(QQQ)(DIA)(SPY)(MSG)(WPO)

“That’s been one of my mantras – focus and simplicity. Simple can be harder than complex: You have to work hard to get your thinking clean to make it simple. But it’s worth it in the end because once you get there, you can move mountains.“ Steve Jobs

Emini Trading Made Hard Simple – Part 1

So two Candlesticks walk into a bar… I wish it were that simple. Let’s face it, if Candlesticks drank they would be half-lit all the time. Time? I’m sorry, what time is it? Oh my, this Candle leaves every hour on the hour unless of course you catch the Fib Express which leaves the station every 1-3-5-8 (infinity) minutes so you never miss the bus unless you know the driver – Elliott, who always waves as he goes by, but oh dear, I do believe your question was about simple. Simple can’t be the answer because that’s just a lot of Bull, but please Bear with me and I’ll find someone who can point you to the Market, There he is, such a nice Profile but a bit sketchy. One minute he’s High and the next he’s Low, but it all has great Value according to our one man band – Bollinger, now there’s a hoot. Don’t get me wrong, if you’re looking for simple I’m sure I know someone, I just can’t think straight with this Ichimoku running up my back. If Woodie were here he could tell you in a minute. He wood call out his CCI squad and they would have your DNA – EMA and oh yeah….. even your SMA under their scopes in no time. And then…

Funny? Depends. (Depends are not funny)

Here’s my point, it’s a nightmare out there. Everything I just mentioned has some merit. Where it becomes unfortunate, is when Traders try to apply them all to their Emini Trading Business at once. Elegance becomes a train wreck.

In the previous post we covered what Emini Futures will do.

This

This

Or This

They can also do this

They can also do this

That’s it. Go look at any chart of the Emini Futures and you’ll see lots of UP, lots of DOWN, and a little bit of SIDEWAYS. The first time you looked at a chart you saw just how simple it was. In fact, it was so simple, you figured a glorified chimp could do it. So you quit your job, cashed in the 401K, liberated the kid’s college fund, basically you did whatever it took to fund an account so you could get busy pulling the trigger and collecting your share of the easy money.

What happened? Did the market change? Did it stop only going UP, DOWN and SIDEWAYS? Did it start doing back-flips or grow jazz hands? No… What happened is, the second you experienced financial duress in the form of a draw down you froze. Not only did you freeze I’m willing to bet you were naked. Locked out in the freezing cold, stark naked. By naked of course, I mean you had no hard stop. To give you the benefit of the doubt I’m sure you at least had a mental stop, which by the way would actually put you in the top 10% of new traders. Believe it or not, 9 out of 10 new traders will enter their very first live trade without a Live Stop Loss Order working on their behalf.

The average dollar amount most new traders will allow their first naked trade to go against them is $1,000.00. There appears to be some kind of psychological trip wire at or near $1k which brings us to our senses. We freak out and hit the panic button labeled EXIT MARKET which usually adds another $100 – $200 to the tab. If the insanity stopped here that would be excellent, but it usually doesn’t. At this point you’re shell-shocked, mad as hell, or both. Now it’s time to get real stupid. First day on the new job; first trade – on the first day – of the new job and I’m already down a grand. OK Champ, shake it off, the markets have only been open for 15 minutes, there’s plenty of time to get it back. Let’s double down and not only get back what we lost but we’ll end this first day up by at least a grand. Line ’em up, I’ll mow ’em down…

Click – Click – Click

New Emini Trader

New Emini Trader

On average, the first day trading live, will cost the average New Emini Trader somewhere between $2,500 and $3,000 depending on their pain threshold. Unless of course you hired the Chimp to trade for you, then results may vary. If all you lost the first day was $3k it would be a great day. An expensive lesson, but a beneficial one you won’t soon forget. However, a few other things just happened. Because of your cavalier attitude and shoot from the hip approach, trading will never look so simple again. At least not as simple as it did before the hurt locker opened.

Now that you’ve had your wake up call, now that you’ve convinced yourself this thing ain’t so easy after all, it’s time to get a gun, a big gun. Heck, let’s order an arsenal of stuff, all fully guaranteed by the man on the TV with the big diamond ring and the dazzling smile. He says, “Never feel like a loser again”. That sounds good to me. A simple Google search for emini indicators brings back 223,000 results, give or take. What are the odds you can pick one that will actually work? You’re smart, you know the odds are astronomical, so you level the playing field by going on a buying binge. You Google till your fingers bleed. Probably you’ll even stop trading for awhile just to play with indicators. Since you have no way of knowing which ones can actually benefit your Emini Trading Business, you’ll fall prey to whichever vendor can afford the best copywriter.

