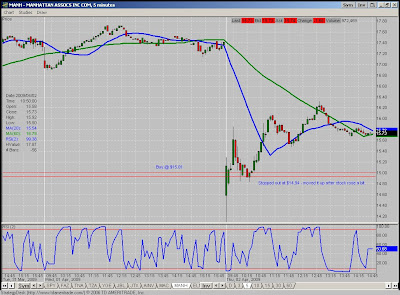

Major upward trend day, nearly break even in my paper trading. While my results are not stellar, I have three green days in a row, but more importantly – I’m making progress in reading the market, seeing things in charts and controlling my behavior in general. I believe I’m close to making some real strides forward. Case in point, see the chart below – made a $1.20 plus move, I just messed up my entry and exit. In fact, the stocks I’m focusing on the night before and the premovers I put on my list in the morning – they’re almost always great momo plays. So I need to focus on how I manage monitoring these opportunities during the day, and take steps so I don’t get stopped out so often. I may need to reduce my list from 10 to even less for starters.

| # | Following Rules | Behavior Chain | % Wins | Gross | Net |

| 4 | 25% | -1 | 25% | 0.08 | 0.02 |

MAHN-.07 LONG ~ Gap-down set up on a bullish day showed a nearly $2 upward range in first fifteen minutes, and I thought it would bounce off $15 under slightly oversold conditions. It did exactly this, but my stop was way too tight, again. It then peaked at $16.20. This is happening way too often that I’m considering that maybe I need to scale into positions so I can have a wider stop, but still in the end lose the same amount of money. So in this case, I originally had a .16 cent stop (which I moved up when the stock rallied some but it would of stopped out anyway). In the scaling in scenario, when the stock sank to my original target of $15.85 with a half position (I would then enter another half position) and put in a stop of $15.78 – I would still have the total .16 exposure equivalent of a full position that I had with my original stop, but this gives more breathing room for the trade to develop. I would have another set of tactics to enter another half position when the trade went in my favor. I would keep using the same risk amounts per trade, though it would cut into my winnings a bit for stocks that moved in my direction immediately. I am going to try this paper trading, at least it will have the potential to keep me in trades longer rather than such quick exits.

AINV -.12 SHORT ~ No good entry signals, only marginally overbought. I was seeing weakness in the financials as compared to the overall market. Definitely need to not take on trades like this with no redeeming edge.

EXM -.10 SHORT ~ Stocks that gap up or gap down, create an opening range. I usually use the first half hour of candles for short-term resistance (morning high) and support (morning support). I shorted at $5.50 which was opening range support. It’s better at this juncture to either long at this point if oversold (with a tight stop), or wait to it short when it break supports and then enter on a bounce when it becomes a little overbought but still holds under support. The other ideal shorting set up is to wait for it to get to the top of it’s opening range at resistance, and short there (with a tight stop if it has a high RSI (2) – and if it breaks past that range, then consider longing it as a break out on a dip if it stays above the previous opening range resistance.

HIG +.37 SHORT ~ I entered this on a pop (rather than chasing) after it showed weakness and then stayed in it until it met my exit criteria. I saw my real position of FAZ (20 shares now – see post earlier today) spiking and HIG was lagging a bit so I jumped in and let it ride. As I said, the financials were not participating fully in the rally today. I was a little lucky, my stop was missed by only a couple pennies before it really tanked. I technically broke my rules on this as I did not wait five minutes after the EXM trade.

On that note, I’ve decided to hold on to my FAZ overnight. Somewhat risk, but it’s still a small position and the sector showed weakness today despite the good news about mark-to-market news.