What a wild week with this overextended rally and a crazy FED day. Personally, it’s nice to have finally made a little money in the stock market too! My charting software is still not working on my PC so I’m going to allocate some time to solve that and other tasks tomorrow. My goal is to paper trade intraday next week everyday, market openings except for Tuesday PM.

What’s Working

1) Posting my prospects the night before, makes me more focused and so far they’ve been moving great.

2) Turning off Twitter, Chat, Email, NPR and other distractions in the morning.

3) Waiting ten minutes between trades has helped prevent overtrading.

4) The majority of the trades I entered this week headed in the direction I thought – I either entered too early, had too tight of a stop, or exited way too soon.

Still Not There

1) Still haven’t improved enough to identify the rhythm of the market environment – to either ride the trend, reversal fades when channeling, etc. Until I get better, I’m going to focus on playing the premarket winners and losers the first hour – the ones with volume and news, they usually move independent of the market. By 10:30am – the market trading structure is more typically established.

2) SCATTERED: Today, I added paper trading Futures (/ESM9 – thanks Jules!) in addition to my forays info Forex, Swing Trading and Bottom Fishing. I want to be well rounded and all this has done wonders for me – but my eyes are no longer on the ball. I’m set up with a prop firm and need to stay focused on that until I either get competent with it, or determine I’m not suited for day trading. So, no paper trading Forex or Futures for a couple weeks. Now that my Bottom Fishing positions are closed, that will no longer distract or emotionally drain me. So I will focus primarily on paper day trading, and then maybe 1 or 2 overnight swing trades with real money small positions in my retail account – nothing else for now.

So, in terms of my prop account – I’m going to shut off my data feeds for April (per their suggestion to save a little money), hunker down and practice trade for 6 full weeks with the goal of going live May 4th ~ with a fully written Trading Plan down on paper. As I said in my Moving Forward post, still by April 1st I need to have completed my “tasks list” (still need to write it up as a start) and be on track with my life balance goals (much better progress but backtracked a little the last couple days).

I hope to find some time this weekend, and re-read my blog to try to synthesize some of the lessons I’ve learned along the way.

So here’s my trades for today, similar to my mistakes / experience of yesterday – OTHER than I need to remember to either be in cash when the FED decision is coming out, or have a strategy for handling how to capitalize – appears that the US dollar or gold maybe good ways to play that. Here’s today’s trades:

OFG -.10 Short: I entered on a nice bounce back in the morning after the morning tank. I thought I was either fading strength at the top of the channel or maybe a deep pullback on a big trending down day. However, I was stopped out to the PENNY and then the stock proceeded to move a half buck.

DRYS +.05 Long: A premarket mover on news and volume. This is a one minute chart. My rules say to enter a gap up like this when the price crosses over the 10 SMA and then get out when it goes back across, I got in a little late. My price target is the morning high, the top line at $5.60 but it never recaputured it, stock traded sideways and a little down from there.

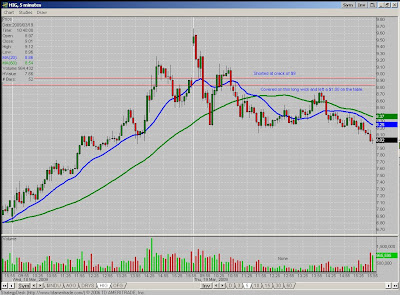

HIG +.09 Short: I had a great entry at $5.93 – just as FAZ had a long green candle forming and this finnie lagged a bit. However, I got spooked by a tall wick ten minutes later took less than a dime profit, left at least a half buck on the table (if I had followed my exit rules). This was the only stock in which I broke my guidelines and the one that had the nicest move as well.

AGO -$.13 Short: Actually my first trade of the day, this had a violent bounce off $6 where I was short. I was stopped out and then it made a $.60 move down.

HIG, as it was yesterday, was my big missed opportunity of the day.

I will back this weekend, and prepping for my the start of my Six-Week Sim Trading Bootcamp – to get me ready to go back to my prop account.