By FXEmpire.com

Silver Weekly Fundamental Analysis April 9-13, 2012, Forecast

Analysis and Recommendations:

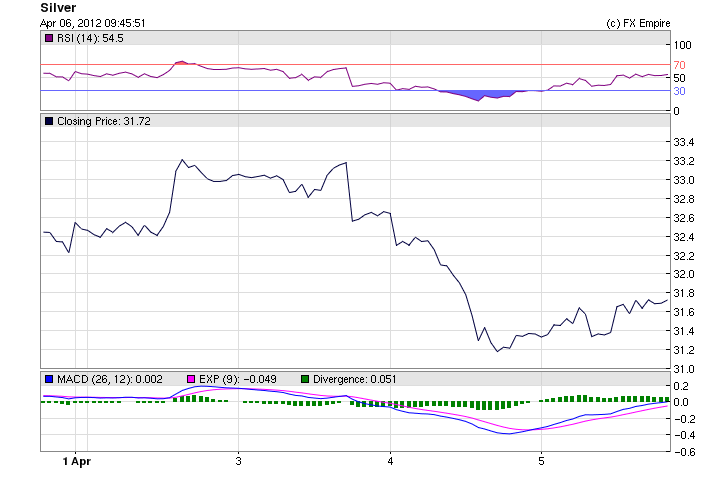

Silver is ended the week at 31.73, silver followed gold on a pretty wild ride this week after the FOMC minutes were released.

|

04/05/2012 |

31.723 |

31.358 |

31.805 |

31.188 |

1.16% |

|

04/04/2012 |

31.360 |

32.625 |

32.662 |

30.978 |

-3.88% |

|

04/03/2012 |

32.627 |

33.042 |

33.290 |

32.475 |

-1.26% |

|

04/02/2012 |

33.035 |

32.470 |

33.238 |

32.358 |

1.74% |

|

04/01/2012 |

32.463 |

32.423 |

32.558 |

32.392 |

0.12% |

The so-called devil’s metal raced up a mere 33% in the first two months of 2012, before giving up almost half of the gains. But for silver, this is relatively smooth sailing. Last year, it chalked up a 57% rally between January and April, before finishing 2011 down 9.8%.

High collateral requirements are helping keep price volatility at bay. Initial margin paid on benchmark Comex 5,000-ounce silver futures is $21,600, which equates to about 13% of the notional value of a contract. The equivalent figures for gold and crude oil are $10,125, or 6%, and $6,885, or 6.6%, respectively.

Higher margins deter speculators: The number of open futures contracts is hovering just above 100,000, well below last year’s peak of 150,000. And while demand for physical silver as an investment climbed last year, it still accounted for only 14.2% of demand overall, according to metals consultancy CPM Group.

Silver’s fortunes are more exposed to the global economy. Industrial applications, photography, electronics and jewelry accounted for about 86% of total demand in 2011, according to CPM. Being bullish on more industrial demand for silver is difficult with Europe’s economy in the mire, slower growth seen in China and a fragile recovery in the U.S. Hence, silver futures are down 10.5% from their February peak of $37.14 a troy ounce.

Silver would likely get a boost in the event of a decisive economic upturn or further monetary easing. Unfortunately, these two outcomes represent scenarios at the extremes of optimism and pessimism about the economy. And the Federal Reserve’s latest minutes dented hopes for more quantitative easing. The current reality of sluggish but persistent economic recovery amid multiple headwinds is less striking–with all that this implies for silver prices.

Economic Highlights of the coming week for the USA (only minor reports, a very light week)

|

Apr. 9 |

15:00 |

USD |

CB Employment Trends Index |

107.50 |

|

Apr 10 |

12:30 |

USD |

NFIB Small Business Optimism |

94.3 |

|

13:55 |

USD |

Redbook (MoM) |

0.70% |

|

|

15:00 |

USD |

Wholesale Inventories (MoM) |

0.5% |

0.4% |

|

15:00 |

USD |

IBD/TIPP Economic Optimism |

47.5 |

|

|

21:30 |

USD |

API Weekly Crude Stock |

7.85M |

|

|

21:30 |

USD |

API Weekly Gasoline Stock |

-4.46M |

Originally posted here