(QQQ)(CBOE)(SPY)(LNKD)(CHK)

The ability to simplify means to eliminate the unnecessary so that the necessary may speak. Hans Hofmann

Simplicity – A Complicated Concept For The Emini Trader

Our ability to profit from the movement of market pricec can be reduced to this:

or this

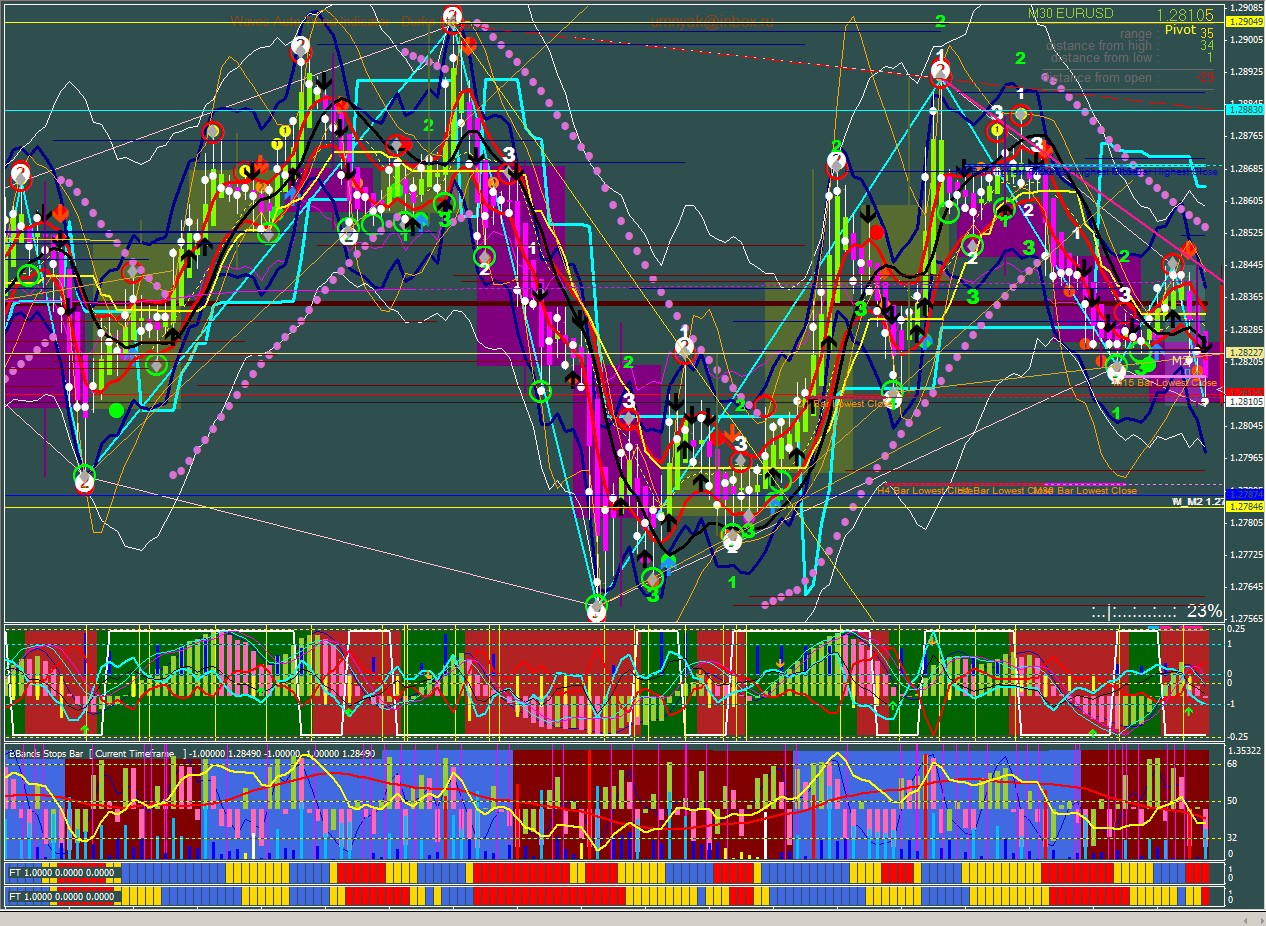

Yet somehow we manage to turn it into this:

I guess there’s a little Pollock in all of us. Our lizard brains become fully convinced that the more information we can compile, the more data we can process, the more numbers we can crunch, the better off we’ll be. I’m a firm believer that quality indicators are like fancy reading glasses, they allow even the novice trader among us to see what is not readily obvious to the naked eye of even the most experienced trader.

This has nothing to do with predicting the future, it has everything to do with seeing what is already in front of you. How many times have you stared at a wall or a bookshelf for the umpteenth time and suddenly noticed an item or object for the very first time. You feel tricked. It’s simply not possible. That object was not on the shelf yesterday, or the day before, or the day before that, because you sit at your desk every day thinking deep thoughts, staring at the very shelf in question, and yet it was.

These indicators I referred to can help greatly with detail, fill in the gaps, turn what “appears” to be chaos into divine order. Then our lizard brain kicks in and orders a second pair, and then a third until suddenly we can see nothing except the noise. Not just any noise but noise at a granular level which leads us to paralysis by analysis. When you have 13 things (a Fib number) telling you to buy the market and 11 things (a Lucas number) advising you otherwise, will you ever develop confidence in your ability to simply apply an edge (any edge) and accept whatever the market is offering? I assure you it’s going to be a difficult journey but maybe if you call 1-800-Ask-Elliot you can be told which wave we are in and if that’s confirmed by the advance decline line then you’re probably good to go. Yes?

There is another way, a somewhat humbler approach to unraveling this knot you’ve tied yourself in. Would you like that? Tonight I’m going to leave you with a few salient quotes to ponder. In our next post we will delve into specific steps to unclutter your mind as well as your chart. It is often said that “less is more” but quite often less, really is just less. There are also times when “more is less” and more simply becomes more. My goal over the next few posts is to help you see what is already there, understand what you already know, and develop a plan that contains more answers than questions.

I hope you’ll join me…

The less I cared about whether or not I was wrong, the clearer things became, making it much easier to move in and out of positions, cutting my losses short to make myself mentally available to take the next opportunity. – Mark Douglas –

To anticipate the market is to gamble. To be patient and react only when the market gives the signal is to speculate. – Jesse Livermore –

An object at rest tends to stay at rest and an object in motion tends to stay in motion with the same speed and in the same direction unless acted upon by an unbalanced force. – Isaac Newton (First Law of Motion) –

Time is more important than price. When time is up price will reverse. – W. D. Gann –

We are what we repeatedly do. Excellence, then, is not an act, but a habit. – Aristotle –

Markets can remain irrational longer than you can remain solvent. – John Maynard Keynes

People who pride themselves on their “complexity” and deride others for being “simplistic” should realize that the truth is often not very complicated. What gets complex is evading the truth. – Thomas Sowell –

January Soybeans (ZSF3)

Consider being long January Soybeans ZSF3 above 15.53 or short below 15.32. #ZS_F #Soybeans #Grains

— DeWayne Reeves (@CFRN) October 31, 2012

Today’s Soybean Tweet made a 10 cent move thus far. 1 Penny = $50 per contract. Chart> bit.ly/Y3OUZP $ZS_F #soybeans

— DeWayne Reeves (@CFRN) November 1, 2012

Soybeans pushed a nickel higher since our last Tweet. Consider locking in a good portion of this move if you have not already done so. $ZS_F

— DeWayne Reeves (@CFRN) November 1, 2012

January Soybeans – Hourly Chart

January Soybeans – Hourly Chart