekly Fundamental Analysis April 23-27, 2012, Forecast

Introduction: Silver futures are standardized, exchange-traded contracts in which the contract buyer agrees to take delivery, from the seller, a specific quantity of silver (eg. 30000 grams) at a predetermined price on a future delivery date.

Some Facts about Silver

Silver is a soft, shiny and heavy metallic element with a brilliant white luster. A very ductile and malleable metal, its thermal and electrical conductivity is the highest of all known metals.

Besides being used as a store of value, other main uses of silver include applications in areas such as electronics, photography and as antiseptics.

Consumers and producers of silver can manage silver price risk by purchasing and selling silver futures. Silver producers can employ a short hedge to lock in a selling price for the silver they produce while businesses that require silver can utilize a long hedge to secure a purchase price for the commodity they need.

Silver futures are also traded by speculators who assume the price risk that hedgers try to avoid in return for a chance to profit from favorable silver price movement. Speculators buy silver futures when they believe that silver prices will go up. Conversely, they will sell silver futures when they think that silver prices will fall.

Analysis and Recommendations:

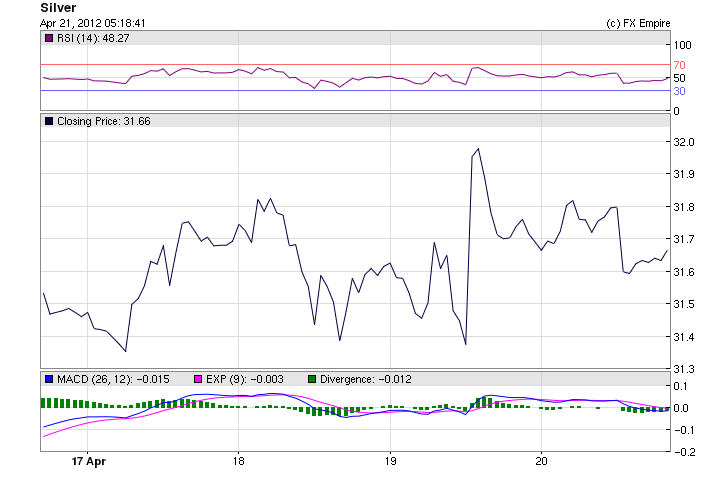

Silver spent most of the week trailing gold. It closed at 31.66/oz after hitting a high of 32.00.

As the weekends, worries over Euro Zone debt and economic growth in the US and China continue to grip commodities and were seen trading in a very tight range waiting for fresh cues for further directional moves. In a lackluster trading, spot gold held steady. Base metals in LME traded mostly flat as investors remained cautious after weak economic indicators from the U.S. Though, successful French and Spanish bond auction allayed concerns over Euro Zone’s deteriorating financial health to some extent. Unexpected rise in German business climate assessed by Ifo lifted the sentiments too. LME copper managed to hang above $8000 a ton. In tandem with the international market, movements in MCX base metal complex and bullions were dreary. Crude oil rose for the first time in three days supported by positive German data. Meanwhile, G-20 finance ministers and central bankers are to meet in Washington later today. The Indian rupee was seen bouncing off a 3-month low it hit during previous session at 52.11 up 0.17 percent

Market emotions remained rather subdued in the wake of persistent debt concerns in the Euro region in spite of a strong German business sentiment. Looking into the evening, no major economic data is slated for release. The ongoing G-20 finance minister’s meet in Washington would be the key event markets would be looking up to take cues from. With Chinese economy going through a lean patch, possible Chinese Central bank liquidity action in the coming days could be a marquee event and have a real impact on the commodities.

Overall, the week has witnessed Euro zone debt crisis scaling up with yields on Spanish and Italian bonds reaching unacceptable levels, which prompted Greece, Ireland and Portugal to ask for bailout.

Economic Highlights of the coming week that affect the US, Euro, GBP, and Franc

|

EUR |

Industrial New Orders (MoM) |

-0.5% |

-2.3% |

|

USD |

New Home Sales |

320K |

313K |

|

USD |

CB Consumer Confidence |

70.3 |

70.8 |

|

GBP |

GDP (YoY) |

0.3% |

0.5% |

|

GBP |

CBI Industrial Trends Orders |

-20 |

-8 |

|

USD |

Durable Goods Orders (MoM) |

-1.5% |

2.4% |

|

USD |

Core Durable Goods Orders (MoM) |

0.5% |

1.8% |

|

USD |

Interest Rate Decision |

||

|

GBP |

Nationwide Consumer Confidence |

44 |

|

|

GBP |

CBI Distributive Trades Survey |

-4 |

|

|

CHF |

KOF Leading Indicators |

0.26 |

0.08 |

Click here to read Silver Technical Analysis.

Originally posted here