That’s what you’re buying – Ad Copy! Not a solution to your trading dilemma.

Think about it. Let it “jell”, as they say. What originally appeared so simple a Caveman could do it, has now become slightly complicated by your unwittingly careless approach and over confidence. Not to mention you now have to wade through 233,00 web sites, give or take, to find the slickest copywriter to hand over your hard earned dough to, so you never have to endure the horrible emotional pain of being wrong again. This may take a while…

Sound about right?

Now let’s not lose sight of the fact that the market can still only do 3 things:

This

This

This

Or This

Or This

The only thing that’s changed, is how you view the market. Forget the Chimp, he got hired to run the Bond Desk at GS and the Caveman is now in Insurance and he couldn’t be happier. You’re on your own pal. You and 233,000 different ways to:

- Skin a cat

- Get rich quick

- Rob banks legally

- Make money while you sleep

- Never struggle to pay bills again

- Trade with the smart money

- Learn the secrets Wall Street doesn’t want you to know

- Kill the market

- Turn pennies into profits

- Retire in 6 months with this Secret Formula

The odds of you picking the perfect system are 233,000 to 1. That’s based of course, on your willingness to believe:

- This system never loses

- 89% winning trades guaranteed

- Our traders end every trading day net positive

- We have never had a losing day

If you are willing to believe one of these claims, or anything remotely close, please consider making a sizeable donation to your favorite charity and go do something meaningful with your life. The market can only go 1 of 3 ways. Up, Down, or Sideways.

I’m no odds maker, but I’m thinking picking 1 out of 3 is easier.

“Wait a minute”, you say “that’s what got me into this mess”.

Quite a pickle, a Catch-22, can’t win for losing, real darn shame. Eh?

Cheer up! The good news is, this is only Part 1. I needed to make sure you knew that you aren’t really alone. You’re not the only goof ball who drank the Kool-Aid and tried to fly. These tights really do chafe don’t they? Un-bunch your cape and listen very carefully to what I’m about to tell you.

If you can

- Slow down

- Trade small

- Always use a hard stop

I promise you there is light at the end of this tunnel. You don’t have to be a market wizard, financial genius, or even taller than average to survive in this business. In fact, you don’t even need to know what is going to happen next to make money as a Trader.

That’s right, when the market opens tomorrow I have no idea if it will go Up, Down or Sideways. However, if it does go Up or Down, there is money to be made. No crystal ball, no tea leaves, no guru required. You simply need to be available to take advantage of whatever the market offers. I realize it sounds eerily simple, but that’s why I’ve titled this series – Simple Emini Trading.

Stay tuned for Part 2…

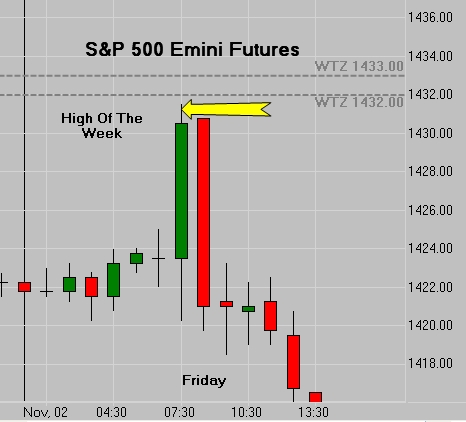

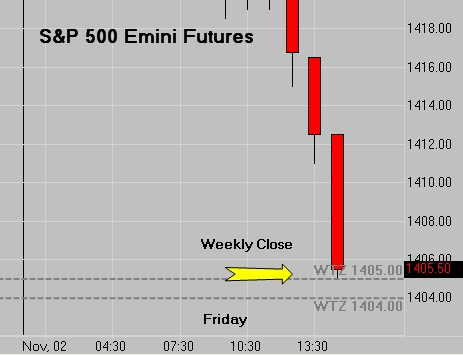

S&P 500 Emini Futures

Before the market opens each Monday, we send the CFRN Community our Weekly Trading Zones or “WTZ” for short.

S&P Futures – Weekly Low

S&P Futures – Weekly Low

S&P Futures – Weekly High

S&P Futures – Weekly High

S&P Futures – Weekly Close

S&P Futures – Weekly Close

Would you like the numbers this week? Apply Here and come to the Training Room this week. We’ll answer your questions and you can watch us trade.

As opportunities unfold we will keep you posted.